LATAM: Business confidence, driven by innovation and AI

HLB Survey of Business Leaders 2024Unwavering confidence amid economic challenges

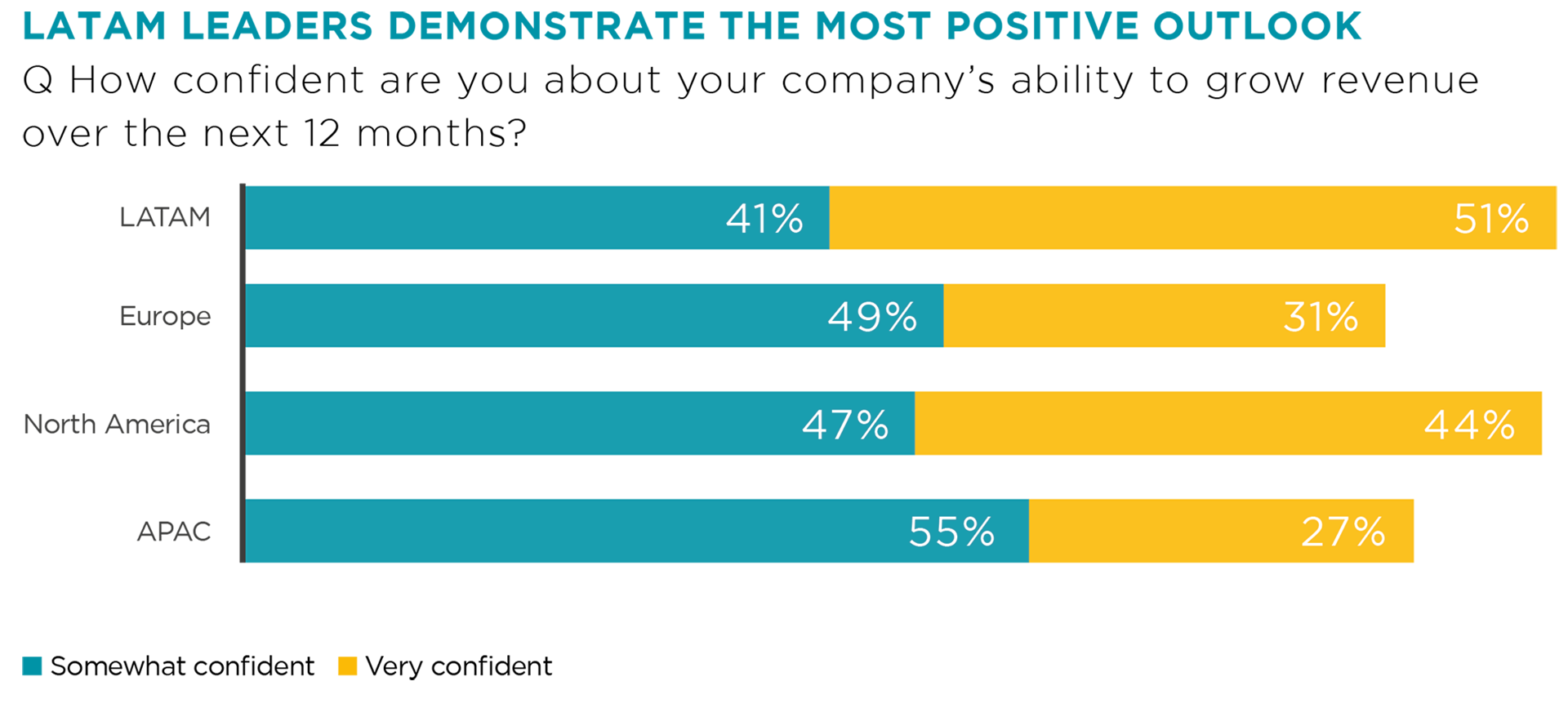

Despite continuing macroeconomic challenges, LATAM leaders continue to demonstrate a positive outlook. At the start of this decade, 91% expressed confidence in their ability to grow revenues. In 2024, 92% believe the same, of which 51% are very confident — the highest percentage in our survey. For comparison, only 31% of European leaders and 44% of North American leaders also maintain the highest levels of confidence.

