Retailers look to AI to face macro risks

Retail Sector Outlook – HLB Survey of Business Leaders 2024Businesses in the retail sector may have endured a bumpy ride recently, but there is cause for optimism, according to a recent survey by HLB. So, how do business leaders intend to prepare for 2024? How will they tackle changes to the international business landscape, and how quickly can they adopt new technologies (including AI) in their businesses?

Showing confidence

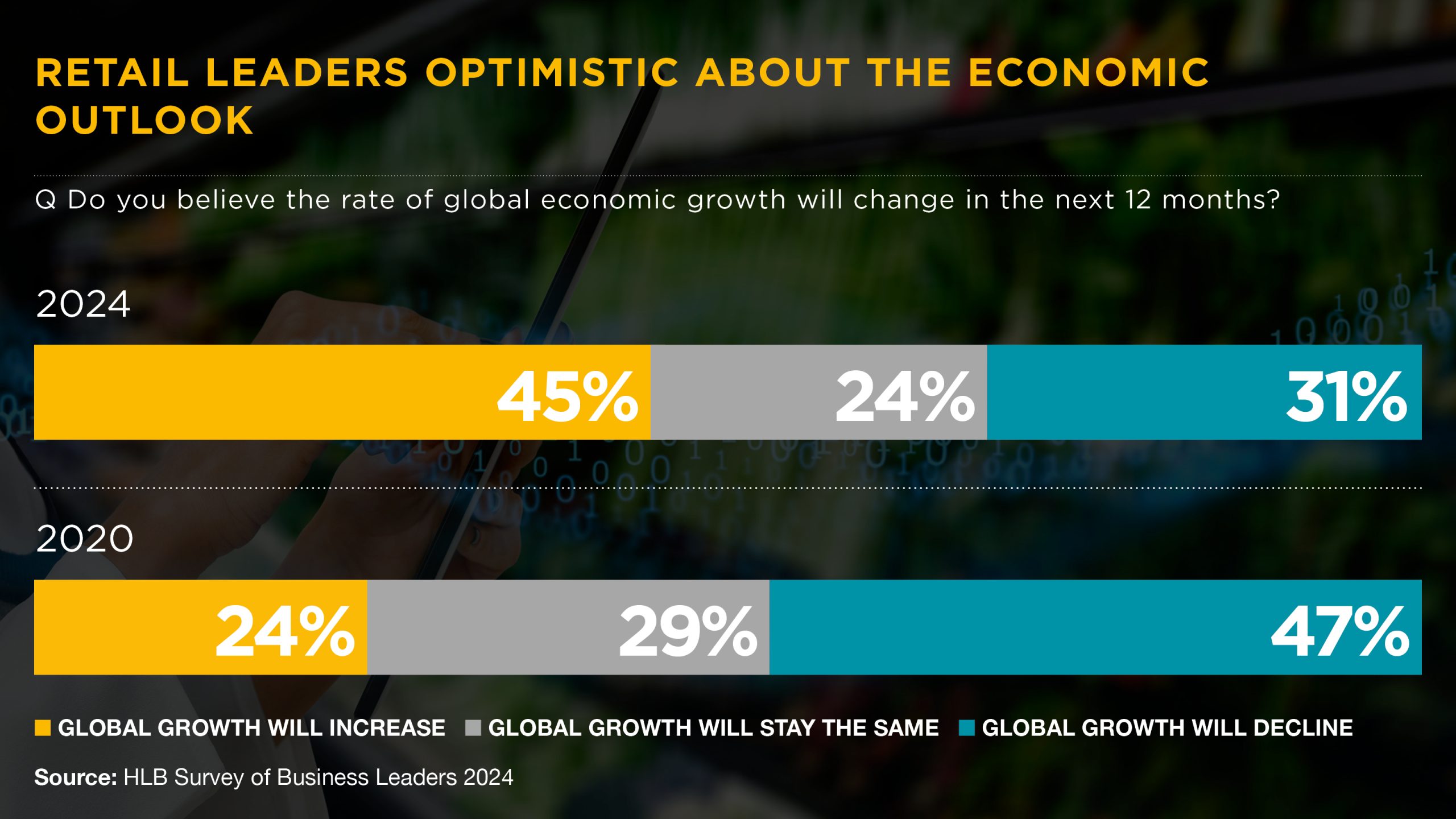

Leaders in the retail sector are increasingly confident about the future. Some 45% believe that the rate of global economic growth will increase over the next year, almost double the number who expected economic growth in 2020 (24%).

