Optimism and change

Financial Sector Outlook – HLB Survey of Business Leaders 2024First launched in 2020, the inaugural HLB Survey of Business Leaders focused on uncovering insights into the modern business landscape. Our latest survey draws responses from nearly 1,000 mid-market leaders across 50+ countries to shed light on critical challenges and opportunities for businesses today.

In this outlook, we zoom in on Financial Services to illustrate its position vis-à-vis the broader economy, seeking to unveil the sector's priorities for 2024 and explore how business leaders are addressing business challenges through the strategic adoption of new technologies, such as AI, to drive innovation and foster growth.

Business confidence surges amid persisting challenges

After demonstrating resilience and adaptability during a period marked by a flurry of crises, the financial sector is experiencing a resurgence in business confidence. According to our survey, 41% of financial sector leaders express confidence in economic growth, and 85% believe in their company's capacity to grow. This sentiment aligns with our global findings, although the sector shows more business optimism than its global peers, with a significantly higher percentage of financial sector leaders (46% versus 36% of global respondents) being 'very confident' about growing their own enterprises.

The prevailing optimism, seen both broadly and within the financial sector, appears to be less a reflection of an improving environment and more an indication of businesses' adaptability to what is often characterised as a relentless' conveyor belt' of crises.

This persistent stream of growth-threatening risks continues to challenge even the most established businesses. Today, more than half of global business leaders in our survey expressed concerns about the impact of at least 12 different risks, a sharp increase from just five risks reported in 2020.

Among these risks, global business leaders' primary concern is inflation (74%). Yet, for financial sector leaders, geopolitical risk also takes precedence (72%), followed by cybersecurity (66%), with 'access to talent' trailing closely behind at 62%. In contrast, only 52% of the global sample of business leaders identify 'access to talent' as their primary concern, showcasing a notable discrepancy in challenges and priorities.

2024 strategic priorities: Operational excellence through innovation

In 2024, financial services leaders are steering the focus on two main areas: enhancing operational efficiency and integrating new technology. Operational efficiency ranks as a priority for 67% of the leaders, while 61% concentrate on the adoption of new technology.

It is unsurprising that enhancing operational efficiency ranks as a top priority, as 39% of the sector's leaders identify it as the primary focus for improvement in the next twelve months. Talent acquisition closely follows as a significant focus, selected by 36%.

Consistent with their growth-oriented approach, financial services leaders emphasise cost reduction less than their peers. Only a third (34%) concentrate on cost management in 2024. Instead, they prioritise investing in human capital, ranking it as their third priority—significantly higher than the seventh position among global respondents.

Technology remains key driver of growth

The sector's optimism is fueled by its staunch commitment to innovation and technology adoption. The past decade witnessed remarkable growth in the integration of digital technologies, from cloud computing to online banking and finance. This trend shows no sign of slowing down as an increasing number of financial services leaders plan to capitalise on new technologies — the proportion surged from 41% in 2020 to 61% in 2024.

Today, more than two-thirds of financial sector leaders (67%) consider emerging technologies at the core of innovation, creativity, and productivity. Our survey also finds that they are more willing than their global counterparts to embrace the additional risks associated with investing in new tech, including AI, with 50% compared to 43% of global peers prepared to take such risks.