LATAM has experienced a strong post-pandemic rebound, demonstrated by a remarkable 4% economic growth in 2022. Ongoing supply-chain relocation in the US has driven an investment boom in countries like Mexico, Panama, and Costa Rica. Major initiatives are underway in the semiconductor and electric vehicle (EV) manufacturing sectors. Critical minerals development and large infrastructure projects are also bringing new partners to the region.

As of 2023, Mexico became the US's largest trading partner, surpassing China, with a volume of $462 billion. The Biden administration has been pushing to increase trade volumes with Latin America further. After pandemic-prompted delays, the European Commission is looking to finalise the EU-Mercosur trade agreement, which will progressively phase out about 90% of tariffs between the 27 EU member states and the Mercosur bloc: Argentina, Brazil, Paraguay, and Uruguay. Among our survey respondents, 68% believe that changes in trade agreements will create new opportunities for their businesses.

Positive market developments translate to a positive market outlook. 59% of LATAM leaders are certain that the economic growth will increase this year, which makes it the most optimistic region in our survey. LATAM leaders appear to be well used to navigating through the perfect storm, taking every challenge in the region (of which there are plenty) as an opportunity to evolve, innovate, and thrive.

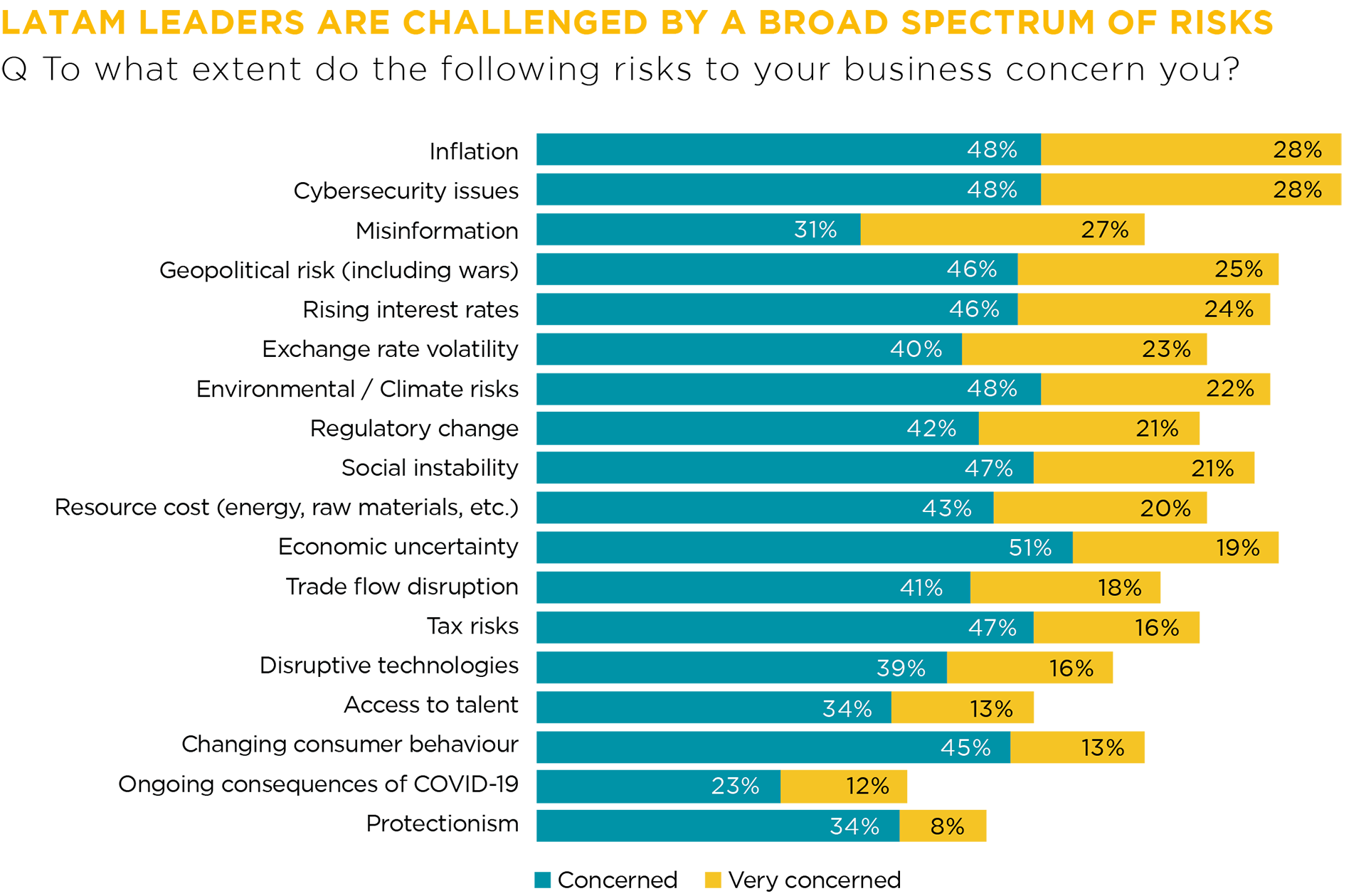

Still, the operating conditions remain complex. Inflation is a top-of-mind concern for 76%. Headline and core inflation, however, are receding in most countries in the region (excluding Argentina and Venezuela). The Banco do Brasil expects inflation to lower to 3.5%. In Chile, inflation is expected to reach 3% in the second half of 2024.

