Forging their own path to growth

Agriculture, Food and Beverage Sector Outlook – HLB Survey of Business Leaders 2024Businesses worldwide are navigating a complex maze of challenges, including geopolitical tension, inflation, and high energy cost. HLB’s annual survey of business leaders, now in its fifth year, continues to offer valuable insights into how leaders view the business environment and adapt to constant change. It’s clear that leaders in the agriculture and the food and beverage sectors (AF&B) are facing exceptional change. How will they harness new technologies like AI to continue to innovate and grow?

Business confidence is rising

There’s been a significant rise in the number of AF&B sector executives who expect economic growth this year. 39% are positive, compared to only 7% during the first year of the survey in 2020. Still, 33% of leaders in the sector are expecting global economic decline in 2024.

Regarding their own organisations, 84% of AF&B leaders think they can grow their businesses in 2024. In fact, 40% of them are very confident, double the number from 2020.

Ongoing risks to business continuity

74% of respondents in this sector were either concerned or very concerned about the rising cost of energy and raw materials. This is the leading worry, closely followed by inflation (73%) and the interrelated risks of rising interest rates (68%).

The number of leaders concerned about climate and environmental risks has risen from 47% in 2020 to 67% today. Other risks cited include trade flow disruption, rising from 42% concern in 2020 to 65% today. Cyber risks worried 54% in 2020 and 64% now.

Managing market and trade disruption

Many of the leaders in the sector display a strong level of business resilience to rising risks and ongoing trade or geopolitical challenges. Just over half of them agree that trade agreement changes will create new business opportunities (53%), while 51% will change their sourcing strategies, intending to focus closer to home, perhaps focusing increasing on a strategy of near sourcing. 44% of those surveyed have discovered new green energy sources to help them overcome political and trade challenges.

Improving operational effectiveness is top priority

AF&B leaders will focus on improving operational efficiencies as their main priority in 2024. 71% of them will put every effort into this, 55% will focus more on reducing costs, and 53% will look to adopt new technologies. 49% of leaders plan to launch new products or services, while 47% will review their strategy throughout the year.

47% of leaders believe that operational effectiveness is a weak spot for them, and they plan to make significant improvements this year. Meanwhile, 35% of leaders cite talent acquisition as a significant challenge in 2024, while 29% flagged cost management and innovation.

