Taking on change head-on

Manufacturing Sector Outlook – HLB Survey of Business Leaders 2024Over the past five years, HLB has published annual surveys of business leaders to offer a comprehensive view of the modern business landscape. Our 2024 survey features responses from nearly 1,000 leaders across 50+ countries and six in-depth expert interviews. Within this extensive dataset, 152 respondents are from the manufacturing sector, offering valuable insights into the industry's challenges and opportunities.

We dive into how manufacturing sector leaders are navigating the complexities of 2024, capitalising on shifts in the global business environment and harnessing emerging technologies such as AI to drive growth and innovation.

Improving business confidence

Recent years have seen a notable escalation in concerns surrounding geopolitical risks, cyber threats, and environmental challenges. In addition, businesses still grapple with the aftermath of the pandemic and the lingering impact of the energy crisis.

Yet, there seems to be a change in business confidence, as the corporate landscape adapts to the perpetual state of crisis becoming the new normal. In contrast to 2023, which witnessed a significant decline in business confidence, with only 27% of business leaders believing in global economic growth, this year reflects a more positive sentiment, with 73% of business leaders expecting global economic growth to either be maintained or increase.

The outlook for the global economy is particularly optimistic among manufacturing sector leaders, who exhibit higher confidence in both the economy and their own growth prospects compared to their global peers. Specifically, 47% expect global economic growth to accelerate next year, compared to 41% of leaders in other industries.

The sector's top concerns

Despite a continuous stream of global crises, from geopolitical conflicts to spikes in resource costs, businesses have adapted to an ever-shifting risk landscape.

Inflation emerges as the foremost concern for manufacturers, cited by 81% of respondents, closely followed by geopolitical risk at 77%. Concerns regarding geopolitical risks have notably increased from 48% five years ago. Additionally, mounting resource costs and cybersecurity anxieties weigh heavily, with 72% and 69% of manufacturing leaders respectively, highlighting them as top concerns.

Since the survey's inception five years ago, we've observed a significant rise in the prominence of emerging risks. For example, environmental and climate risks have doubled to 56% over this period. As manufacturers prioritise embracing new technologies, concerns about disruptive technologies have risen from 26% to 41% over the same period.

Facing disruptions head-on

The manufacturing industry rapidly evolves to align with new market trends and technological advancements. Among manufacturing leaders, 55% have embraced sustainable energy sources, surpassing the global average adoption rate of 49%. This shift towards green energy, once associated with ecological enthusiasts, has become mainstream in manufacturing, with only 15% of respondents in our sample disagreeing with this strategy.

Change is rapid, and the sector’s leaders are attuned to its dual nature, recognising it as both a risk and an opportunity, particularly within international trade. Embracing this change and the heightened level of uncertainty, a substantial majority of leaders (59%) believe that shifts in trade agreements will generate new opportunities for their businesses.

Manufacturing focus in 2024

In 2024, manufacturers are concentrating on two key areas: 70% prioritise enhancing operational efficiencies, while 63% aim to adopt new technologies.

They are also more inclined to launch new products or services within the next year than their peers in other sectors (62% versus 49%).

When it comes to addressing operational weaknesses, manufacturing leaders are focusing on three main areas: cost management (30%), supply chain optimisation (30%), and cybersecurity (30%).