AI takes the lead

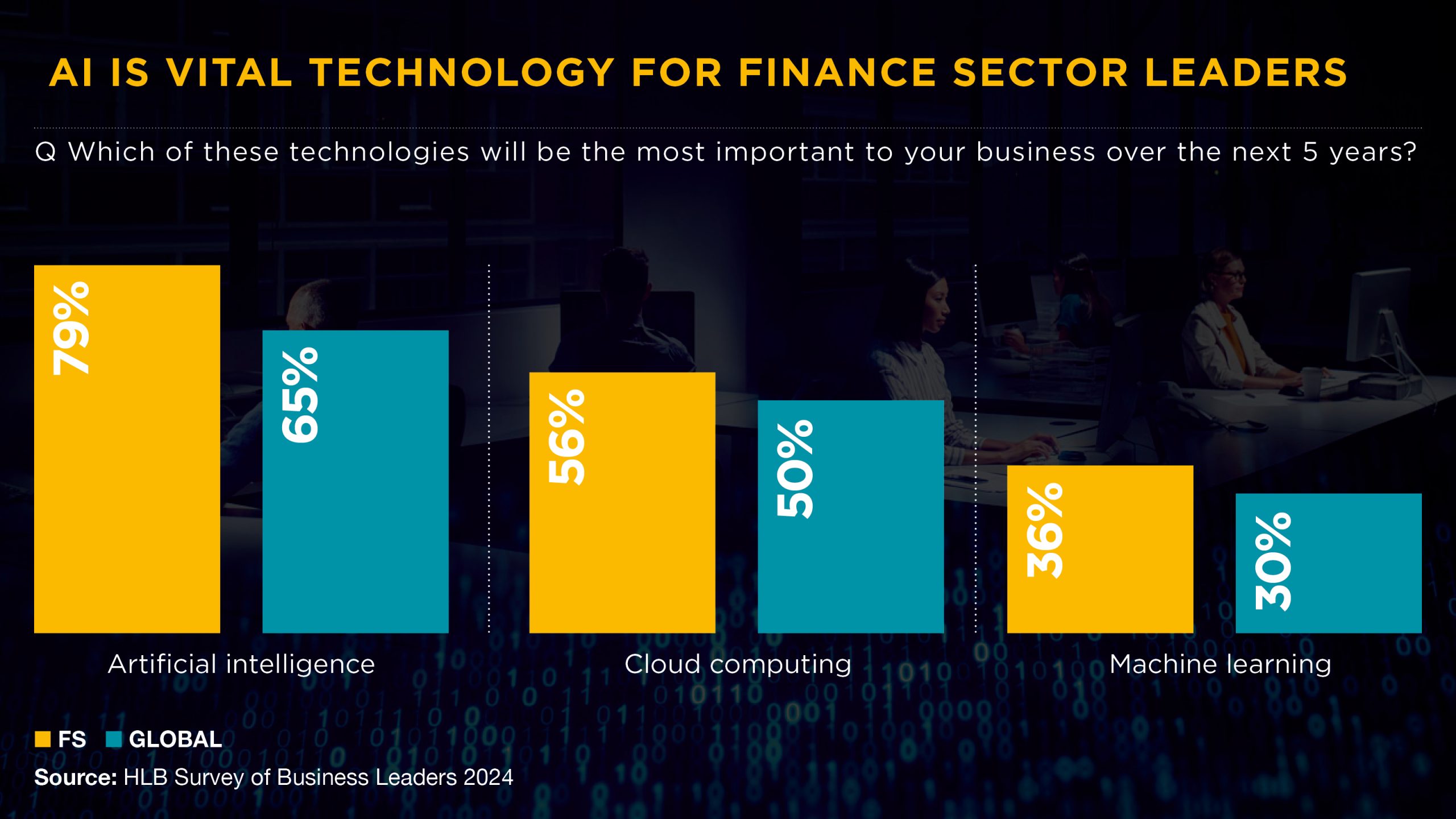

Among technologies, finance leaders consider AI the most important, with 79% of companies prioritising this cutting-edge technology over the next five years—exceeding the 65% share found in our global sample. Cloud computing follows as essential infrastructure for facilitating AI integration, but it holding greater significance for finance businesses (56%) compared to their counterparts (50%).

Diverse attitudes, divergent maturity

Our research reveals a nuanced landscape of AI adoption within the financial services sector, demonstrating an overall heightened awareness but nonetheless varied attitudes and approaches among leaders regarding the integration of AI technologies into their business strategies.

A significant portion (34%) of the sector's leaders identify as 'Innovators,' actively utilising AI technologies or exploring its potential for gaining a competitive edge, while 47% classify themselves as 'Adopters,' willing to experiment with AI but its adoption is not a business priority.

