Latin America: Strengthening agility to compete on the global stage

HLB Survey of Business Leaders 2025LATAM leaders entered the past year in high spirits. 92% were confident in their ability to grow revenues. This year, business confidence is more muted. Only 38% expect an increase in global growth and 79% are certain in their ability to increase revenues.

Local economies have just recovered from previous shocks due to global geopolitical tensions, pushing up resource prices and cost of living. Inflation remains a concern for 69% of leaders, although down by 7 percentage points from last year. Yet, lingering economic uncertainty continues to preoccupy 86% of respondents, along with resource costs (73%).

The region’s economic growth is subdued, with GDP growth expected at 2.4%. Brazil may face slower growth of 2% after an interest rate hike to 13.25%. Mexican growth is complicated by new US tariffs, which could subtract over 3 percentage points from GDP growth.

On the other hand, Costa Rica is likely to continue its growth streak with GDP accelerating to 5.1% in Q1 2025, thanks to a robust performance in the special exports regime and ongoing growth in foreign direct investments (FDI).

A greater focus on operating model optimisation, workforce development, and innovation will help LATAM businesses’ succeed in the new operating environment and ensure long-term competitiveness.

Achieving operational excellence

‘Improving operating efficiencies’ is the key growth driver for LATAM leaders this year. While many also focus on cost reduction, technology adoption, strategy reviews, and new product or service launches, the primary goal is to streamline operations for sustainable growth.

Leaders recognise that their current models are inefficient enough: 87% acknowledge the need for significant upgrades. LATAM companies were slower than other regions to embrace digitisation. Many still rely on labour-intensive processes, often due to historically low labour costs. However, the business landscape has shifted, as more companies realise the value of technology for enhancing agility, scalability, and cost-efficiency.

Panama has emerged as a regional productivity leader, with GDP per hour output reaching $45, leading in Latin America and surpassing some European countries. While the Panama Canal remains a major economic engine, Panama has positioned itself as a growing financial centre, attracting foreign direct investment (FDI) and technological innovation.

Similarly, Costa Rica has transitioned its economy from agriculture and tourism to digital services and technology in several years. In 2024, 59 multinational projects were launched in Costa Rica, fueled by FDI.

However, to benefit from the growing surge in nearshoring interest, LATAM businesses will also need to demonstrate their competitiveness beyond lower labour costs. Some foreign partners remain concerned about the local operators’ productivity and availability of skilled human capital. Leaders are taking note and aim to address weaknesses in their operating models.

To gain efficiency with the help of technology, it is necessary to establish operational processes that can be measured and optimised.

Perhaps to gain greater clarity in their operations, 45% plan to enhance their data analytics capabilities, of which 53% aim to do so with the help of AI. 43% of leaders seeking process optimisation plan to do so with AI.

53% of leaders plan to improve operational structures, and 50% aim to invest in technology system updates to streamline processes.

Budgetary discipline

While leaders seek structural improvements to their businesses, they also aim to do so with a lean budget. Compared to last year, leaders are 1.3X more likely to seek cost reduction. In addition, leaders are 1.5X more likely to flag ‘cost management’ as a weakness worth addressing this year.