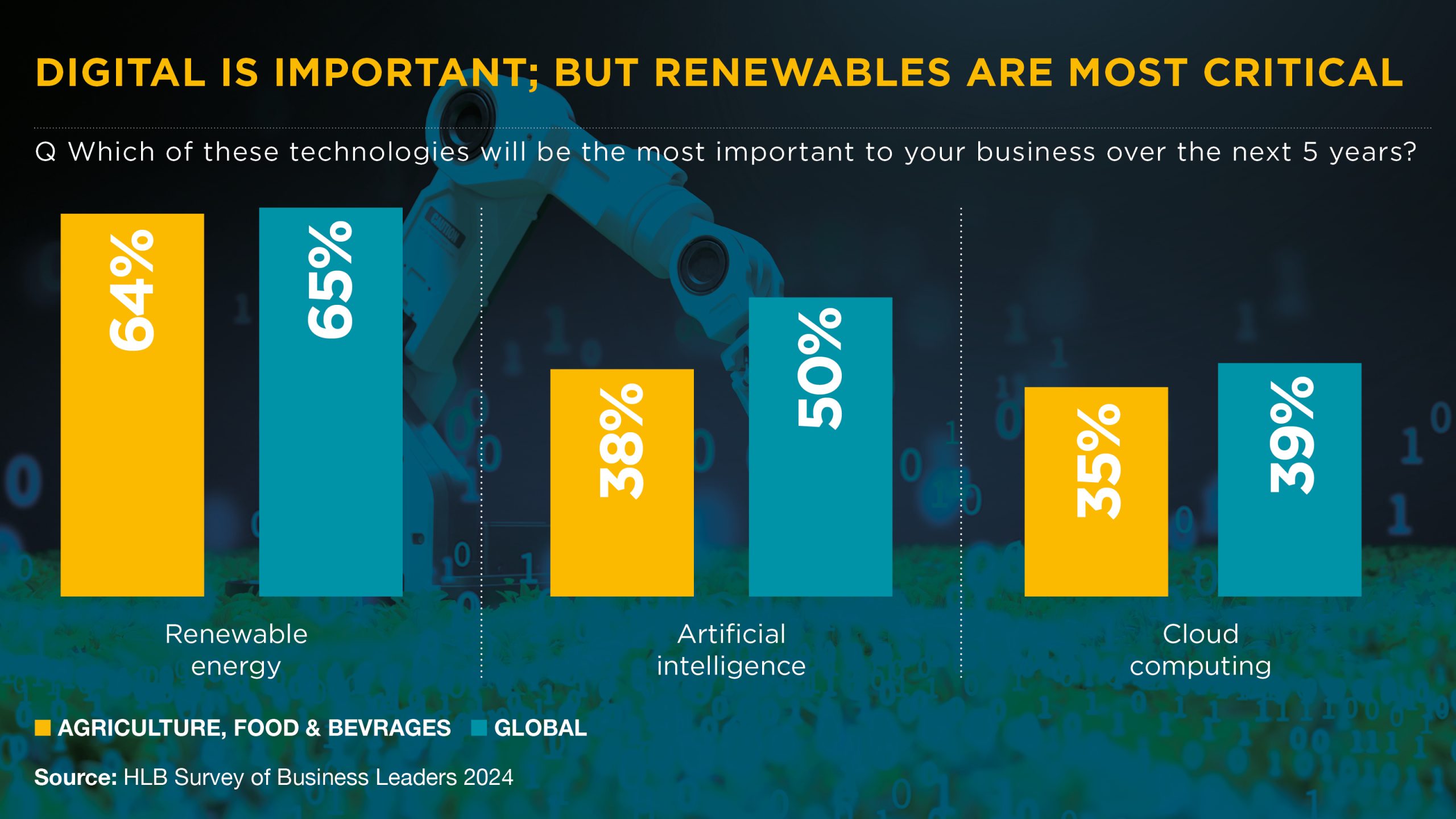

Emerging technology as crucial business enabler

47% of the leaders surveyed believe technological advancements will help them overcome future cross-border business issues. However, 54% agree that short-term priorities and unexpected disruptions could make it difficult for them to invest in new technologies. This compares to 43% of their global peers.

Almost two-thirds of leaders fully agree that emerging technologies (like AI) will drive their business innovation, creativity, and productivity. Additionally, one-third are prepared to take on further risk as they integrate AI technologies, given the potential benefits of success (36%).

Across many sectors of the economy, digital technologies are most vital. However, renewable energy is the top technology for AF&B leaders over the next five years, as selected by 64% of respondents. AI (39%) and cloud computing (35%) come next on the list of critical technologies for future business success.

When digging into the data to see how leaders view their AI progress, more than half believe they are “adopters.” In other words, they are willing to try a technology if someone can put a convincing business case forward, but adoption of AI technologies is not a business priority for them.

Yet, a healthy selection of respondents (24%) think they are “innovators”, who are already using AI technologies to gain competitive advantage. A smaller segment is “conservative” regarding AI adoption (22%), more worried that the risks will outweigh the benefits, and some of them (7%) are completely averse to AI.