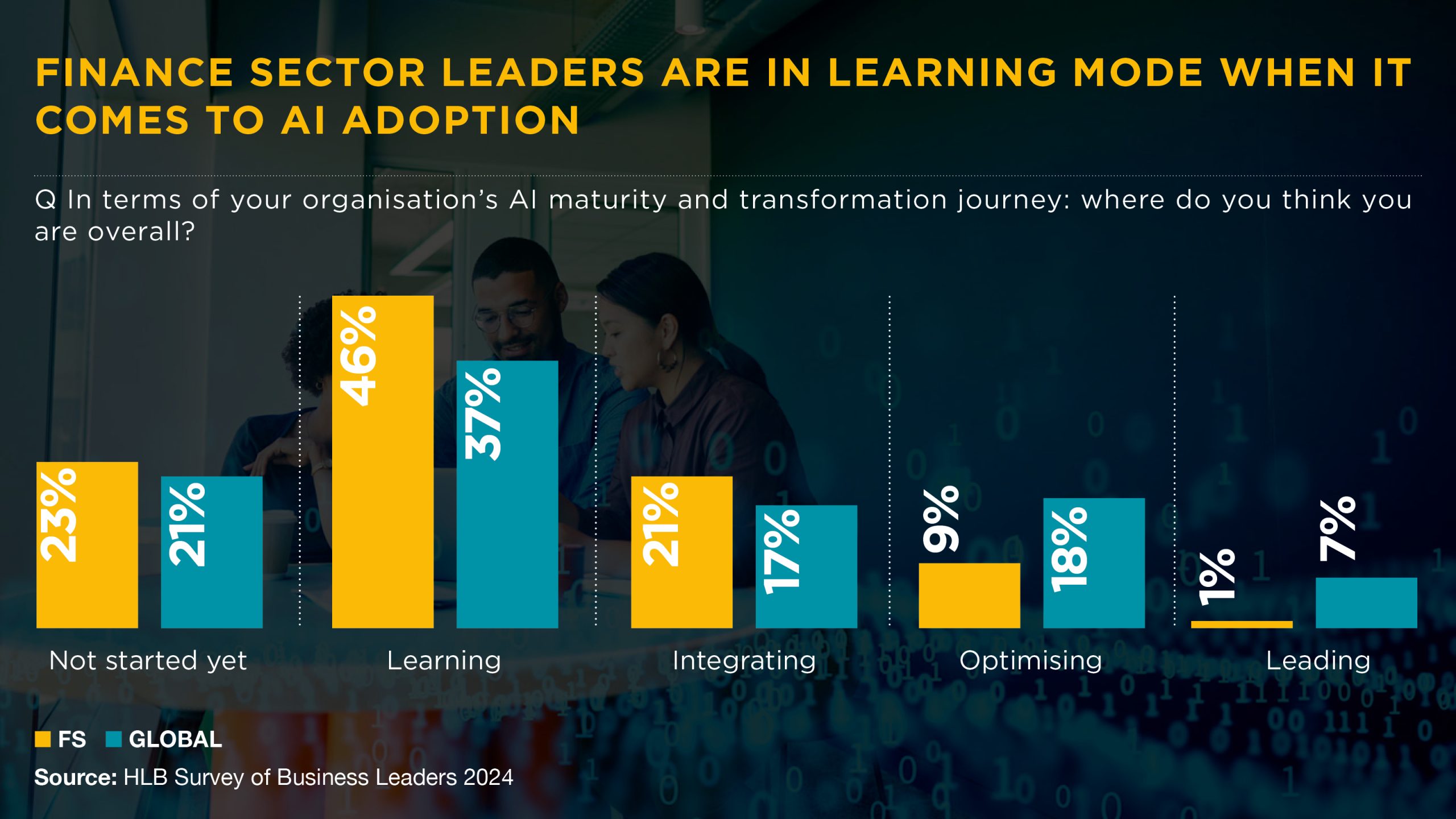

The financial services sector primarily falls within the 'learning mode' phase of the AI maturity curve, prioritising understanding AI technologies over leading or optimising. 46% consider themselves to be learning , exceeding the 37% observed among their peers.

Nevertheless, there is still significant room for improvement. Despite the sector's aspiration to be an AI trailblazer, 23% of the surveyed business leaders have yet to embark on their AI journey.

Confronting AI challenges, maximising impact

Operational efficiency through process automation is the number one driver of AI deployment in financial services. Text and data mining emerge as the second most prevalent AI applications, demonstrating a notable presence compared to other sectors surveyed.

Given the sensitive nature of the information handled within the sector, ensuring data security and privacy is of utmost importance in financial services. Nearly half of the leaders (47%) identify these as the primary barriers to AI adoption and integration, closely followed by a shortage of digital transformation skills (46%). Challenges related to data quality and legacy IT systems are also significant, with over 40% of respondents citing them as issues.

Embracing uncertainty: Leading through rapid transformation

The world is changing, and it's changing fast. Geopolitical risks, cyber threats, and environmental challenges have escalated dramatically over the five years since we started our annual survey. From inflation and geopolitical tensions to energy crises, today's business environment appears to be a constant stream of crisis after crisis.

In an environment like this, the ability to adapt to new conditions and lead with flexibility becomes critical to business survival and success. This constant disruption has emerged as a catalyst for innovation, propelling strategic investments in operational efficiency, transformative business models, and technology-driven advancements.

How HLB can help

As technological advancements accelerate, the disparities in potential business outcomes between companies adopting AI technologies enthusiastically and those proceeding with more caution become more pronounced.

If your business is looking to understand the competitive advantage new digital technologies such as AI can offer, we are here to help. The HLB team is equipped to design tailored strategies and solutions to help you maximise the benefits of new technologies and stay ahead in today's rapidly evolving landscape.

Contact HLB Global today to discover how the insights from the survey can assist you in navigating the financial services landscape in 2024 and beyond.

Survey of Business Leaders 2024

Learn more about our research