Seeking efficient and sustainable paths to growth:

APAC leaders’ agenda - HLB Survey of Business Leaders 2023Business leaders in APAC have taken longer to get back on track post-pandemic given more recent easing of restrictions on movement and operations in the region. Among survey respondents from APAC, 60% remain concerned about the ongoing consequences of COVID-19, with twice as many APAC leaders being very concerned versus their global peers.

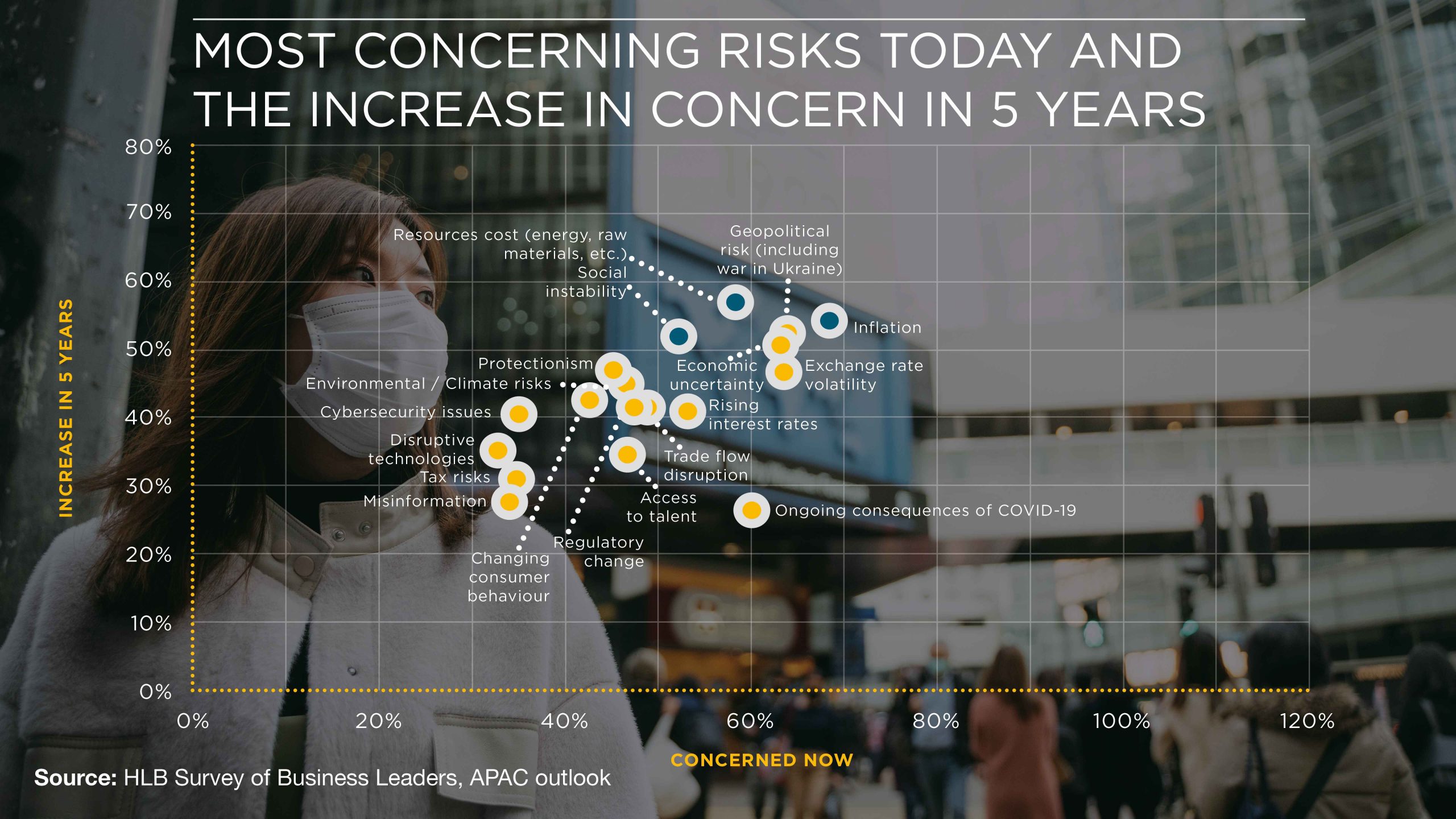

Yet, the vestiges of the pandemic aren’t the only risk APAC leaders face. According to our research, the overall risk profile for businesses in APAC is substantial. “Inflation”, “exchange rate volatility”, “geopolitical risk”, and “economic uncertainty” are the top four worries for leaders in the region, followed closely by “resource costs” and “trade flow disruptions” - all concerns for over half we polled.

Inflation in APAC is set to slightly slow down in 2023 to 4.2% from 4.4% in 2022 according to Bloomberg. Headline inflation is decreasing in response to cooler global commodity prices and regional fiscal measures for currency stabilisation. Core inflation, however, will be more persistent. Among survey respondents, 54% expect inflation to remain a concern in the five-year perspective.

Geopolitical risk worries 63% of leaders in APAC. Malaysia faces a hung parliament for the first time in history, which may prove both a positive political outcome and a nuisance. Political uncertainty also applies in Thailand, with a new government in formation as a result of May’s general elections.

Of course, local political dynamics are overshadowed by a degenerating relationship between the US and China, exacerbated by the war in Ukraine. Both countries have strong local influences with China actively investing to strengthen economic and infrastructure cooperation with new partners in ASEAN.

