Is optimism waning?

Business Services Sector Outlook – HLB Survey of Business Leaders 2024In a major survey, HLB assesses the mood of business leaders worldwide every year. As part of the company's fifth annual survey, HLB asked the leaders about various factors with some interesting results. So, how are these leaders navigating changes in the international business landscape? Furthermore, how quickly can they adapt to new technologies (including AI)?

Looking at global growth

There are mixed projections from business services leaders about general global growth. One-third of them believe that the growth rate is declining, while a further third believe that conditions will remain the same. The remainder are more optimistic and believe that the global economic growth rate will increase next year. Furthermore, a higher proportion of those surveyed expect economic growth to grow this year than during the survey's first year, when it was at 24%.

It's interesting to compare this data with business leaders in other sectors who, on balance, seem more buoyant. 41% of them believe that global growth is on the rise.

When looking at their own businesses specifically, 77% of leaders in the business services sector are confident in their ability to grow revenue in 2024. Over a quarter are very confident, with firms based in northern Europe having the most confidence compared to other regions.

Getting used to risks

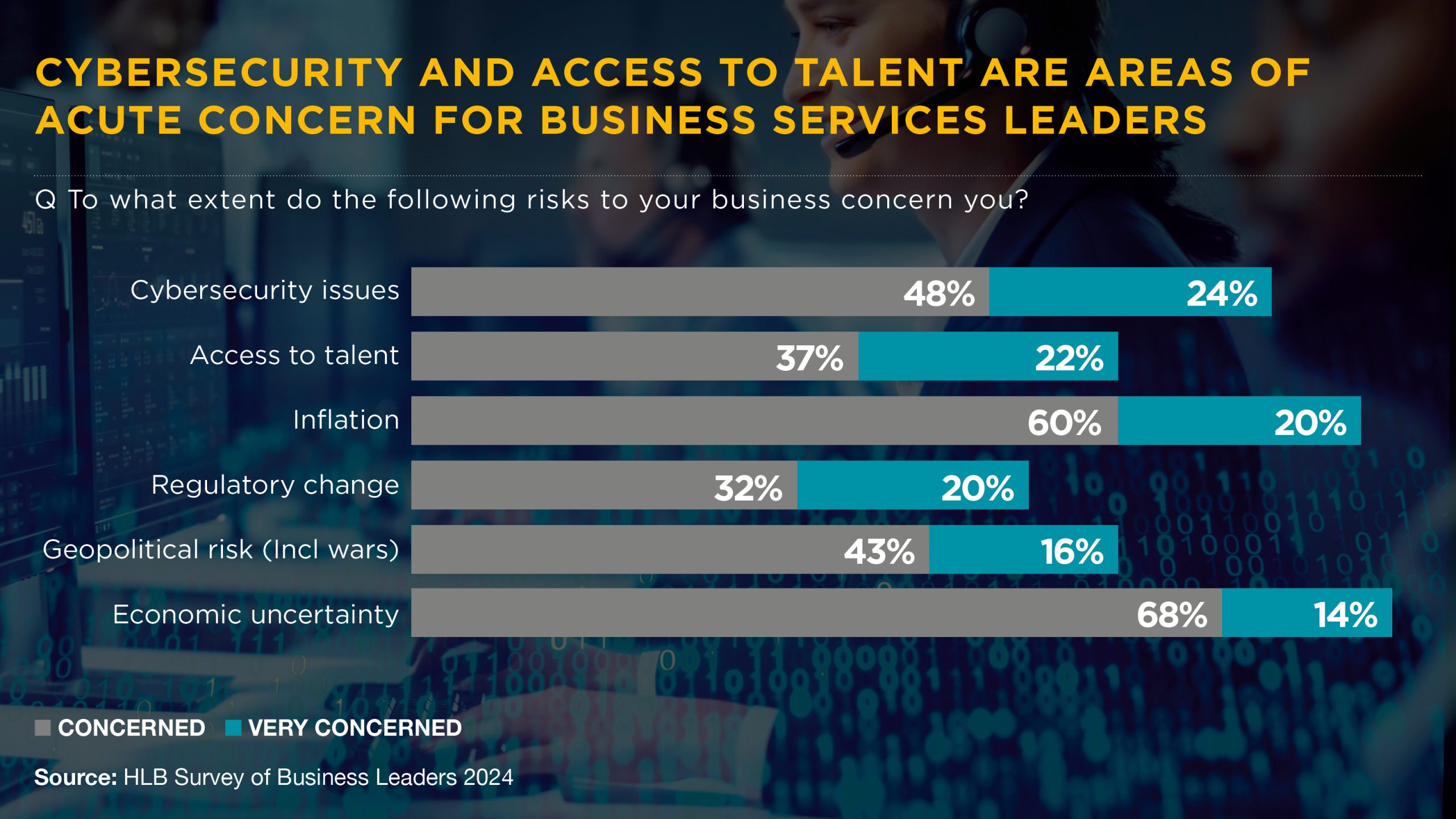

Leaders now accept a growing range of business risks. Economic uncertainty is the top risk for business services, as mentioned by 82% of respondents, followed by inflation cited by 80%.

