Leaders in APAC: Adopting AI to prosper

HLB Survey of Business Leaders 2024Resilient growth amidst varied confidence

The APAC region has delivered a strong recovery post-pandemic, with rapid economic expansion of domestic products and services consumption after lifting COVID restrictions. 82% of APAC leaders feel confident in their own ability to grow their revenues this year. However, confidence levels have gone down by 7% from last year. The sentiment is also more muted compared to North American (91%) and LATAM leaders (92%).

APAC has been one of the fastest-growing global regions for several years and is forecasted to account for 60% of global GDP growth by the end of 2024. India’s economy continues to demonstrate strong performance, with an 8.4% real GDP growth in Q4 2023, ahead of expectations.

In the medium term, Bangladesh, Vietnam, Malaysia, and, to some extent, the Philippines are predicted to grow quickly, approaching the GDP per head level of developed Asian economies like Japan, Singapore, and South Korea.

Over half of the regional growth will come from China, despite a slight deceleration in economic growth from 5.2% in 2023 to an estimated 4.5%-5% in 2024. This is substantial, especially compared to other regions. For comparison, the real GDP growth in the eurozone will be around 0.8% this year, and the US is looking at 2.1%.

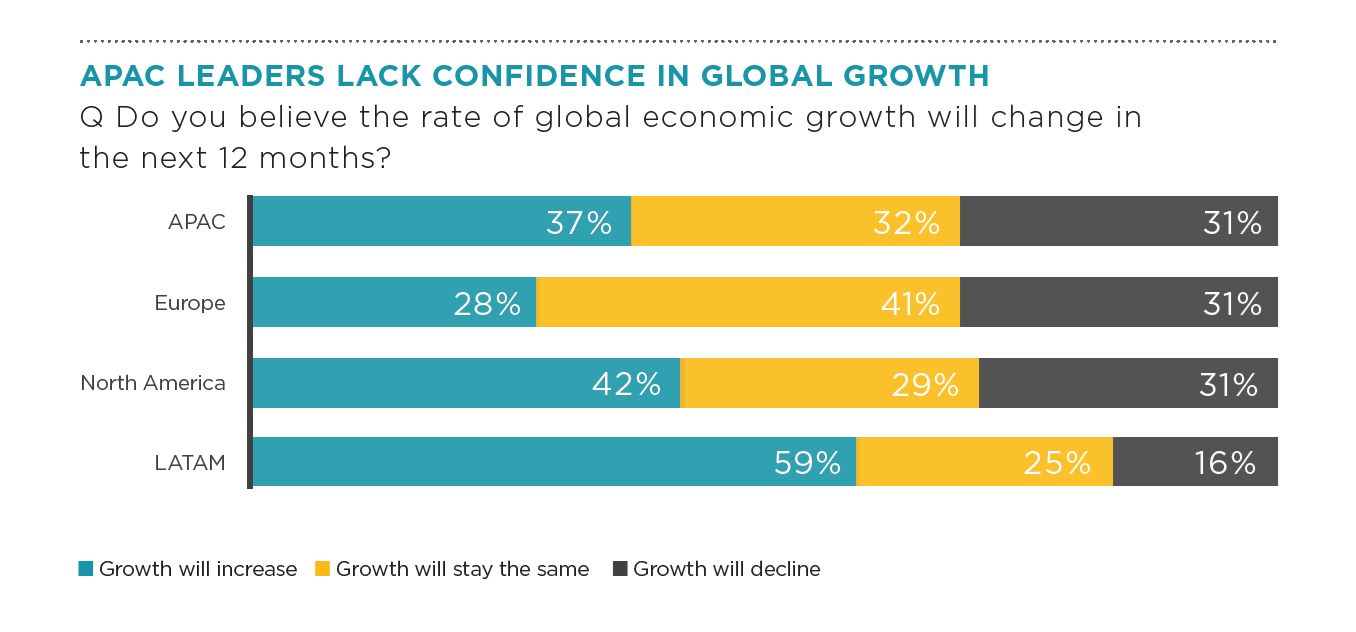

Perhaps this explains the leaders’ sentiment towards the global state of affairs. Only 37% are confident in global economic growth bouncing back in 2024 vs 42% of North American leaders and 59% of LATAM. Like Europeans, 31% of APAC leaders expect a decline.