President Biden's administration launched the U.S.-ASEAN Comprehensive Strategic Partnership at the end of 2022, promoting further economic and infrastructure collaboration. A series of initiatives include electric vehicle (EV) infrastructure development projects, new connectivity infrastructure, defence projects, food security, and clean water support programmes among others. Economic cooperation renews after the five-year ‘cool off’ of the Trump administration.

Although the US has lost regional influence to China in terms of economic relationships, the country still maintains strong defence relationships in Southeast Asia. According to the 2023 Asia Power Index by the Lowy Institute, China maintains higher influence scores in countries such as Cambodia, Indonesia, Laos, and Myanmar among others. However, their influence is level-pegging in the Philippines, Singapore, Thailand, and Vietnam.

In terms of diplomatic influence, China leads due to its extensive outreach, but the US cultural influence remains higher due to its media reach and people-to-people connections. The impacts of such bipolarity directly affect the regions’ political stability and economic growth.

Trade bloc and geopolitical risk challenges are compounded by inflation, rising living costs, and constraints on borrowing. In the next 5 years, 59% of APAC leaders expect further increases in resource costs and 54% - higher inflation. Moreover, 53% are concerned with social instability, which is 5 percentage points higher than globally.

Compared with their global peers, business leaders in APAC appear to be also less pressed by talent risk (a present-day concern for 48% vs 62% globally) and tax risks (36% vs 48% globally). APAC leaders are also slightly less concerned about future climate/environment risks (45% vs 57% globally) and cybersecurity issues (41% vs 61%).

APAC growth prospects

Geopolitical tensions, paired with the economic slowdown and an expanding risk profile, make APAC leaders wary about growth prospects. 58% expect global growth to decline in 2023 vs 20% believing in the opposite. That’s a sharp contrast to 2021 when APAC respondents were certain of the opposite: 63% expected a growth increase, while 12% braced for a decline.

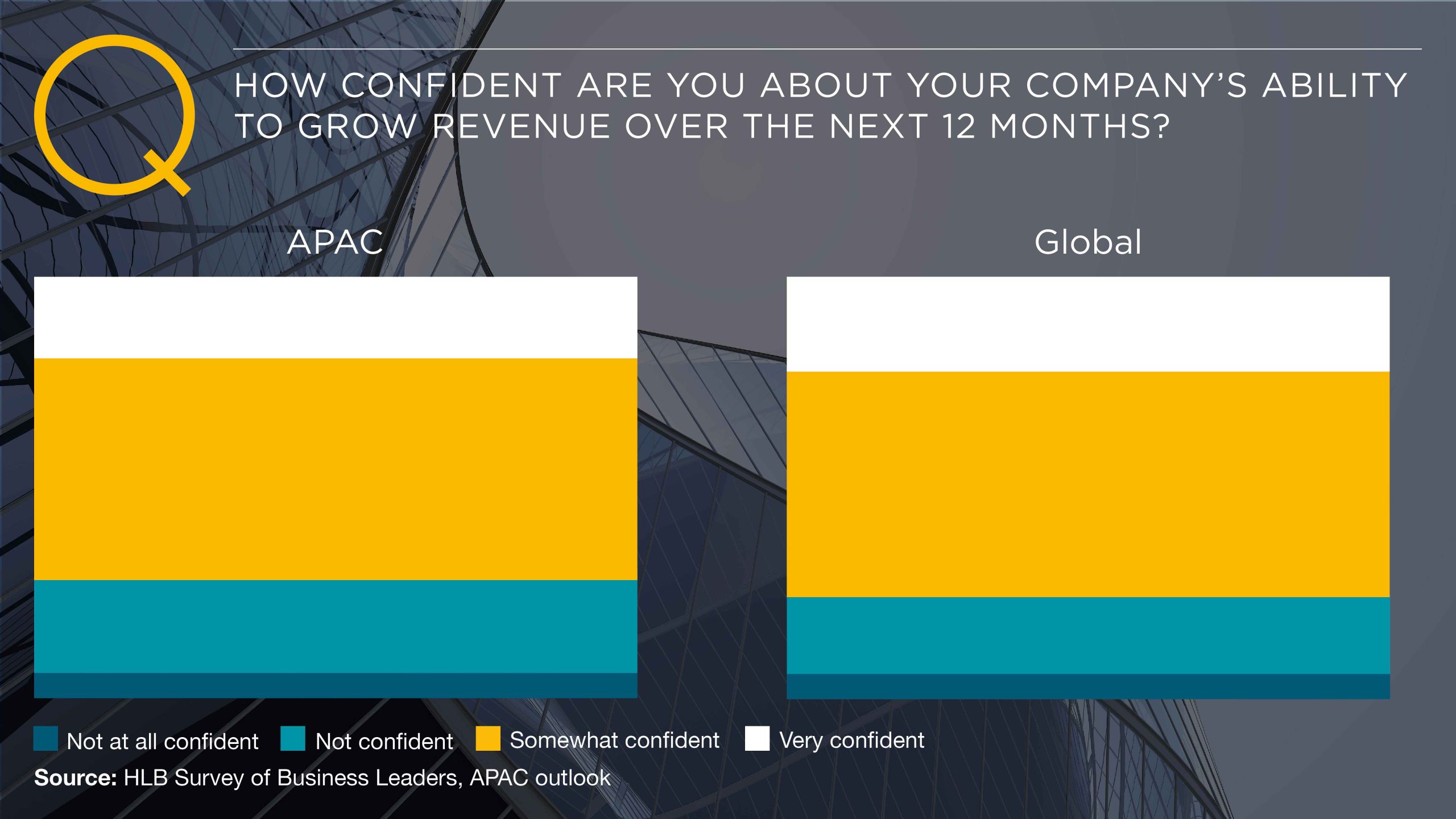

This cloudy global outlook casts a shadow on their own confidence levels. 71% have confidence in their own company’s ability to grow revenue over the next 12 months. Yet, 26% also lack it, which is 7 percentage points higher than their global peers.