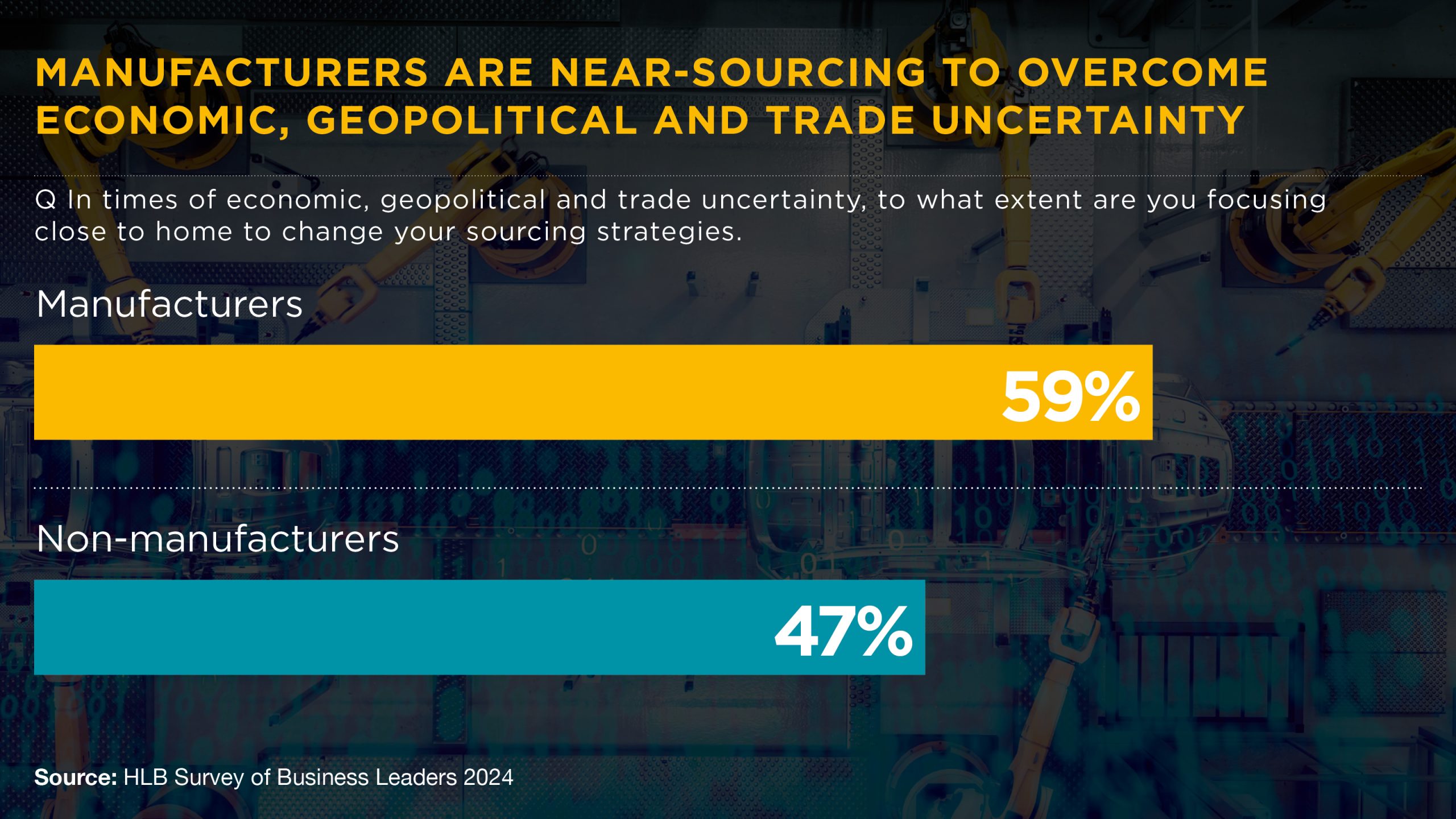

Sourcing close-to-home to head off risks

Although it's no longer the predominant concern, the lingering impact of the pandemic remains evident across markets and economies. Persistent disruptions in the supply chain, coupled with geopolitical tensions, are continually reshaping the global business environment.

As a result, 59% of manufacturing leaders are adjusting their sourcing strategies to prioritise domestic suppliers, aiming to mitigate political or trade hurdles. This percentage is higher compared to the 47% of non-manufacturing respondents in our sample who are taking similar actions.

Key technologies in manufacturing

Historically marked by transformative innovation, the manufacturing sector faces rapid change. Technological advancements and evolving business models require companies to adapt, or they risk disruption.

Chosen by 61% of respondents, Artificial Intelligence (AI) tops the list of key technologies in the next five years. Robotics process automation (RPA) is prioritised by 52% of sector respondents, significantly more than by their global peers (32%), which is understandable given the nature of the sector.

Cloud computing and renewable energy share the third place, each reported by 48% of respondents. These results indicate that manufacturing businesses prioritise renewable energy to a greater extent compared to their peers, where it is considered a priority by only 39% of respondents.

Advanced AI adoption

Although the sector is more advanced in implementing AI-specific staff training, retooling, or upskilling initiatives, our survey reveals a nuanced landscape of attitudes towards AI and AI maturity levels.

Most manufacturing respondents are Innovators, actively using or exploring its benefits. About a third are Adopters, keen to integrate AI into their operations. Only 15% express caution or reluctance towards AI, citing concerns about risks outweighing benefits or doubts regarding its advantages.

When it comes to the AI maturity and transformation journey, just under half of manufacturing sector respondents are already 'integrating,' 'optimising,' or 'leading' in most aspects of AI adoption.

AI use cases in the manufacturing sector

The manufacturing sector leads globally in using AI for supply chain management, process automation, and quality control.

The sector's leaders primarily focus on deploying AI for customer analytics, with 35% citing this focus compared to 27% among global peers. This is followed by a focus on process automation (32% versus 28%) and supply chain optimisation (32% versus 17%), alongside quality control (32% versus 22%).