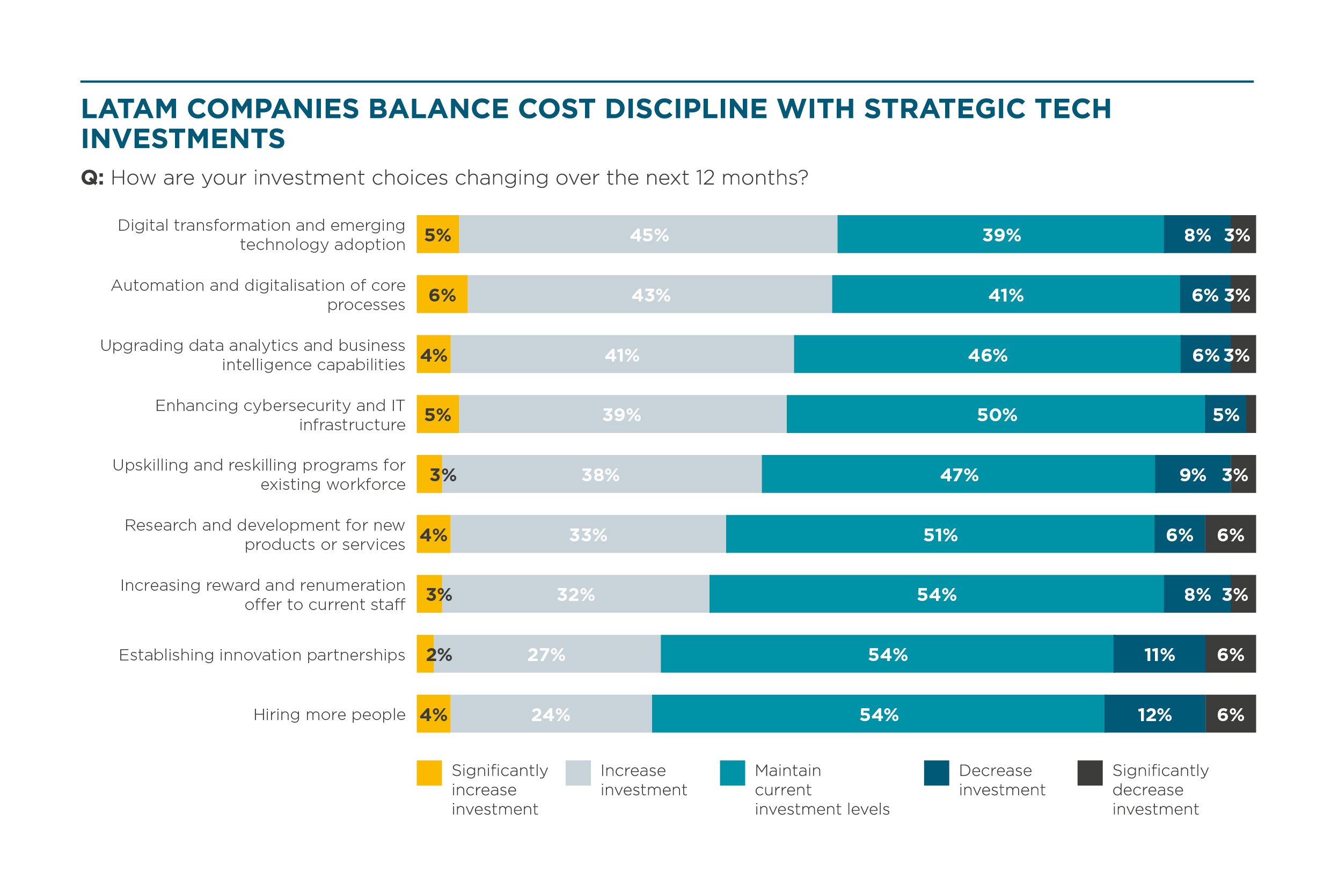

Nonetheless, over 50% of LATAM plan to increase their investments in digital transformation and emerging technologies this year and 49% — in automation and digitisation of core processes, likely as part of their commitment to greater operating efficiencies. The majority aim to maintain the same investment levels in cybersecurity and IT infrastructure improvements, as well as R&D for new products and services.

However, 18% plan to reduce hiring budgets and 17% — funding for innovative partnerships. However, this may be a hasty reaction, driven by short-term challenges. To stay competitive LATAM companies will not just have to become leaner, they will also need to cultivate a more competent, creative, and digital-literate workforce.

Building a high-performing workforce

Compared to other regions, LATAM businesses are not facing as severe talent shortages, though 32% see talent acquisition as a weakness. However, productivity remains a concern.

While most leaders (63%) consider their workforce productive, 9% describe their employees as ‘disengaged and missing targets.’ On a broader scale, labour productivity in LATAM is 33% lower than in other OECD countries.