Although slightly muted at present, long-term growth prospects in the region are pretty reasonable as compared to the World Bank’s outlook for global growth of 1.7%. The Asian Development Bank expects economies in Asia and the Pacific to grow 4.8% this year and next year, improving on the 4.2% growth rate in 2022. However, China is unlikely to reach its original target of 6% GDP growth this year.

The IMF posted a similarly optimistic forecast for most economies with the following real GDP growth figures for 2023:

- Australia – 1.6%

- New Zealand - 1.1%

- Japan – 1.3%

- China – 5.2%

- India – 5.9%

- Indonesia – 5%

- Malaysia – 4.5%

- The Philippines – 6.0%

- Vietnam – 5.8%

The opening of China’s borders has accelerated business in other APAC countries, which depend on China as a trade and tourist partner. Malaysia, for example, expects at least a 1% GDP increase due to renewed tourism. In addition, government-backed projects within China’s Belt and Road initiative are getting restarted and generating an extra influx of investment into APAC.

According to S&P, the latest economic indicators for mainland China are positive and indicate a rebound. In the first two months of 2023, industrial production increased by 2.4% year-on-year, while retail sales grew by 3.5%.

The IMF expects a 1.6% real GDP growth in Australia and New Zealand for 2023 with a starting inflation rate of 5.4% on average consumer prices and a 3.9% for the end period, with the Australian economy performing slightly better. The Reserve Bank of Australia expects growth in household consumption to remain subdued due to rising interest rates and consumer prices. Yet, a strong labour market will foster progressive consumption growth increase in the second half of the year.

Neighbouring New Zealand received a more pessimistic outlook from the IMF, with an expected real GDP growth slowdown to 1.0% in 2023 and 1.2% in 2024. Increasing housing costs combined with rising interest rates and inflation, are negatively affecting private consumption. Tighter credit conditions and weakening consumer demand, respectively, also dampen business investment.

The Bank of Japan is signalling a modest recovery in mid-2023, due to the normalisation of economic activity and the materialisation of pent-up demand, although the risks of inflation persist. Japan’s economy remains subject to high commodity prices and a slow recovery among key trade partners - China, South Korea, Thailand, and Hong Kong.

Although the macroeconomic climate remains challenging for the APAC, early signs of recovery are evident. Inflation and resource costs are progressively stabilising. Economic activity is picking up speed both among businesses and consumers. Although APAC leaders had to throttle back on some of the earlier economic ambitions, there are now tailwinds working in their favour.