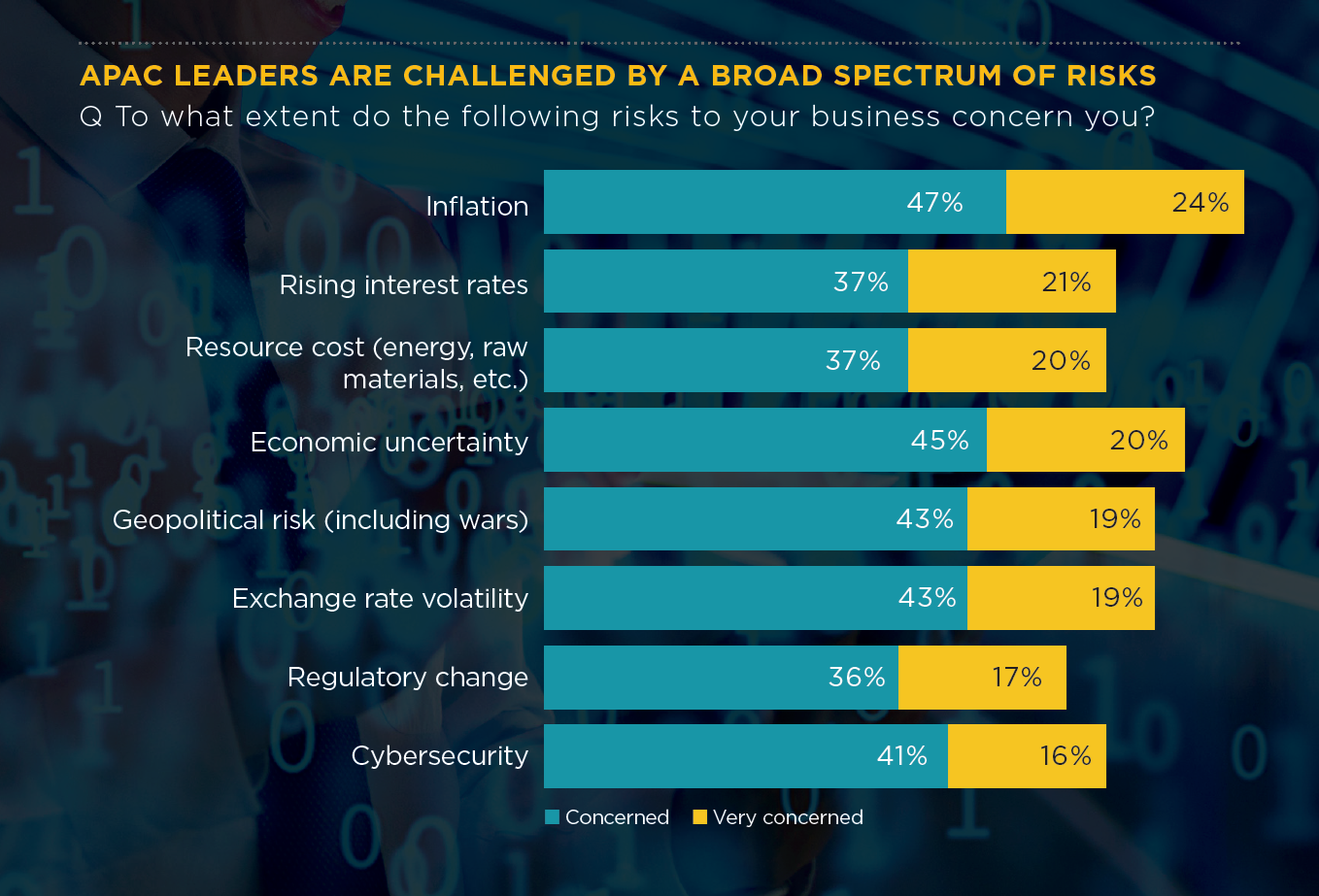

Equally, there are risks to growth that concern leaders in the region. Inflation (71%), economic uncertainty (65%), exchange rate volatility (62%), and geopolitical risks (62%) are the main stressors. Concerns about inflation and rising interest rates are higher compared to last year. A downturn in the property market has undermined China’s growth streak. Policymakers have issued fiscal support and policy rate cuts to ease the impact, with additional stimulus planned for 2024. Growing inflation has weakened Japan’s economic recovery. The Bank of Japan is looking to revise its negative interest rate policy to tackle headline inflation for the first time in twenty years.

Concerns about inflation and rising interest rates are higher compared to last year. A downturn in the property market has undermined China’s growth streak. Policymakers have issued fiscal support and policy rate cuts to ease the impact, with additional stimulus planned for 2024. Growing inflation has weakened Japan’s economic recovery. The Bank of Japan is looking to revise its negative interest rate policy to tackle headline inflation for the first time in twenty years.

Interest rates diverge across countries depending on domestic growth and inflation conditions. China, India, and Indonesia may loosen fiscal policies to support economic growth. New Zealand and South Korea may hold rates until the first quarter of 2024 to reach the 2% target. The State Bank of Vietnam cut rates in 2023 and plans to maintain them at historic lows this year to support economic growth⁷.

Australia’s consumer price inflation remains at 5%. The central bank expects a return to a 2-3% target by late 2025⁸. The Monetary Authority of Singapore expects core inflation to reach the optimal range of below 2% later in 2024⁹.

However, local currencies may show uneven performance due to different trade sensitivity. JP Morgan expects Indonesian (IDR) and Thai (THB) currencies to maintain strong performance due to increased commodity exports and tourism recovery. The Chinese Yuan (CNH) may be slightly at a disadvantage due to falling export prices.

Trade flow disruption concerns 57% of APAC leaders, but shifts in global trade create new opportunities. South Korea has increased semiconductor exports, posting a 21.8% year-on-year growth by December 2023. China and Japan expanded manufacturing facilities across ASEAN, especially in the automotive sector. In 2023, China overtook Japan in car export volumes, becoming the top global exporter due to its success with electric vehicle (EV) sales. 53% of APAC leaders believe trade agreement changes will create new opportunities for businesses. Three-quarters of leaders also believe technology advancements will help overcome cross-border challenges.

