As nonprofit boards across the globe are being challenged in new ways, what is the role of board governance in nonprofit success?

The global impact of the Wayfair decision on M&A deals

What is the global impact of the Wayfair decision on M&A deals for sellers and acquirers?

Innovation in the Food and Beverage industry: The push and pull of consumer engagement

Consumer demand for new products is the primary driver for food and beverage innovation. We explore the industry trends that drive customer engagement.

Driving digital transformation through Intelligent Process Automation

Five manual processes organisations must replace with Intelligent Process Automation to drive digital transformation.

It’s time we all find a balance for better: Building the business case for gender parity

To bring the business case for gender parity to live, a better balance is needed to allow women to move into roles of power and leadership and reach their economic potential in society.

IPO Watch Australia

IPO Watch Australia provides a detailed summary of IPO activity within Australia for 2018.

2019 VAT updates from the Netherlands

A brief update on the main changes to VAT in 2019 in the Netherlands.

Consumer demand, new technology and trade tariffs: What are the trends impacting Agriculture businesses in 2019?

HLB Agriculture industry expert Duane Thompson shares his insight on trends impacting Agri businesses in 2019.

Real Estate trends 2019

Real Estate trends 2019 New and continuing industry shifts Real Estate businesses need to prepare for Ralph Mitchison & Rebecca Machinga, HLB Real Estate & Construction industry experts As a Real Estate professional, you want to have your finger on the pulse of the changes going on so you know what to expect and can plan how to react. But … Read More

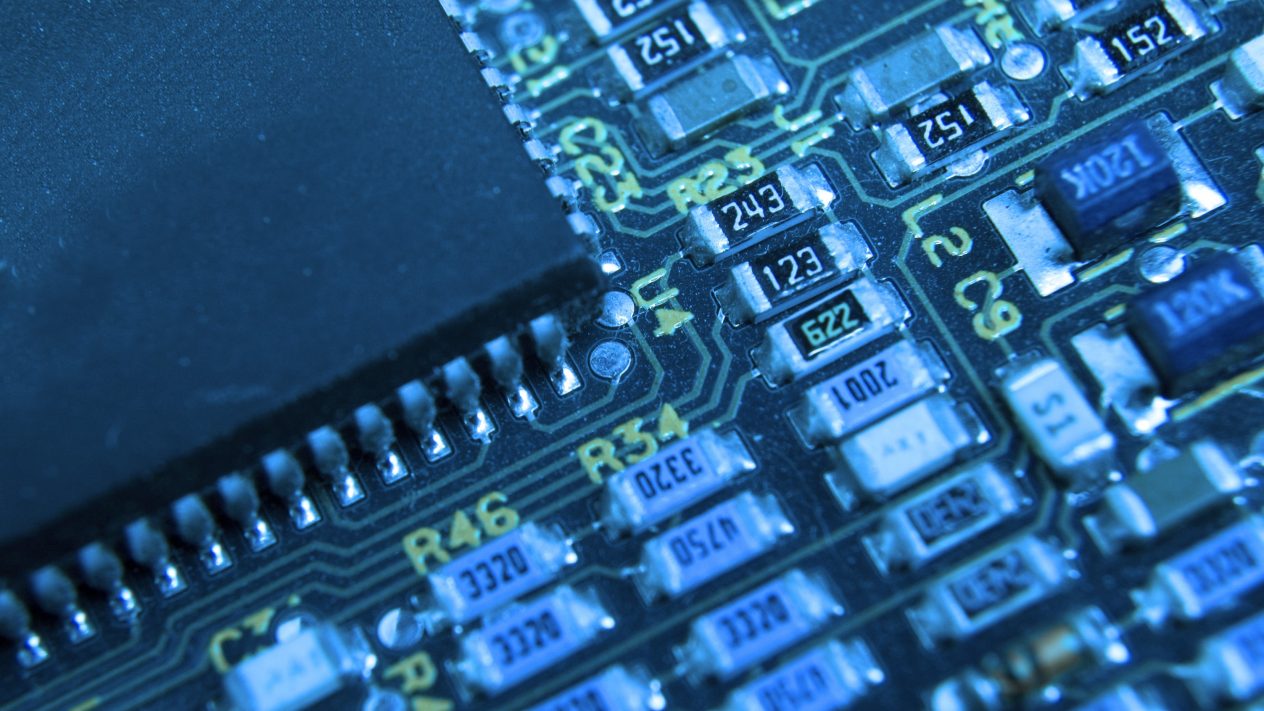

The impact of Industry 4.0 on society

HLB’s CEO Marco Donzelli shares his thoughts on the impact of Industry 4.0 on society.

Withholding tax in France for individuals

All you need to know about the transition to new withholding tax for individuals if you have employees in France