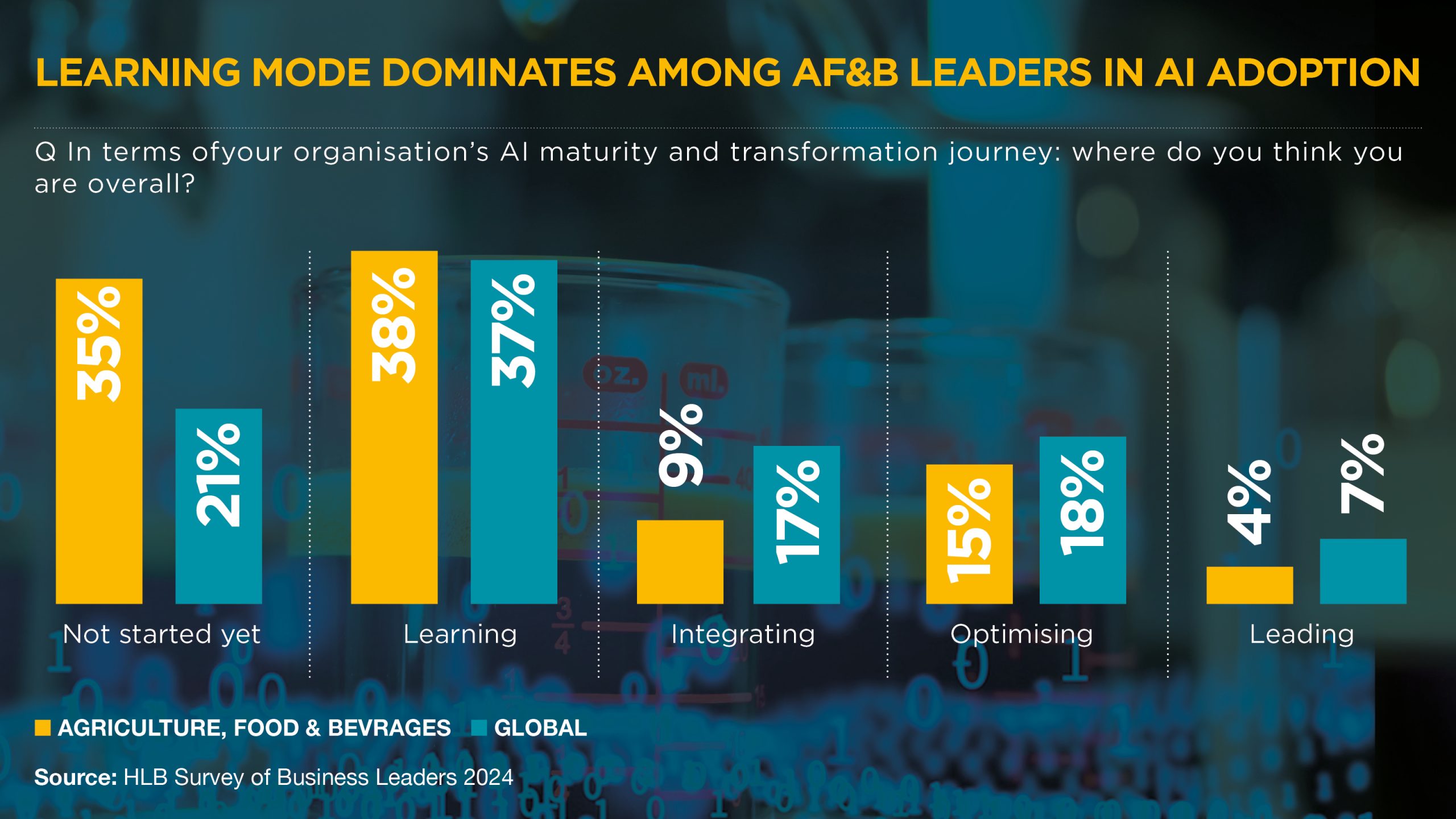

Starting the AI journey

When quizzed about their AI maturity and transformation journey, leaders in this sector are mostly in learning mode, with38% claiming to be at this stage of the maturity curve. A significant number (35%) say they have not started yet.

AF&B leaders are ahead in some aspects of adoption. 62% of leaders are learning, integrating, optimising, or leading in technical assessment and readiness. They’re making good progress in assessing ethical bias and compliance implications. 60% of respondents are learning, integrating, optimising, or leading here. However, in these aspects, more than half of those acting are in learning mode.

Sector leaders have made the least progress in relation to partnership and vendor evaluation, as 53% of them have not started yet. They’re also making slow progress around AI-specific staff training, retooling and upscaling, of which 51% have not started yet.

Digital skills may be a barrier to adoption

30% of respondents said that digital skills could be the top barrier to AI adoption and integration. One APAC region CEO says they “need help to educate and train employees, who might find it daunting or are misled by what AI can do for them.” Many leaders are looking for more talent and knowledgeable hires.

Following digital skill barriers, 36% of leaders mention a lack of use cases as a barrier to AI adoption and integration.

Leaders mainly focus on quality control (22%), sales and marketing (20%), and process automation (16%) as the top three AI technologies to help them automate or enhance their operations. Although these numbers are relatively low compared to global peers, it may indicate that AF&B businesses are deploying more niche tech applications centred around specialised food products.

Sector leaders seek specialist AI applications

In the agricultural sector, many leaders indicated that they are using AI for applications that are not listed. These are likely to be customised precision farming applications. Food and beverage leaders were also more likely to indicate “none of the above” AI technologies applied to them.

Businesses in the sector indicate that they would welcome support to better understand the ROI for AI investments. This would be helpful, given the wide variation of products and techniques deployed in the sector (from arable crops to wine production) to provide a better understanding of how they might use AI and which tools would enhance competitiveness.

Sector leaders also realise they must get familiar with new technologies and discover their potential. They also know they shouldn’t delay exploration as they may otherwise be left behind. A LATAM family-owned business leader felt that they need “greater knowledge of the possibilities of use” for AI and related technologies. At the same time, another sought some “proven use case examples,” as they “don’t know what they don’t know.”

How HLB can help

HLB represents a global network of independent advisers and accounting firms with more than 40,000 professionals across 156 countries. At HLB, we strive to help organisations in these tough times, combining local expertise and global capabilities to serve many customers in the AF&B sector and elsewhere. We like to build a trusted relationship with sector leaders by getting to know you and understanding your specific requirements.

Read more about how HLB can help businesses in the agricultural and food and beverage sectors, and contact one of our knowledgeable staff members for more guidance.

Survey of Business Leaders 2024

Learn more about our research