AI: The top technology over the next 5 years

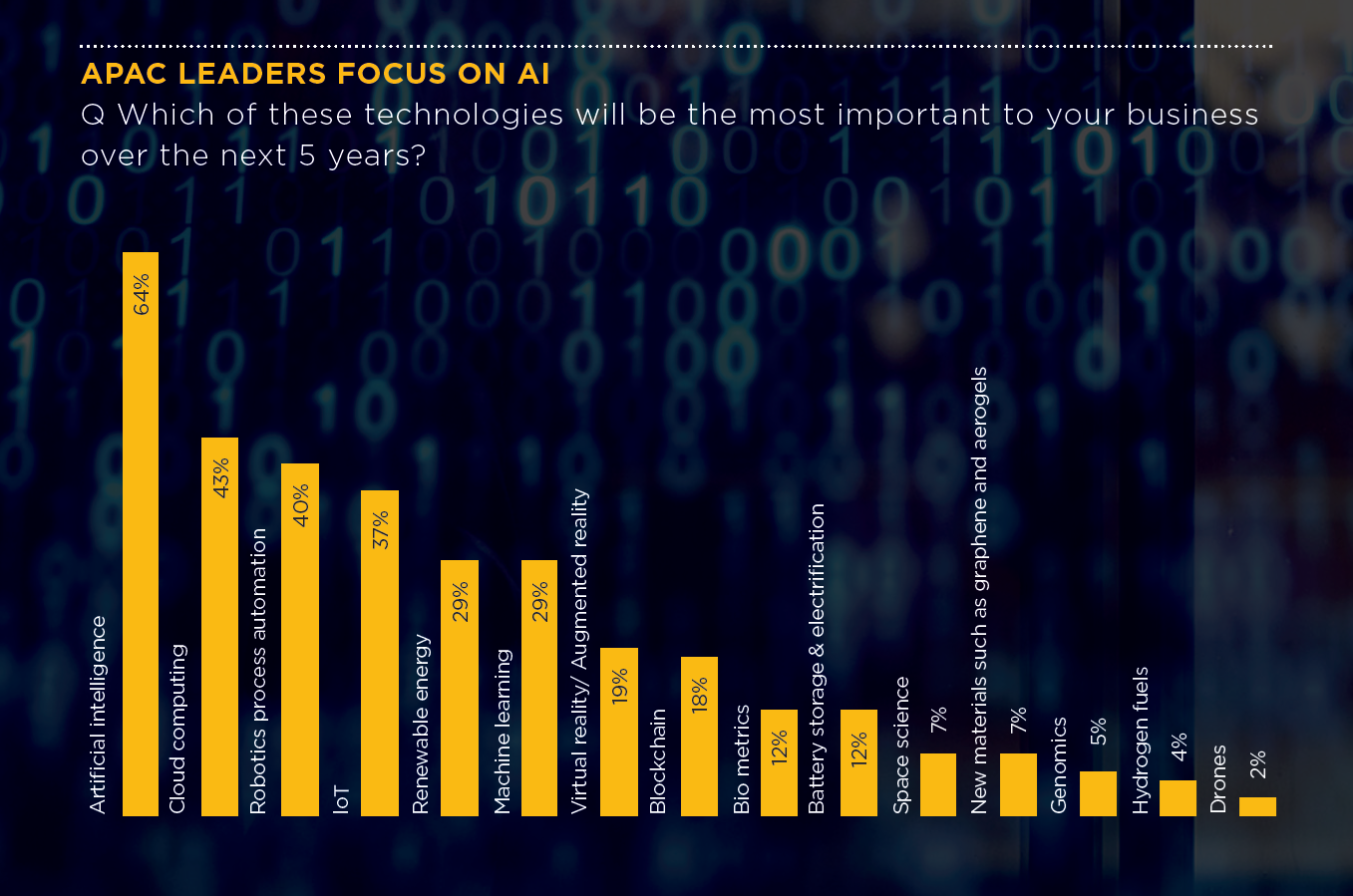

Generally, 68% agree that emerging technologies like AI are key to driving business innovation, creativity and productivity. So it’s not surprising that AI tops the list of technologies most important for businesses in APAC over the next 5 years (up by 9% from 2022), followed by cloud computing and robotic process automation (RPA).

In addition to keen investment in AI, APAC leaders are more interested in RPA adoption and Internet of things (IoT) technologies compared to global peers. IoT has already proven to be a viable technology in the manufacturing sector, enabling advanced equipment monitoring, predictive maintenance, and real-time asset tracking. Combined with advanced analytics systems and artificial intelligence, IoT devices enabled advanced industrial automation scenarios.

The newest 'lighthouse factory' by LG in South Korea uses VR to visualize production processes with data from IoT devices and computer vision systems. It provides real-time status of logistics operations and identifies issues within the next 10 minutes. Factory workers can also detect production issues early on using deep learning sensors.

Curiously, fewer APAC leaders (29%) view ‘renewable energy’ as the most important technology for the next five years compared to global leaders (39%). This could be because many countries are already leading in this area.