Leadership in challenging times

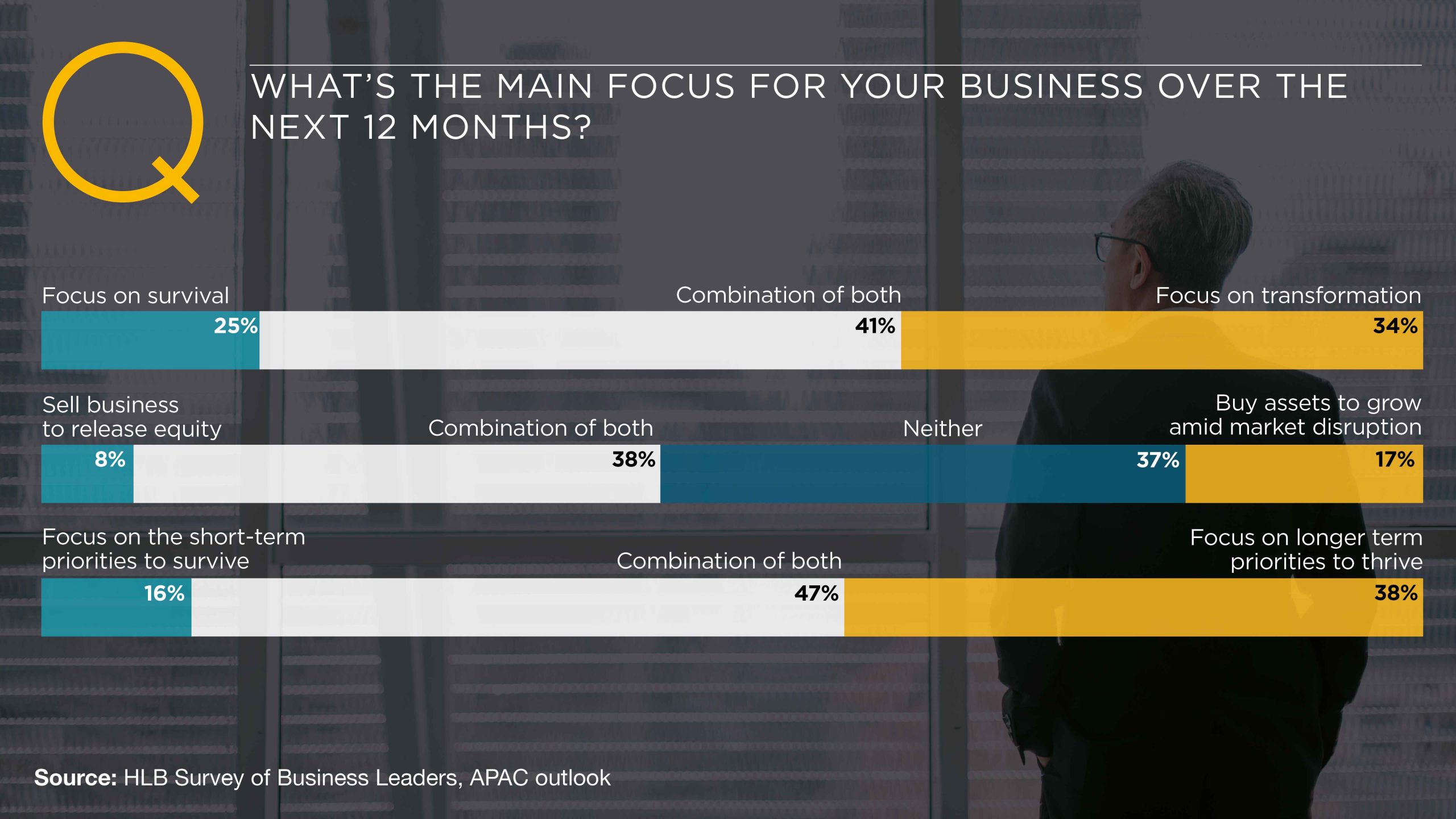

Despite the present-day challenging conditions, APAC leaders remain forward-looking. 85% of leaders are focused on both short-term, survival-critical items and longer-term goals. Of these 38% are solely focused on seeking long-term priorities to thrive.

The past two years have been undeniably challenging, yet three-quarters of our respondents indicate that they are investing to innovate and grow (although over half of these leaders are doing so in conjunction with a focus on targeting operational efficiencies). In last year’s survey, over a quarter of our survey respondents considered themselves to be ‘much more innovative’ than their industry peers, and 42% indicated they see themselves slightly ahead of the competition with regard to innovation.

To innovate and grow during tricky times, organisations will require new leadership strategies and operational practices. This year, we asked business leaders what behaviours they deem essential in times of crises. The top three attributes deemed crucial for successful leadership in the face of adversity, are: (in ascending order):

- Flexibility

- Growth mindset

- Integrity

As one of the respondents from the real estate industry further elaborated: “Survival and development go hand in hand. Leaders will need to take into account the needs of others and integrate them into the strategy”.

Flexibility

Given the challenges facing business leaders in the region, it’s not surprising that flexibility is the top essential behaviour for successful leaders facing a crisis. Leaders in APAC are showing great agility in flexing their strategies to suit the fast-changing trading conditions.