The region’s central banks may also diverge from the Federal Reserve policies and start lowering interest rates early in the year. Central banks of Brazil, Chile, and Peru have already cut rates in the third quarter of 2023. Mexico’s Central Bank plans to lower the rates to 9.25% over the year. Though, fiscal policies may change if inflationary pressures persist during the year. Economic uncertainty preoccupies 70%, although it appears to be more of a back shadow as only 19% of leaders are very concerned, while 51% are somewhat concerned.

LATAM leaders are highly worried about cybersecurity risks (76%). Regional IT services and business process outsourcing (BPO) sectors are expanding as global businesses struggle to grapple with talent shortages with the right technology skills. LATAM also has a thriving startup ecosystem. However, the digital market has also been a prime target for cyber-actors. Last year, 69% of LATAM organisations experienced a security incident6. The cyber-risk radar may also intensify with AI adoption, as such systems could be used as another entry point to the organisation.

Other risks also attract concern. Misinformation, geopolitical issues (including ongoing conflicts), rising interest rates, exchange rate volatility, climate risks, regulatory change, and social instability are all causes of significant concern for more than a fifth of LATAM respondents. Broadly, over 20% of LATAM leaders feel ‘very concerned’ about 10 different types of risks. For comparison, European and North American leaders are very concerned about 5 risk vectors, APAC leaders — about 4, and Africa and the Middle East — about 7.

LATAM leaders are used to operating in a volatile environment, but this year provides greater political uncertainty. Mexico prepares for general elections in June 2024, which can go either way. Argentinian and Brazilian presidents continue to face strong opposition. Tough economic measures to reduce the fiscal deficit may lead to social unrest. Peru, Ecuador, and Colombia face public pressure against new mining activity.