On looking at their own businesses, 84% of business leaders in this sector are confident about their ability to grow revenue in 2024. 37% identify as "very" confident, with the sentiment strongest in North America versus other global regions.

Identifying risks

While there is clear confidence in the sector, business leaders are also fully aware of the industry's challenges ahead. 79% of respondents believe that inflation remains the top risk to the sector, although economic uncertainty follows close behind at 76%.

There's been a significant increase in the level of concern about the geopolitical situation. 71% of respondents cite the risk of wars and global conflicts as a key concern. This compares to just 44% in 2020, the survey's first year.

Retailers are much less concerned about exchange rate volatility in this sector than their peers in other industries (42% versus 52%). Nevertheless, they remain much more concerned about changing consumer behaviour than their peers (63% versus 49%).

Retailers also identify several other growing risks. These include misinformation, where the response has risen from 39% to 53% over two years, and cyber risks, which 68% of leaders see as a growth risk this year. This has risen from 44% in 2020.

Addressing market and trade disruption

Despite these headwinds, retail business leaders believe they can overcome geopolitical or trade challenges. To help them move forward, just over half (51%) are now deploying near-sourcing as a key strategy. They believe that sourcing products closer to home represents a narrower risk.

Retailers also identify both increasing cost pressures as well as pressure from customers on the sustainability front. Accordingly, 47% of them have discovered new greener energy sources to help address both political and trade challenges.

Alongside this, more than half of retailers believe that trade agreement changes will create new business opportunities.

Focusing on strategies for 2024

The primary focus of retail leaders in 2024 is to improve operational efficiencies in their business. Two-thirds of respondents cited this tactic. Secondly, the leaders plan to adopt new technologies as one of their priority activities (65%).

Retail leaders are more attuned to fluctuating consumer behaviour than their peers in other industries. 55% of them plan to launch new products or services to align with consumer requirements through 2024.

55% of leaders in this sector also plan to reveal or refresh business strategies throughout the year. In particular, they'll look at their digital security capabilities to address cyber security. This is the most important area for improvement in 2024.

Other areas for improvement include talent acquisition and cost management (31% and 27%). Business leaders also plan to seek new skills to help them with their digital transformation.

Investing in emerging technologies

Emerging technologies may represent significant opportunities, and business leaders understand that they need to invest to harness this potential. 63% of respondents believe technological advancements will help them overcome future cross-border business challenges. However, most business leaders see organisational capacity as a challenge. 54% of retail leaders (versus 43% of global peers) think that short-term priorities or unexpected disruptions could make it hard for them to make new technology investments.

Two-thirds of retail leaders think emerging technologies (including AI) will drive innovation, creativity, and productivity. Meanwhile, 55% would take on more risk as they integrate AI technologies due to the potential benefits on the other side.

Embracing AI

AI has become a hot topic across all sectors in 2024, and retail sector respondents believe it will be the most important technology for their businesses in the next five years (66%). 47% of respondents cited cloud computing as a necessary technology for successful operation. Renewable energy came in third, according to 39% of leaders in this sector.

Many leaders already use AI technologies to give their businesses a strong advantage, and 52% of these leaders consider themselves "innovators" in AI. Other leaders set aside time daily to explore how AI could enhance their businesses. If they develop a convincing business case, 37% consider themselves "adopters" and are willing to try AI technology. Still, for this segment, all-out adoption of AI technology isn’t a priority.

Only a few respondents viewed themselves as "conservative" about AI adoption. 11% of leaders are cautious and worried that any risks will outweigh the benefits or may be completely against adoption.

Retail leaders are also highly focused on identifying appropriate use cases for AI, such as customer analytics (42%), process automation (37%), and sales and marketing (32%). They are more proactive around data cleansing, technology assessment and readiness than their global peers. Also, they are less likely to indicate they are only in learning mode or are yet to embrace AI.