Cybersecurity is also a concern for 72% of leaders in the sector, however, it is top of the list causing heightened concern for Business Services leaders

Business services sector leaders are more concerned about economic uncertainty than their peers (82% versus 68%). Although not in the top risks, disruptive emerging technologies have risen from 36% to 53% over the last year. This might be due to the rise of artificial intelligence (AI) in business services like accounting, copywriting, and others.

Overcoming market and trade disruption

To help them overcome market and trade disruption, many cross-sector leaders see technology as the saviour, with two-thirds of global respondents stating that new tech could help them overcome future cross-border business challenges. Yet business services leaders are not as optimistic, with only 50% agreeing with this statement.

Respondents are also less inclined to agree they would benefit from changes in trade agreements, which could create new business opportunities. Only 33% would agree with the potential benefits of trade agreement changes versus 52% of global respondents. This may be because many business services firms tend to be national in terms of their reach and less exposed to global trade challenges.

Focusing on strategies for 2024

Business services firms rank four specific strategies for the next 12 months as important to their growth:

- Improving operational efficiency

- Adopting new technology

- Reviewing strategies and reducing costs (joint third)

Two-thirds expect to put primary effort into improving operational efficiencies through 2024.

The adoption of new technologies comes a close second, with 63% saying this would be a priority in 2024. This is up from 49% in 2023, despite lower expectations of tech’s ability to overcome market turmoil. 57% of leaders will review their strategies or see if they can reduce business costs through 2024.

When it comes to the top areas for improvement, 42% mention talent acquisition. 38% believe they need to focus on improving operational effectiveness.