Key focus areas: Efficiency, technology, and innovation

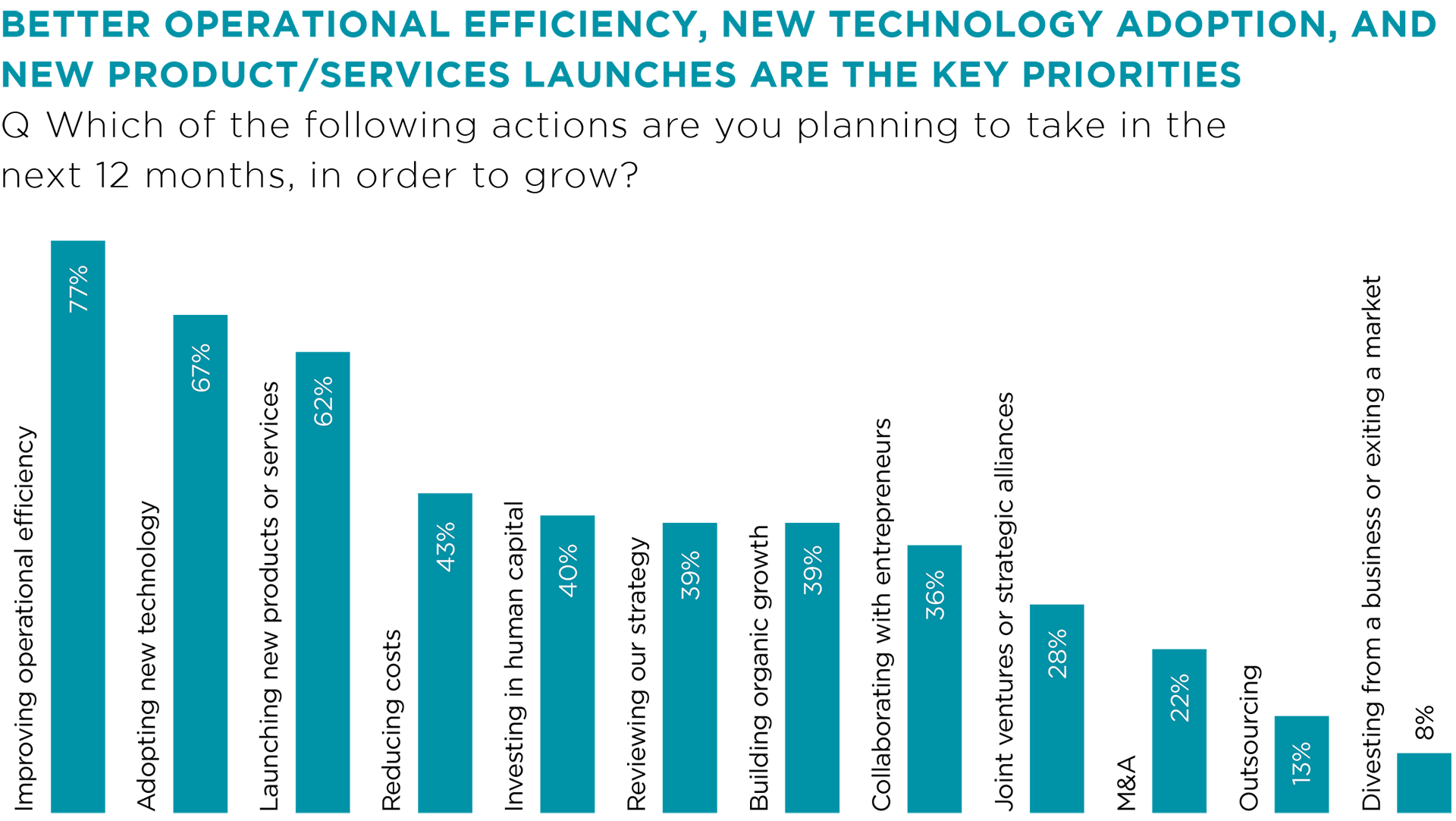

To grow in 2024, leaders in LATAM aim to increase operational efficiencies (77%), adopt new technologies (67%) and launch new products or services (62%). Compared to global peers, LATAM leaders are more focused on streamlining operations but are less inclined to do so for the sake of cost reduction. Only 43% plan to cut costs this year versus half of European and APAC leaders. Only 22% view cost management as a weakness area worth addressing.

It appears that LATAM leaders are more eager to invest funds into new operational capabilities to maintain their growth streak. Given the increase in trade volumes, extra investments in transportation and logistics solutions may be warranted. IMF estimates that by improving trade infrastructure, LATAM businesses can increase export volumes by 30% and lower the trade costs with neighbouring countries. Over 70% of leaders in our survey believe that technology advancements will help them overcome future cross-border challenges.