China is emerging as a leader in renewable energy production, expecting to contribute 56% of global renewable energy capacity additions between 2023 and 202813. The country’s solar photovoltaic manufacturing capabilities have almost doubled over the last year. EV manufacturing has also been established as a key component of China’s transformation policy, aimed to establish a strong domestic market and become a leader in the global EV market.

Rising consumer demand and diversification in sourcing strategies are encouraging transformations in other ASEAN economies. Asian automakers like Toyota and Hyundai are establishing new EV manufacturing facilities in Indonesia. EV battery production made up a significant share of foreign direct investment in Malaysia and Thailand. In fact, 46% of leaders are now focusing on sourcing closer to home.

Since the start of the decade, APAC leaders have rapidly orchestrated digital transformation — and AI seems to be the next frontier. In the context of emerging technologies and AI, 52% are prepared to take on more risk for potential benefits.

“Review and identify the consistent obstacles that continue to exist in your business and the costs incurred in tackling them in recent years”, recommends Wendy Ler, Director at HLB Malaysia. “In terms of cost efficiency, these might be the sweet spots to look out for now and explore with digital transformation and AI adoption. Now is the right time as we observed regulatory reforms in the region, and some adoption risks can be better managed”.

Preparing for an AI-led growth cycle

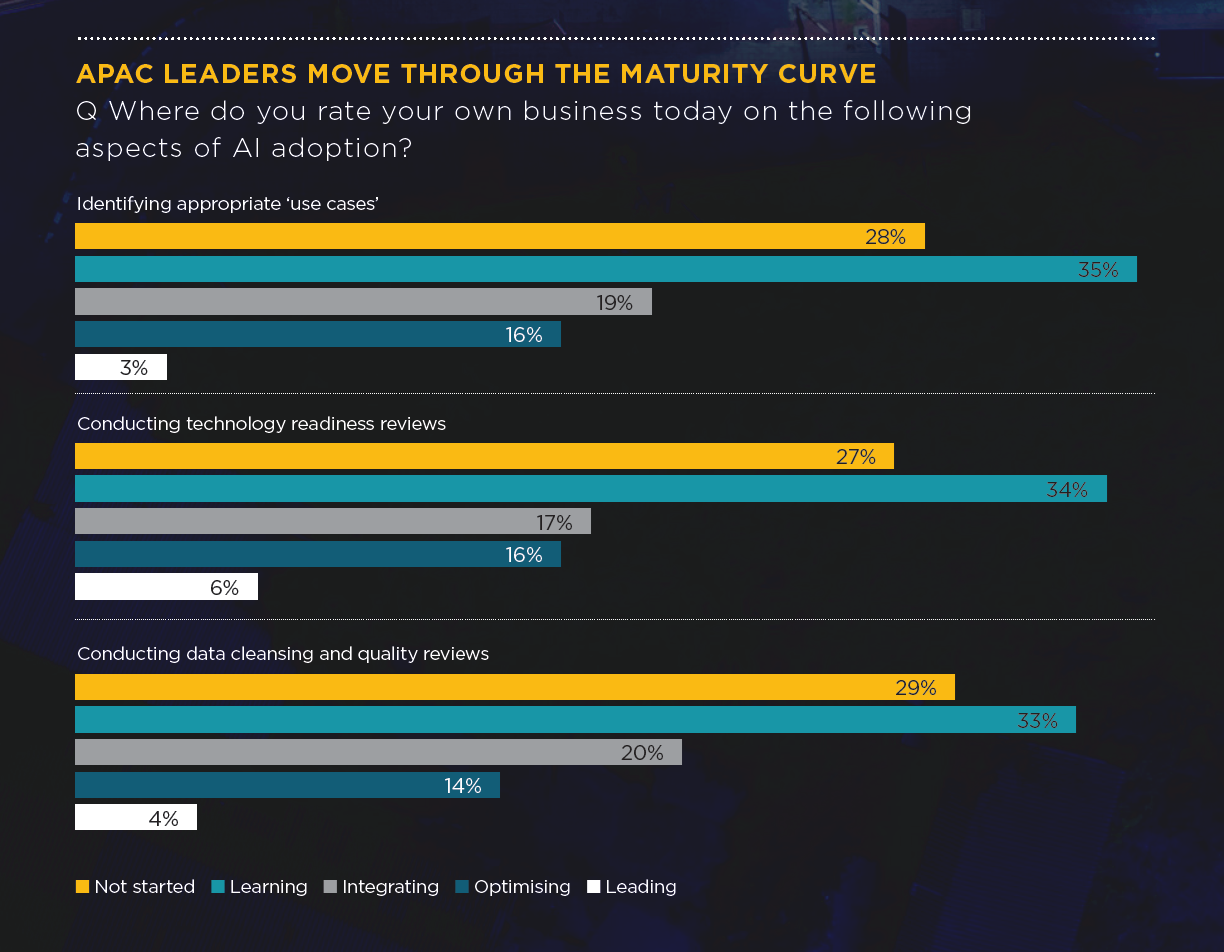

Although AI Innovators are sprinting ahead in most areas. A larger fraction of businesses are already optimising and leading in areas like data quality reviews, use case identification, adoption of specific AI tools, and AI-related staff training.

Over a third of APAC leaders have yet to investigate the IP, legal, licensing, ethical, bias, and compliance impacts of AI adoption, compared to just over a quarter of business leaders based in North America.

The AI regulatory landscape in APAC is dynamic. Singapore has recently updated their ambitious AI strategy to reflect substantial progress, shifting its focus to maximising AI value and pursuing social initiatives in areas like population health and climate change. Another key pillar of Singapore’s Second National AI Strategy is the development of a fair, trusted, and responsible AI ecosystem.