Identifying technological opportunities

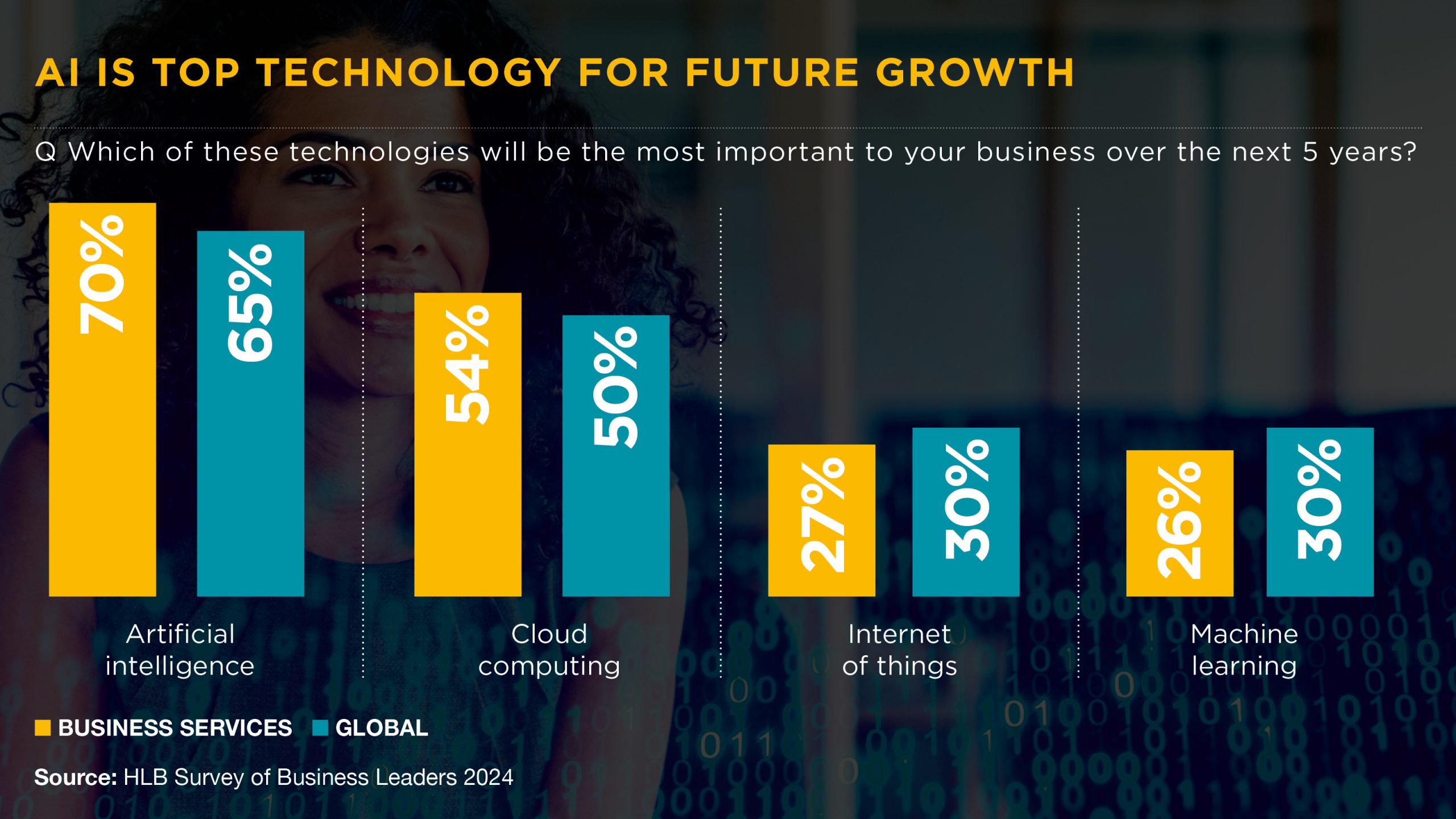

Business services leaders point to AI as their top technology for the next five years, as mentioned by 70% of respondents. This is higher than their peers in other sectors (65%). Cloud computing was also a high scorer in the list of technologies needed for successful operation .

Looking at the technological challenges

Despite the allure of "tech" and its importance to future growth, leaders are somewhat cautious about diving in. More than one-third of them believe it could be difficult to create organisational capacity to fully explore the opportunities presented by these emerging technologies. They think shorter-term priorities or unexpected disruption could get in the way.

Meanwhile, around one-third are more bullish and prepared to take on extra risk when integrating AI technologies. They see the potential benefits of success, although the number of respondents was far lower than their peers in other sectors.

The attitude towards AI in the business services sector is generally more cautious than within other sectors. For example, 24% say they are careful or averse compared to 18% elsewhere. They worry that the risks will outweigh the benefits, or they may even wholly oppose AI adoption.

48% of business services sector respondents classify themselves as "explorers." This means they will try AI technology should someone present a convincing business case. Still, they are unwilling to make adopting AI technology a business priority.

Regarding all-out efforts, 28% of respondents consider themselves the "innovators" in this area. Interestingly, this is a relatively small portion compared to peers across all industries (44%).

Stalling on the start line

Almost half of respondents (49%) consider themselves to be mainly in learning mode regarding their AI maturity and transformation journey. Only 1% assume they are leading, while 5% are optimising, and 16% are integrating. Worryingly, 29% say that they have not started yet.

Specifically, 58% have not started any AI-specific training, retooling, or upscaling. 57% also say that they have not started an assessment of IP, legal, or licensing impacts. These critical areas would give them a strong foundation for AI tools as other businesses move closer to adaptation.

Barriers to AI adoption

There is a lot of concern among business services leaders when it comes to data security and privacy (44%). This is the largest barrier for leaders in the sector, many of whom (38%) mention a lack of "use cases" as another obstacle to AI adoption.

In terms of other barriers to adoption, one-third of respondents are fearful of AI technologies or are resistant to change, and a similar proportion indicate that they do not have enough budget.

Business services leaders who already use AI technologies are deploying for document processing, first and foremost. Content generation is the second most likely use case, followed by custom analytics and process automation.

Assessing the state of play in the business services sector

Companies in the business services sector seem stuck in learning mode and might benefit from a greater understanding of the opportunities and some "handholding" and educational support. One European leader says, "Knowing the potential pros and cons in the long run would be useful." Another in Africa and the Middle East seeks "a more complete understanding of how AI can help my business to grow or even benefit." Tellingly, a third CEO was unconvinced: "We don't know what it's for."

Despite the level of caution, 56% of business services leaders think that emerging technologies like AI would be the key to driving innovation, creativity, and productivity. Still, this figure lags behind their global peers (65%). Maybe the reason can be summed up by a European business leader who is "waiting to see advancements in the specific areas where we would use it."

How HLB can help you to adapt?

HLB harnesses the power of more than 40,000 professionals across 156 countries to create a global network of independent advisers and accounting firms. We combine local expertise with global capability to serve the needs of business services companies (and others) worldwide. Furthermore, we take the time to build a trusting relationship with each client and can set up a localised HLB client team to help companies navigate through challenging times.

If you're interested in how we could help your organisation in the business services sector, contact one of our experienced team members for further information.

Survey of Business Leaders 2024

Learn more about our research