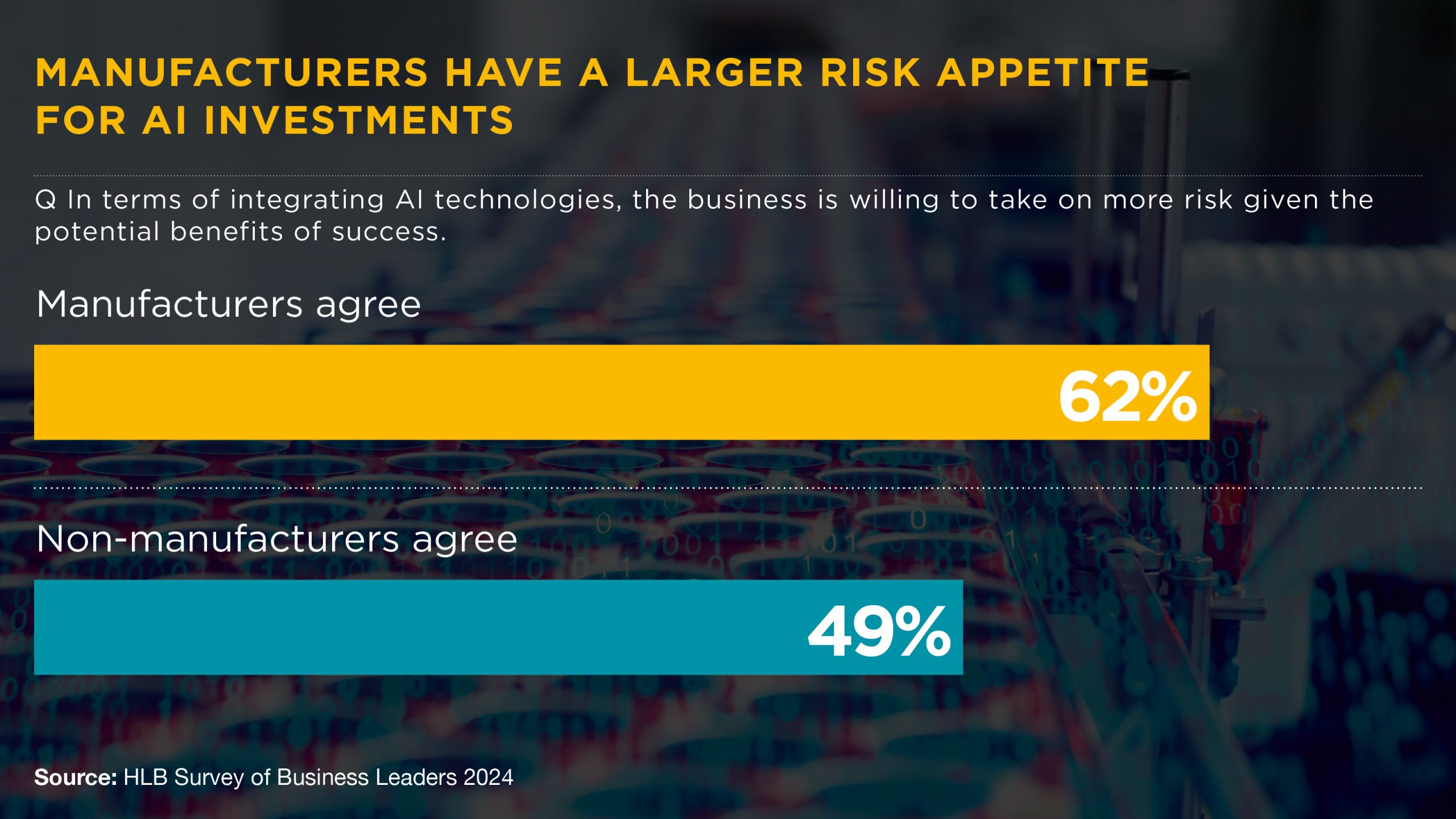

Barriers are significant, but opportunities outweigh risks

Data security and privacy concerns rank as the primary barrier to AI adoption, cited by 48% of respondents. Following closely is the lack of digital skills, selected by 41% of manufacturing leaders.

Nevertheless, embracing new technology remains the sector's key investment. According to the survey, manufacturing leaders exhibit a greater propensity for risk-taking in this area, with 62% of respondents willing to invest in new technologies, given the potential benefits of success, compared to 49% of global respondents from non-manufacturing sectors.

Additionally, 66% of leaders believe that technological advancements can help overcome future cross-border business challenges and trade risks, while nearly three-quarters (74%) agree that emerging technologies, including AI, are key to driving innovation, creativity, and productivity for the business.

Tackling challenges through technological promise

Businesses worldwide are grappling with various challenges, from inflation to geopolitical tensions, and energy crises. Over the past five years, concerns about increasing costs and inflation have grown, aggravated by disruptions in trade flows that affect supply chains. Nevertheless, technology remains a source of optimism, driving innovation and assisting business adaptation across sectors and regions.

How HLB can help

Seizing market opportunities can be challenging in today's global business landscape, where international politics impact trade, supply chains, and regulations. Yet, those manufacturers who adapt quickly to changing conditions will be positioned for success. With its team of experienced advisors, HLB Global is available to help manufacturing companies navigate uncertainty and seize opportunities in this ever-changing global market.

Survey of Business Leaders 2024

Learn more about our research