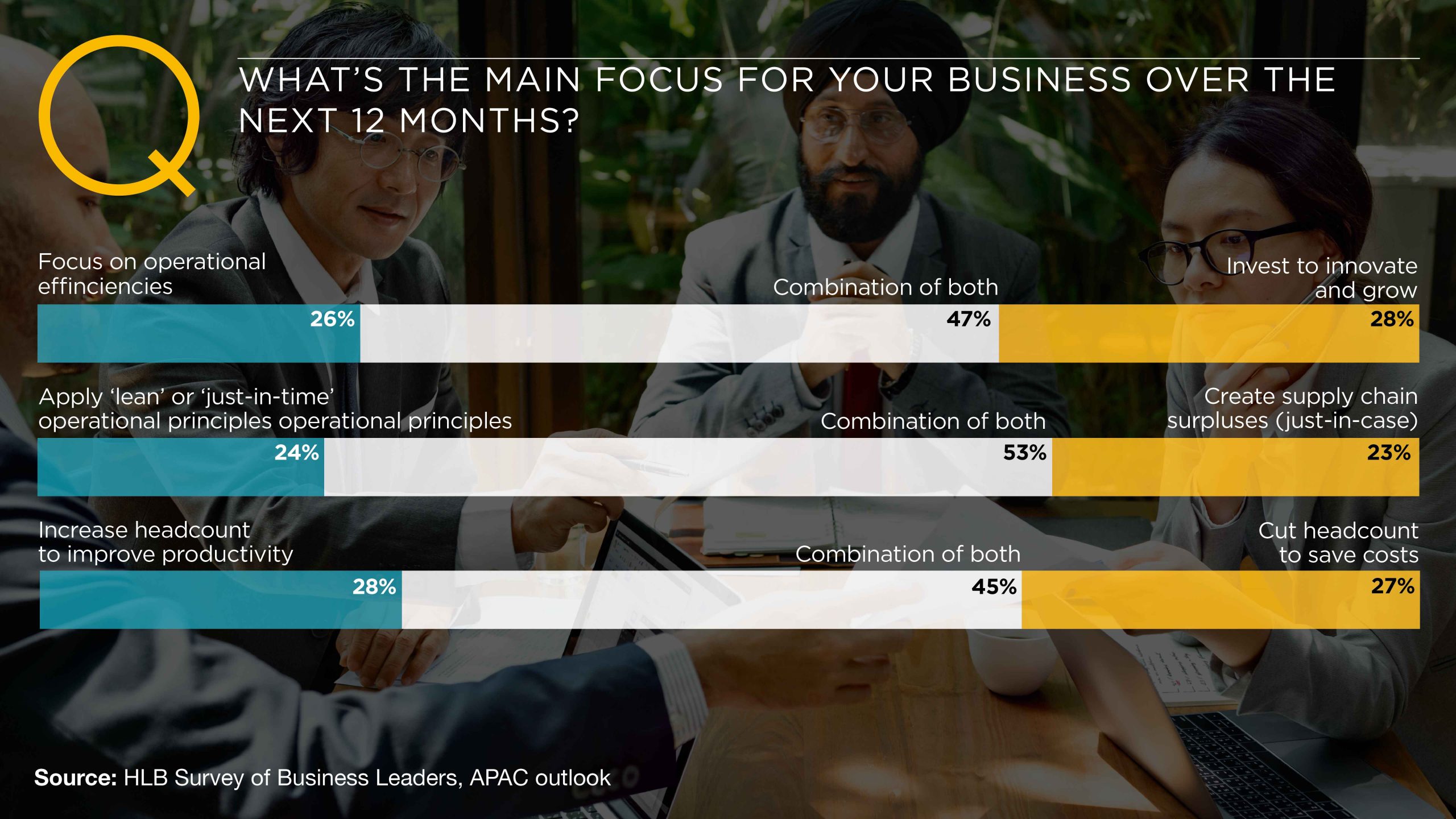

In almost all aspects of steering businesses through tough times, leaders in the region told us they were trying to cover multiple objectives simultaneously. 41% are focusing on achieving both transformation and survival over the next 12 months. 45% are aiming to increase headcount to improve productivity at the same time as cutting headcount to save costs. Our results suggest even higher numbers of combined efforts around supply chains, technologies and efficiencies. 47% are focusing on improving operational efficiency in combination with investments in innovation and growth, with 28% choosing only the latter over the next 12 months.

However, improving operational efficiency is this year’s ‘first priority’ action business leaders are planning when asked what they will be doing in order to grow and remain profitable. It was selected by 70% of our sample ahead of cost reduction and launching new products or services, joint second priorities for more than half of the respondents.

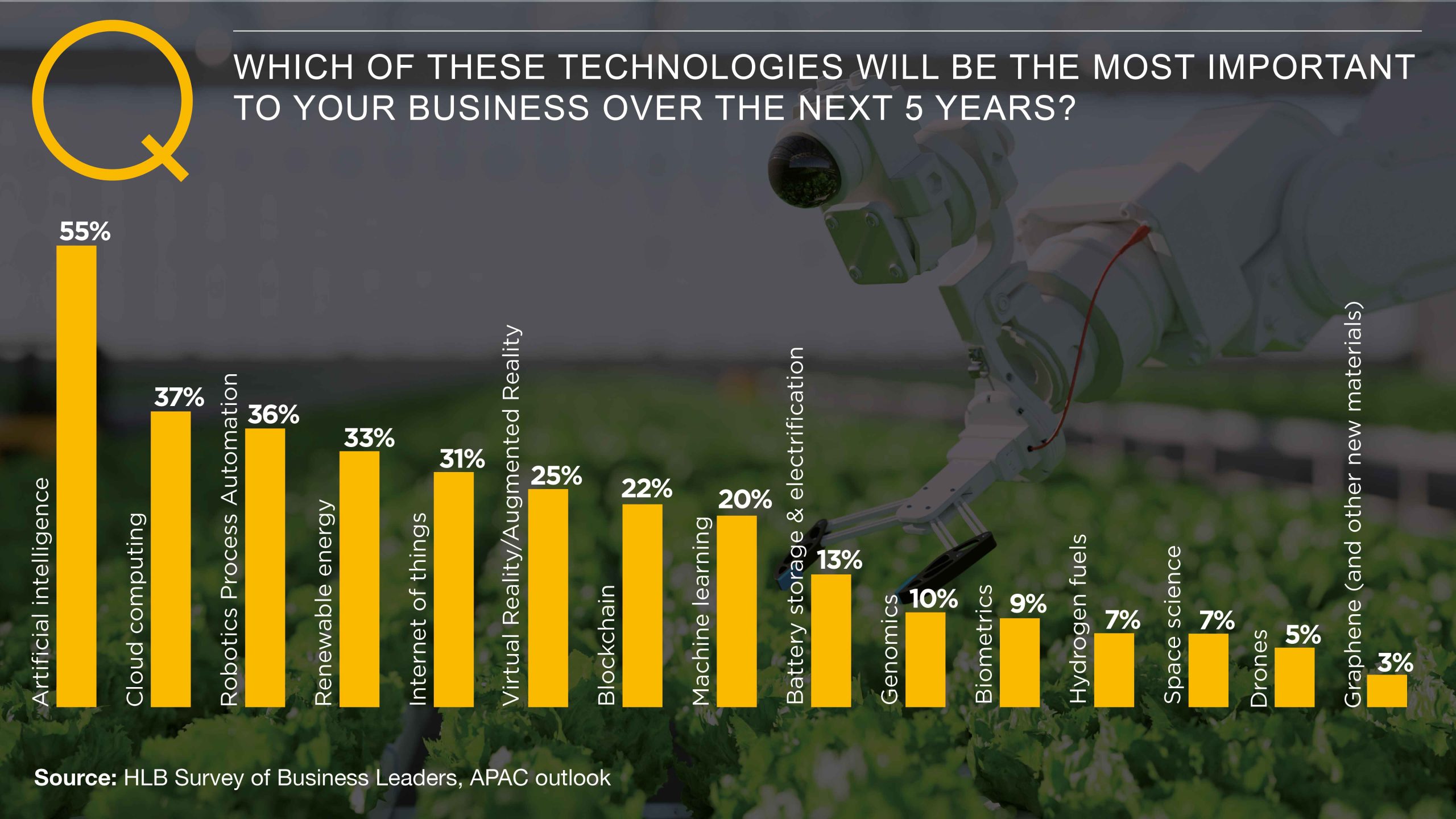

Adopting new technology is also a priority for over 40% of respondents as the speed of doing business continues to accelerate. Artificial intelligence (AI), cloud computing, and robotics process automation (RPA) as the top-3 most important technologies for their business in the next 5 years.