In late 2023, the Indonesian government issued a letter detailing the new code of ethics for companies involved in AI-based activities, specifically targeting the financial technology industry. The provision mandates that all AI implementation must be based on principles of humanity, security, accessibility, transparency, credibility, and accountability.

China has yet to announce its ‘AI laws’ despite being quick to regulate emerging technologies and introducing legislation on generative AI soon after the ChatGPT launch. By August 2023, Baidu introduced a local version of a generative AI assistant, ERNIE, after obtaining a compliance clearance from the government. “China is in the process of setting AI regulatory landscape”, says Christine Cai, Partner at ThinkBridge, HLB China. “Mostly, there are supportive policies with some restrictive regulations to avoid abusing the technology”.

Malaysia also plans to release AI governance regulations this year, which are expected to cover data privacy, transparency, accountability, and cybersecurity. “As with all things related to disruptive technology, history has shown that regulations have often lagged behind compared to the pace of adoption”, noted Jude Lau. “Rapid adoption rates are perhaps a timely reminder for all governments around the world to ensure that their legislative settings, such as compliance, monitoring, and taxation of these, are reflective of the new world paradigms, as opposed to the old sets of rules”.

Half of APAC leaders are integrating, optimising, or leading the adoption of AI in their business models—almost twice that of Europe. 12% of North American leaders and 4% of APAC leaders report leading in the area of AI adoption into their business model. “Compared to the US, APAC is quite behind. For example, China still needs time to develop algorithms and also lacks high performance chips to reach the required computing power, which constrains the development of AI technology in China”, notes Christine Cai. “Thus, how to utilize AI technology and how to cope with the opportunities and risks in their own industries becomes a bigger concern for APAC leader”.

Still, the progress has been substantial. Process automation is the main use case of AI, selected by 33% of leaders, followed by document processing (26%), customer analytics (26%), and text and data mining (26%). It appears APAC leaders want to use AI to reach other overarching goals — improvements in operating efficiencies, cost optimisation, and new product development, as also reflected by use cases in sales, marketing, and content generation.