Beyond trade, 79% agree that emerging technologies (including AI and machine learning) are key to driving innovation, creativity, and productivity in business.

As of 2022, Internet penetration rates in LATAM (78%) surpassed those of China (74%), with Chile leading the pack at 90%, followed by Argentina (87%), Brazil (84%), and Mexico (77%). Greater connectivity has led to the rapid adoption of digital products and services by consumers and businesses alike. The digital commerce market stood at US $510 billion in 2023 and is expected to almost double by 2026 to US $944 billion.

Young and internet savvy LATAM consumers have quickly adopted digital financial services, business SaaS apps, and ecommerce shopping platforms, which comprise most of LATAM’s burgeoning startup ecosystem. Over 60 unicorn companies (with a valuation of US $1 billion and above) now operate in LATAM, including one of the fastest growing global IT brands, Globand, specialising in B2B software products, FinTech companies Stone and Nubank, and Ascenty — a cloud computing and data centre services provider.

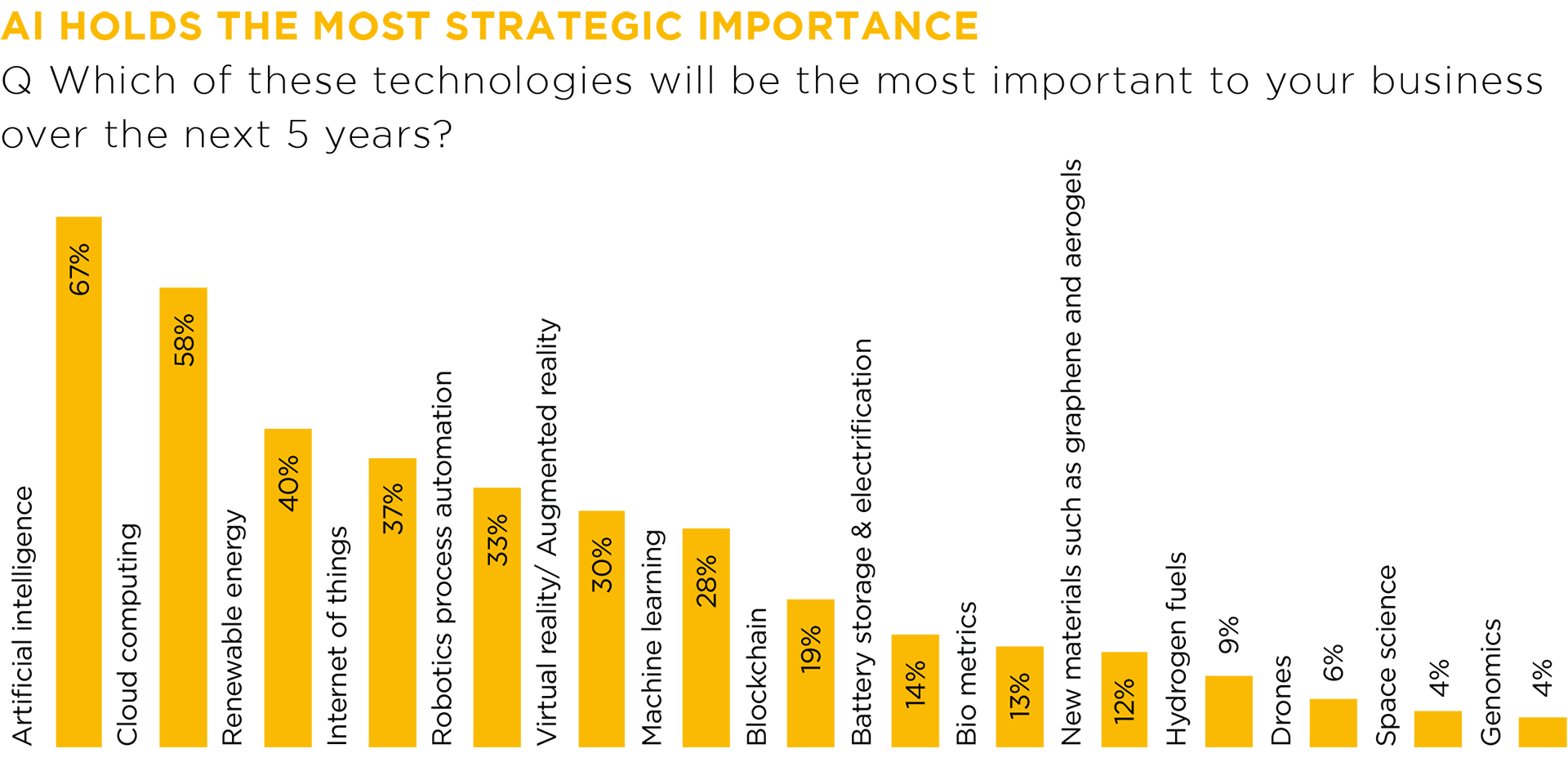

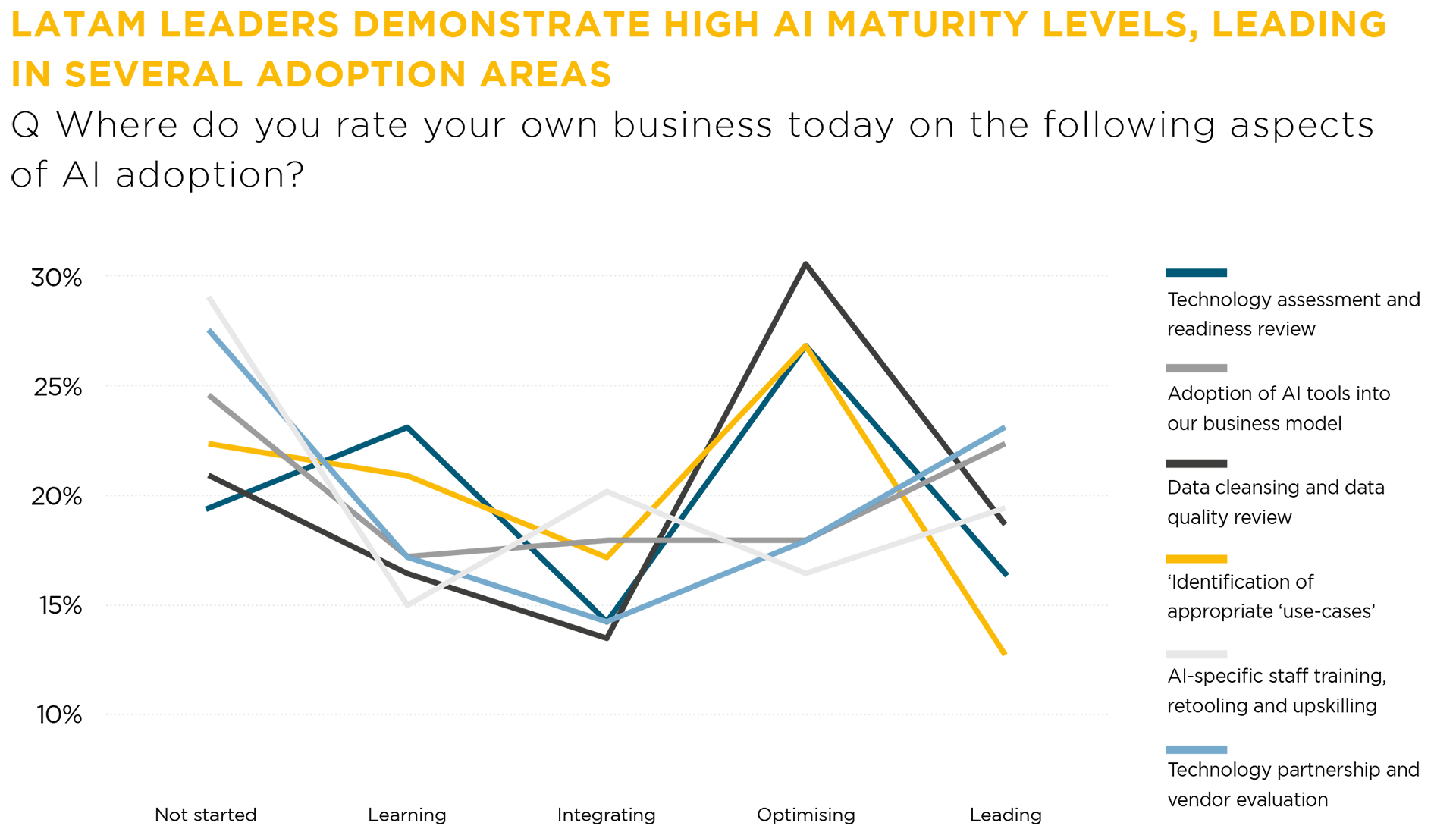

In the next five years, 67% of LATAM leaders believe that artificial intelligence (AI) will be the most important technology for their businesses — it tripled in significance since 2021. Cloud computing comes second, steadily ranking highly since 2020.

Since the start of this decade, we have been introduced to the increasing capabilities of AI — from autonomous vehicles to large-scale industrial automation and, more recently — accelerated knowledge management, instant content generation, and more accessible analytics thanks to generative AI.