Better data, smarter algorithms and stronger computing power has powered AI forward this year to become the critical digital capability for business leaders. Generative AI models like ChatGPT alone could increase the global GDP by 7% during the next decade and productivity growth by 1.5 percentage points, according to Goldman Sachs. For leaders focused on increasing operational efficiencies and containing costs, AI often appears as the optimal means to an end. Governments, in turn, view digitisation and AI in particular as the future pillars of economic competitiveness.

China and the US have been engaged in the “AI race” since the late 2010s, with both countries allocating substantial investments in artificial intelligence algorithms and supporting technologies. In 2022, China spent over $2.3 trillion on new digital infrastructure projects, which is double the $1.1 trillion infrastructure package the US plans to spend over 5 years.

Stanford University placed China as the top second country worldwide for “AI vibrancy”. The country produced one-third of global academic papers and citations on AI-related subjects in 2021 and raised one-fifth of global private capital for developing it.

American policymakers have been working steadily to decouple the deeply intertwined AI ecosystems of the US and China as each strives to outpace the competitor, restrict access to key technologies and seize greater economic gains. However, international academic exchanges are often essential for further technological innovation. Tighter collaboration, joint standards and regulations around ethical usage will be essential for the sustainable development of the future AI economy.

For businesses, emerging technologies like AI, cloud computing, and RPA among others are enablers to faster response to changing market conditions and customer preferences. The workforce, empowered with access to real-time insights, on-demand access to knowledge, and smart automation can shift gears with less friction and accomplish strategic objectives faster. Likewise, these technologies are essential for creating value-added products, which APAC leaders could use to rekindle the demand both in domestic and international markets.

Business leaders in some APAC countries are grappling with gaps around digital talent and limited access to reliable digital infrastructure, which could hamper ambitious growth targets. Indonesia, for example, has an ample young workforce (with a median age of 29) and a rapidly growing digital economy (worth $77 billion in 2022). However, the country also has one of the lowest internet penetration rates in Southeast Asia, restraining growth.

Our survey respondents appear to recognise the need to invest in this area. Despite the commitment to cost optimisation, a sound 53% are evolving their human resources model to meet the future requirements of work. Also, 51% plan to simultaneously accelerate the adoption of new technologies and improve workforce productivity.

Growth mindset

Having a growth mindset is the second-highest rated behaviour essential in times of crisis selected by business leaders in APAC. Although businesses are facing strong headwinds, they remain committed to innovation and growth. Over half of respondents are planning to launch new products or services in 2023. Whereas, 75% of leaders are focusing on transformation, albeit more than half of these hope to achieve it in conjunction with business survival tactics.

In addition, 85% of business leaders in the region are focusing on longer-term priorities to thrive. Half of this group is also keeping an eye on tactics in the shorter term. On balance numbers support a growth mindset focused on the optimum strategy in the longer term.

With borders reopening, APAC companies are looking beyond their own for growth. China is strengthening its trade relationships with the ASEAN economic community, which has already overtaken the EU as China's top trading partner. The Global Times reports that in 2022 trade volumes between China and ASEAN grew by 15% to 6.52 trillion yuan. That’s a year after ASEAN’s Regional Comprehensive Economic Partnership (RCEP), a free trade agreement between its ten member states, went into effect.

Trade between Australia and China is also advancing. China is now the country’s largest bilateral trade partner, accounting for almost a third of Australia's exports. The largest export marketers are agriculture, commodities, and services. In March 2023, trade volumes hit a new record high of 19 billion Australian dollars as thermal coal exports surged by 122%, according to data released by the Australian Bureau of Statistics.

Strong trade relations provide advantages for businesses: reducing export friction, increasing economies of scale and competition, and ultimately supporting future economic growth. The pandemic exposed weak links in the global supply chains. Trade routes are again being recharted to account for new geopolitical events. No wonder 56% of leaders in APAC remain concerned with trade flow disruption.

China has also significantly increased the rate of non-financial outward direct investment in ASEAN, which increased by 43% year-on-year and topped $3.94 billion during Q1 of 2023, according to HSBC. That’s three times the growth rate of China’s investment in countries participating in the Belt and Road Initiative. An outbound economic policy will likely create more growth opportunities in partners’ economies, as well as further accelerate China’s cross-border commerce and business expansion.

Among the leaders we sampled, 24% are planning to establish new joint ventures and strategic alliances in order to grow this year. Another 55% of APAC leaders are buying business assets in order to grow amidst the market disruption, including many who are partaking in both buying and selling assets (to release equity). Notably, 37% aren’t engaging in any M&A at present. SoftBank, for example, is negotiating a strategic alliance with Samsung, regarding SoftBank’s-owned chip manufacturing company ARM.

The expanding digital economy in Southeast Asia continues to be critical for business leaders with a growth mindset. The digital economy generated almost $200 billion in gross merchandise volume in APAC in 2022 and is expected to maintain a 20% CAGR until 2025, according to a Google e-Conomy study.

China’s big tech firms are increasing their stake in the region. The Alibaba-owned Lazada, for example, is now the largest ecommerce marketplace in Southeast Asia, servicing Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam. Alibaba and Tencent also have major stakes in the most successful local startups - Go-Jek (a mobility super app) and Tokopedia (an ecommerce marketplace) among others. Ongoing digitisation efforts are also driving demand for Chinese cloud companies, which often enter new markets before the Big Tech firms arrive.

Japan’s SoftBank actually stands behind some of the early Alibaba growth. SoftBank used to own an almost 30% stake in the company, however, has moved to sell most of its holdings this year to release some equity and limit its exposure to China’s changing policies, the Financial Times reports. Yet, not all Japanese companies are exiting China. Panasonic, on the contrary, plans to invest an extra $373 million through the end of 2024 to expand its manufacturing operations in China.