Curiously, almost half of AI Innovators have already implemented AI for process automation versus just 12% of AI Conservatives, who are the cohort most likely to use AI for content creation (24%), quality control (24%), text and data mining (24%) — simpler use cases which can be fulfilled with ‘plug and play’ AI tools.

AI Conservatives seem held back by fear of the unknown. Compared to other groups, they prioritise improving risk management this year. In the context of AI adoption, conservative leaders said that they’d like to “have more data points in the relevant industry to provide confidence in output such as wider adoption by peers”, as well as a “reliable IT team, stable business environment, a legal framework to avoid abuse”.

“While the concerns remain valid, we should recognise that some of them will not go away so soon. With the various supportive national measures for AI adoption and rapid AI strategies rolled out by countries, it is anticipated that the development of a legal framework around it to be accelerated as well”, notes Wendy Ler.

“Business leaders who are hesitant to adopt AI due to perceived risks should start with smallscale pilot projects to sharpen the business case, evaluate different use cases, and demonstrate early wins to secure buy-in”, recommends Surabhi Bansal.“Establishing robust data governance frameworks is also essential to minimise data privacy risks and potential algorithms bias”.

Access to the right skills holds back AI adoption

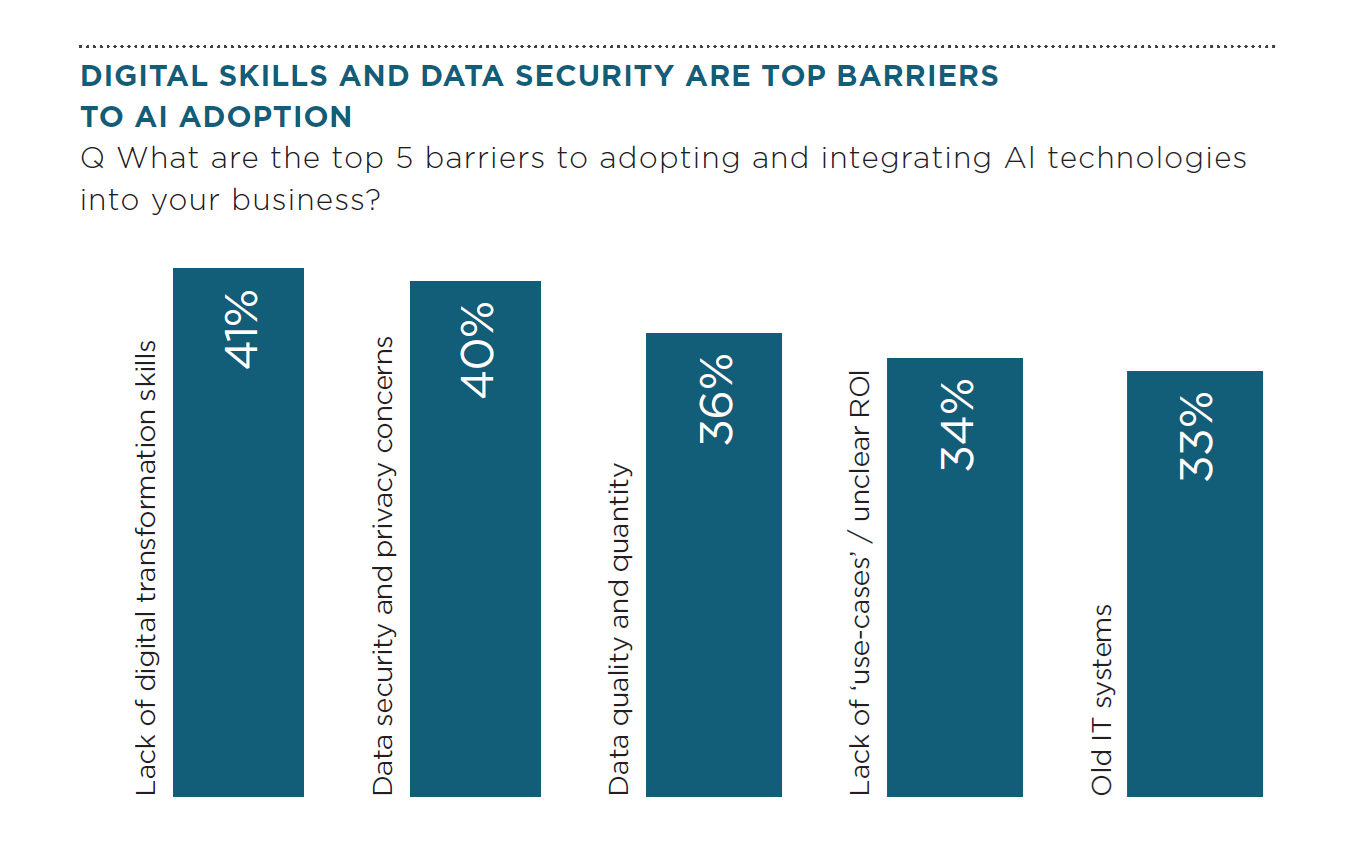

APAC leaders appear to know how they want to use AI but struggle with implementation. The main barrier to adoption is the ‘lack of digital skills’, followed closely by data security and privacy concerns.

AI Innovators feel more pressured by insufficient data quality and quantity (47% vs 36%) and data security and privacy concerns (46% vs 40%). AI Conservatives are more likely to be held back by a lack of use cases/unclear ROI (38% vs 34%), and business model obstacles (33% vs 31%).

Talent shortages appear to be more pronounced in APAC. Over half of the leaders named ‘access to talent’ a persistent risk. An equal number of 31% of AI innovators and AI Conservatives also recognise weaknesses in talent acquisition that they want to improve this year.