However, as with any emerging technology, the gains are almost as high as the risks. IBM had to abandon its multi-million Watson’s IBM project for healthcare. Facebook had to shelve several chatbot projects, while Amazon scrapped an AI resume screening tool that delivered biased results.

LATAM leaders, however, are ready to face the complexities head-on to secure a competitive advantage. In the context of emerging tech and AI, 63% are prepared to take on more risk given the potential benefits of success. However, they’re also planning for disruption. This year, leaders want to address weaknesses in cyber security (34%) and risk management capabilities (28%).

More so than peers, LATAM leaders are also wishing to improve their innovation capabilities (34%). “Innovation is not just the adoption of new technologies in an organisation. Innovation means the adoption of new ways of working, new ways of thinking of people and, of course, the use of new technologies”, notes Gustavo Solis, CEO at Cynthus (HLB Mexico).

“This transformation requires several underlying elements. Aspects such as risk management, information security culture, and organisational change management methods. Historically, these elements have shown deficiencies in LATAM countries, which, in the minds of senior management, translates as a weakness. However, it is not specifically of innovation, but of the means to manage transformation properly within their companies”.

These commitments are understandable, given that new product or service development is the third focus area. Although natural resources exports and agriculture will remain important economic sectors in the region, local leaders are also diversifying to offer higher value-added services. Mexico is becoming a new EV manufacturing hub, housing production plants for BMW, GM, Ford, Jetour, and Tesla.

Among respondents, 40% also named renewable energy as the most important technology in the next five years. Renewables, led by hydropower, already account for 60% of the region’s electricity supply, twice the global average. With some of the world’s best wind, solar, and hydrocarbon resources, as well as some critical rare minerals, LATAM makes a significant contribution to global energy security and the transition to green energy while also generating benefits for the local communities.

How HLB can help

The full HLB Survey of Business Leaders LATAM report provides additional data on the topics of the challenges & opportunities of AI adoption, where the region is ahead in its attitudes to innovation, and how to accelerate your own journey to AI adoption.

With technological advancements evolving at an ever-accelerating speed, businesses are looking to understand the competitive advantage new digital technologies such as AI can offer them. Our findings suggest significant differences in potential business outcomes between businesses embracing AI technologies and those more cautious about adoption. A structured approach is needed to effectively reduce risk and gain ROI from digital transformation efforts.

If you would like to explore the findings in this report and how they inform your next phase of transformation and growth, we would welcome the opportunity to discuss these with you.

Learn more about our research