The South Korean digital economy has grown significantly over the past several years. The country has ambitious plans to become the number three in global artificial intelligence competitiveness and double its data market size to $34.7 billion or above by 2027, said President Yoon Suk Yeol. As part of the plan, Korea already signed a digital economy deal with Singapore, aimed at improving e-payments and digital identities interoperability, as well as overall cross-border data flows and joint AI investments.

Although the digital economy offers plenty of new growth opportunities, APAC leaders are also looking to capitalise on technologies beyond digital. In fact, a third of APAC respondents selected renewable energy as one of the technologies most important to their business over the next five years.

Apart from improving the quality of life, decarbonisation is creating new economic opportunities in ASEAN. The region has one of the fastest-growing emission levels in the world due to population growth, rising income levels, and subsequent development gains. High reliance on fossil fuels (namely coal) is problematic. ASEAN's energy-related emissions will increase by 60% by 2040 if no concerted effort is made to transition to clean energy sources.

That said, several APAC countries are making progress on climate change. The country is on track to have 34.6% of its generation mix coming from renewable sources by 2030. China could exceed the original renewable energy target of 33% by 2025. The New Zealand government set an aspirational target of 100% renewable electricity by 2030. At present, renewables already represent 82.1% of total energy generation and 40.8% of the primary energy supply, according to the public New Zealand Energy Dashboard.

Transitioning to clean energy generation also provides investment opportunities. New infrastructure development projects for solar, wind, and thermal, will bring new public and private investors in the region. Likewise, the potential is there for regional energy players to become competitive global renewable suppliers. Australia signed a collaboration deal with Japan on fuel cells and planned hydrogen exports. This program aims to accelerate the development of the Australian hydrogen export industry to make it a preferred supplier of hydrogen to Japan and its neighbours.

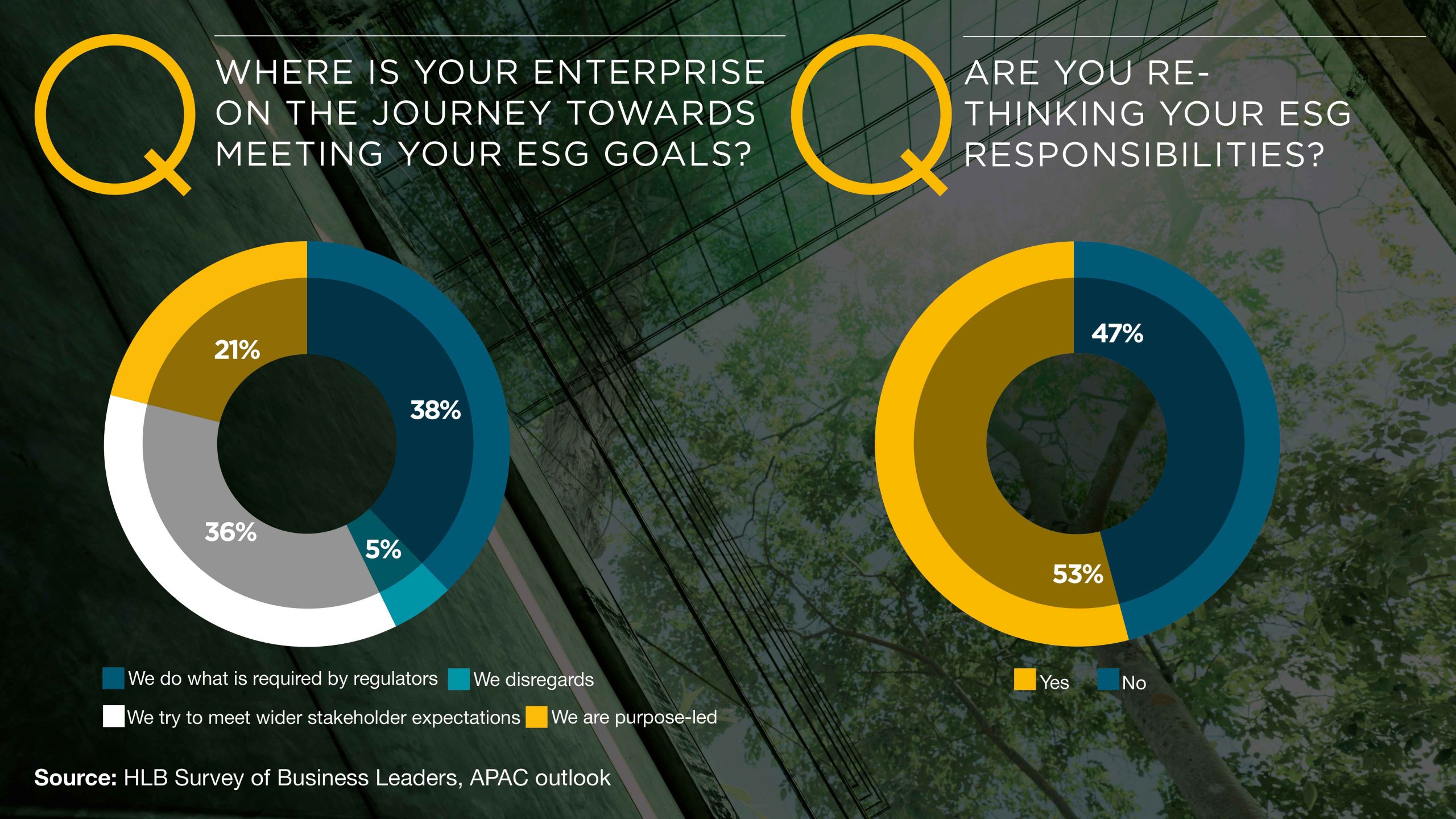

APAC leaders we surveyed appear to recognise that rapid growth shouldn’t come at the cost of sustainability. 66% have a dual focus on improving business performance and environmental, social, and governance (ESG) impacts of their operations.