Although general unemployment rates are relatively low in the region, APAC leaders are facing digital skills shortages. Three-quarters of APAC employers, government officials, and academics consider a ‘significant digital skill gap’ in their county.15 An estimated 86 million workers, including those needing training, will need to be upskilled or reskilled to keep up with technological change.

APAC employers lack professionals with specialised skill sets to drive ambitious transformations. “AI is still a new technology in China and more talent is needed to further develop this industry and enhance the technology application”, says Christine Cai. “Leaders need to find the right business partners to collaborate on AI adoption, as well as improve talent recruitment practices to address shortages”.

AI, machine learning, data analytics, and software engineering are constantly named as competencies in short supply. In response, businesses are experimenting with new recruiting schemes. “There has been a substantial boost in investments to encourage the uptake of STEM, AI, and data analytics-related studies in Australia”, says Jude Lau. He also encourages business leaders to invest in recruiting and training new graduates internally to ensure a strong fit and prevent talent shortages in the future. For instance, Microsoft plans to train almost 2 million young Indian workers in tech skills by 2025.

Amazon launched a global AWS re/start programme to provide cloud training to 29 million people by 2025. Greater adoption of emerging technologies increases the importance of cybersecurity awareness. Over 60% are concerned by cybersecurity issues, of which 25% are highly concerned. AI adoption creates new attack vectors that threat actors could exploit to tamper with the system, distribute malware, or steal sensitive user data.

Appropriate cybersecurity measures become increasingly important as organisations adopt AI. Implementing specialised privacy-preserving techniques for AI systems like homomorphic encryption, differential privacy, or secure multiparty computation can help business leaders protect new digital products and ensure compliance with emerging data privacy and security regulations. Sony, for example, developed a specialised privacy framework for securely training AI systems.

Data scientists can auto-redact sensitive elements from training datasets or use privacy-preserving training algorithms. The system also tests model security against common threats like model inversion or membership inference attacks.

Learn more about our research