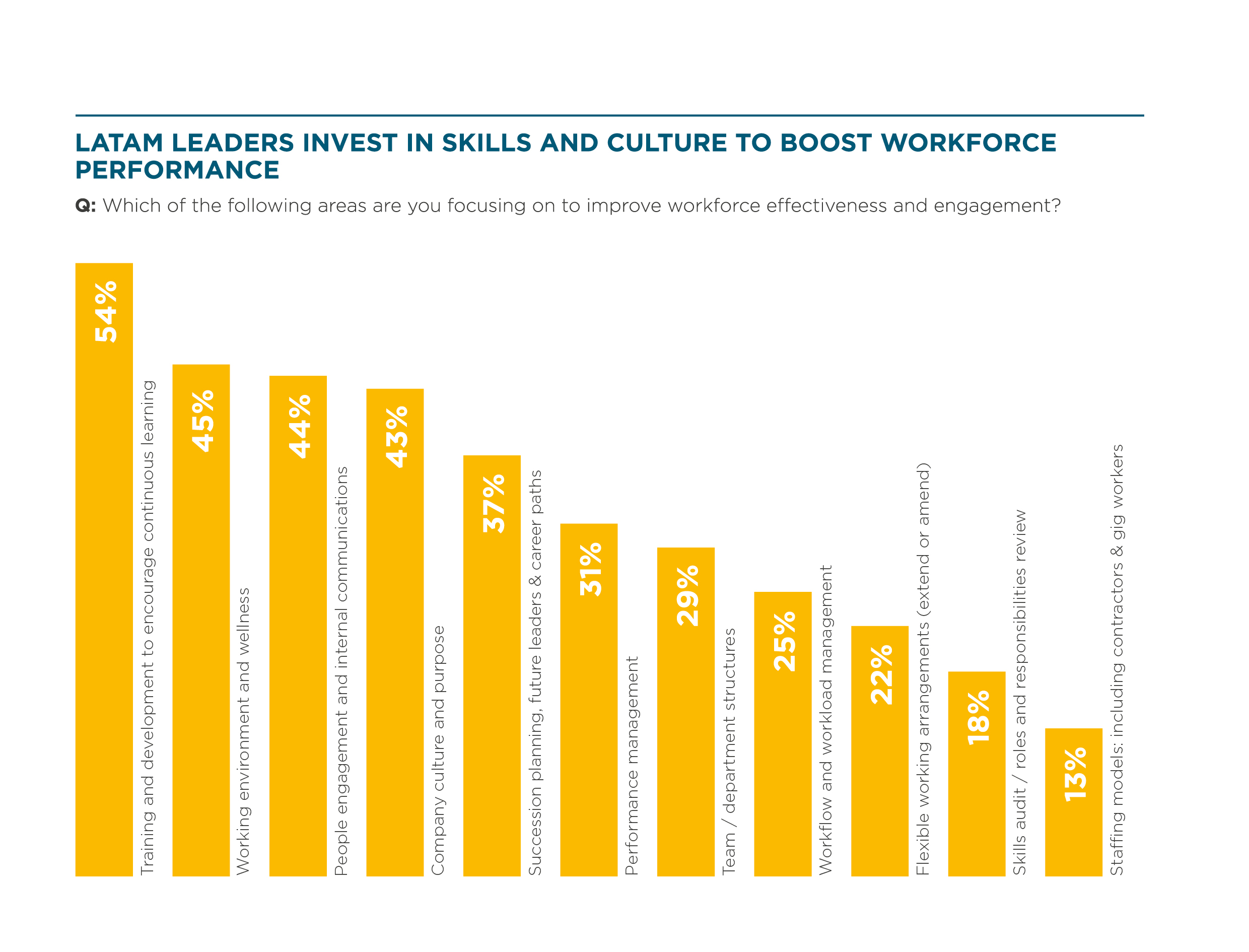

Leaders recognise that technology and operational improvements alone won’t drive sustainable growth. Empowering people is now a business priority. This year, 54% of executives plan to invest in training and development to boost workforce engagement and performance.

Multinational companies offer more lucrative salaries and benefits, as well as relocation assistance in some cases, leaving regional businesses with fewer hands-on deck. 64% of regional public sector companies had to delay technology projects due to skills shortages.

Brazil is facing significant IT talent gaps, but the shortage extends beyond tech. The demand for skilled labour has also started to outweigh supply in sectors like transport, logistics and automotive (91% report hiring difficulties), finance and real estate (86% face difficulties), and energy and utilities (85% face difficulties).

Re-thinking innovation

LATAM leaders recognize the need to continuously reinvent their operations but often struggle to mobilise the necessary resources. Only 17% consider themselves successful innovators, while 83% say their innovation success is inconsistent or difficult to achieve.

Economic instability has pushed many leaders into short-term thinking. Bureaucratic hurdles, inflation, and high borrowing costs—combined with limited government investment in R&D—further discourage innovation. With companies largely funding their own innovation, many opt for adopting existing solutions rather than creating new ones, limiting internal learning and long-term competitive advantage.

Leaders are working to change that. To strengthen innovation capabilities, 48% aim to build a stronger culture of innovation, while 36% plan to improve cross-functional collaboration. Additionally, 30% are setting aside dedicated budgets, resources, and time for innovation, and 25% are increasing collaboration with external organisations.

The region is also home to over 300 startup accelerators, providing small businesses with capital, mentorship, and compliance support.

Many of these startups act as proof points, demonstrating that innovation is possible despite economic and structural hurdles. As these ecosystems mature, they could create a multiplier effect — nurturing a new wave of high-growth companies that further strengthen LATAM’s position in global innovation networks.

AI remains the top business technology for three-quarters of LATAM leaders. In fact, half are already widely using AI in their operations or actively investing resources in its deployment.

Compared to last year, leaders have gained greater clarity on AI’s most valuable applications — focusing on sales & marketing, content generation, and process automation. Profit Accelerators in turn are 1.5X more likely to use AI to collect and analyse customer data, offering more potential insights for new product development and customer experience management.

This shift in the application of AI in the region signals a move beyond experimentation toward strategic implementation, where AI directly drives efficiency and competitive advantage.

Profit Accelerators are 1.7X more likely to rank their innovation efforts as successful and their people as high-performing and engaged. Discover effective ways to improve your revenue and profit margins this year; download our in-depth report

Learn more about our research