Improving digital skills to take advantage of AI

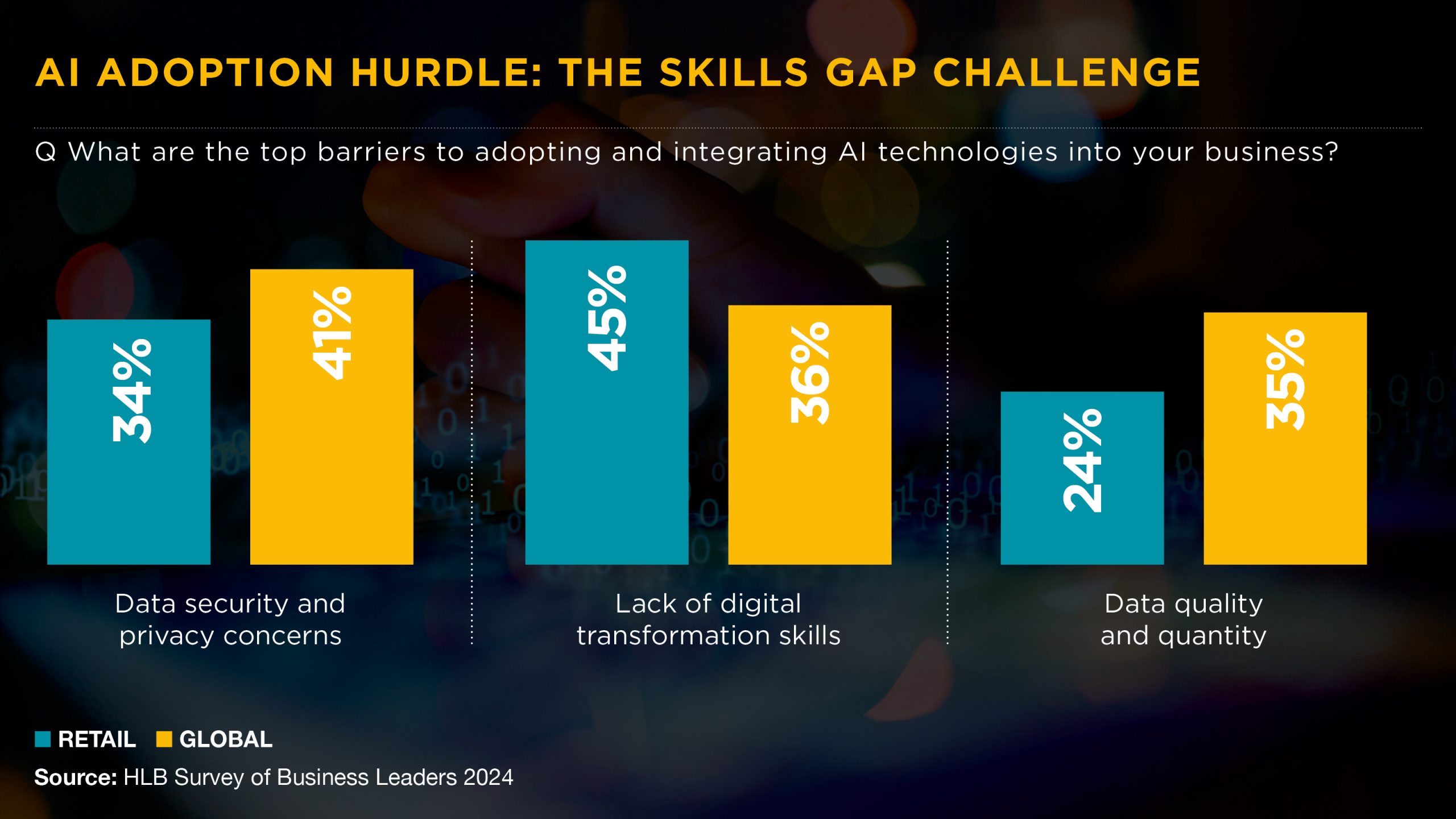

Retail leaders understand the need to attract talent to embrace AI fully. 45% of them (versus 36% of the global sample) believed that lacking digital transformation skills could be the largest barrier to adoption. One retail CMO in North America believe that "Enterprises embarking on an AI journey have a much greater opportunity for success when they have executive leadership support and the right talent in key AI roles."

Leaders identify data security as another barrier to AI adoption. However, as they may have good experience managing customer data through the sector, they are less worried about security and privacy barriers than their peers (34% versus 41%). This sentiment extends to data quality and quantity, as many leaders have instant access to good quality loyalty scheme data.

Businesses in the retail sector are well on their way to successful AI adoption and deployment. One retail leader in LATAM sums it up succinctly: "We're in the implementation process, doing everything we can to gradually integrate this new tool as it will be fundamental in the coming years."

How HLB can help

As leaders in the retail sector address these challenges and opportunities, many will turn to experts for support. HLB is a global advisory and accounting network with more than 40,000 people across 156 countries, ready to help clients grow across borders.

We combine local expertise and international capability to assist businesses in the retail sector and can deliver a localised client team tailored to the client's needs. Get in touch with one of HLB’s advisors for advice and practical services to help you to grow your retail business.

Survey of Business Leaders 2024

Learn more about our research