Integrity

Integrity is the third most essential behaviour selected by leaders in APAC to support successful leadership in times of crisis. The importance of integrity has likely risen as a result of leading businesses and their people through the pandemic.

Among APAC leaders, 68% say they have clearly defined and communicated the purpose of their business. For many, their purpose extends beyond revenue generation for shareholders, to include their wider contribution within the communities in which they operate. As the CEO in the energy sector points out: “environmentally friendly, long-term stable development of society” is something progressive leaders should aspire to and many already do.

An impressive 21% of APAC-based companies identify as purpose-led vs 15% globally. Another 36% aim to meet wider stakeholder expectations when it comes to environmental, social, and governance (ESG) targets. APAC leaders are pursuing a number of actions with regard to their ESG responsibilities including: “sourcing and developing technologies to fulfil ESG responsibilities and training and developing our staff”, “focusing on environmental and climate-oriented technology enhancements”, “systematic introduction of sustainable financing mechanisms”, and “strengthening cooperation with various institutions“.

A sound 53% plan to further re-think their ESG responsibilities this year. “We try to actively fulfil our social responsibilities, specifically in employment, carbon reduction, volunteer activities and other aspects. At the same time, we will continue to increase the punishment for corruption,” shared an executive in the real estate industry.

However, a CEO from the business services sector admits that their company also seeks “areas where we can reduce cost but maintain our focus on ESG”. Another leader in the real estate industry shared a similar view of trying to “balance social responsibility with corporate profitability by focusing on sustainability and risk resistance for future management”.

With cost reduction being one of the top three priorities for the next 12 months as well as a weakness area 29% of leaders wish to address, the desire to make ESG activities more cost-centric is understandable. But perhaps cash-strapped leaders shouldn’t not only view ESG as another cost centre but treat it more as an opportunity to create future profit pools.

Economic development and green growth go hand in hand. The Climateworks Centre estimates that over $1 trillion in annual economic opportunities can emerge by 2030 through the development of Southeast Asia’s green economy. Business transformation in the manufacturing sector could improve emission levels but also enable labour productivity growth and a progressive transition towards circular economies, which create new revenue streams.

The government of Thailand presented a Bio-Circular-Green (BCG) Economy plan during the 2022 meeting of Asia Pacific Economic Cooperation (APEC). The alternative national development model sets a target of recycling 100% of polyethene terephthalate (PET) and polyethene (PE) plastics by 2030 through newly established infrastructure, jointly funded by the government and startups in recycling. Extra regulations will be issued to restrict plastic usage in food packaging. The plan also tackles agricultural burning, food loss, and food waste with new rules and mechanisms for creating financial incentives to turn agricultural residue into resources.

Singapore’s Green Plan 2030 also includes a mix of targets around waste reduction, water consumption, public transport electrification, and progressive transition to renewable energy usage in all sectors. Japan’s roadmap to net zero includes actions towards reducing greenhouse emissions by 23% by 2030 and becoming fully carbon neutral by 2050.

To fund climate solutions, APAC governments and private entities have issued a record number of green bonds in 2022. According to S&P, China issued a total of $56.5 billion in green bonds in 2022. APAC countries in total issued $120.83 billion of green bonds in 2022.

Although the green bond market declined globally in 2022, due to geopolitical events and unfavourable market conditions, it is projected to rebound in 2023 and perform strongly onward as ESG disclosures are becoming a necessary prerequisite for obtaining funding from public and private investors.

The Malaysian stock exchange released an updated sustainability reporting guide in 2022, which applies to all public-listed companies starting from 2023. The Singapore stock exchange also introduced a phased approach to mandatory climate reporting based on the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). Climate reporting will become mandatory for issuers on a ‘comply or explain’ basis from 2023. Japan made ESG disclosures mandatory for all publicly listed companies starting from March 2023 under the new Financial Services Agency amendments.

Australia's government plan to introduce mandatory sustainability and ESG reporting requirements for large Australian entities in the next few years. Although local companies can already voluntarily report on ESG using frameworks like the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and the aforementioned TCFD.

A flurry of legislative changes around ESG reporting is leaving some APAC leaders confused. Only 53% admit that they have a good understanding of the future ESG reporting requirements. Seeking external advisory on the matter can help better navigate the present-day compliance requirements and locate future opportunities for green-led growth.

Resuming cruising speed, sustainably

Business leaders in APAC continue to face strong headwinds to growth ambitions. Maintaining a growth mindset will be essential to success, reflecting business leaders' recognition of the need to embrace change, learn from challenges and foster innovation.

To execute their plans, leaders are exhibiting a great level of flexibility: exhibiting ambidexterity and adapting quickly to re-navigate their businesses through changing circumstances.

Integrity, their top trait for effective crisis leadership, reflects a growing realisation among business leaders that trust, transparency, and ethical decision-making are not only essential during challenging times but also contribute to long-term organisational resilience and success.

Business leaders in APAC will need to continue to transform their businesses to weather crises and emerge stronger on the other side. By embodying these leadership attributes, leaders can instil confidence in their teams, foster a culture of resilience, and steer their organisations towards a brighter future.

Regional outlooks

Learn more about our research