Europe: A cautious path to AI maturity

HLB Survey of Business Leaders 2024European business leaders remain resilient in a difficult year

Inflation and interest rates proved taxing in 2023. Energy prices also remained high, while the macro growth slowed as expected. As businesses look to 2024, confidence is slow to recover in Europe: Only 28% of leaders expect an increase in economic growth this year versus 41% globally.

Yet first signs of optimism are emerging. When asked last year, 69% of European business leaders expected a decline in global economic growth. This year twice less (31%) respondents expect the same outcome. Stabilising energy supply and progressive transition to renewable energy, paired with more moderate weather, kept the demand for energy low, fostering stronger economic growth in 2023 than expected. The headline inflation has slowed and is projected to fall to 2.7% year-on-year by mid-2024. The unemployment rate remains relatively low and the normalisation in wage growth continues.

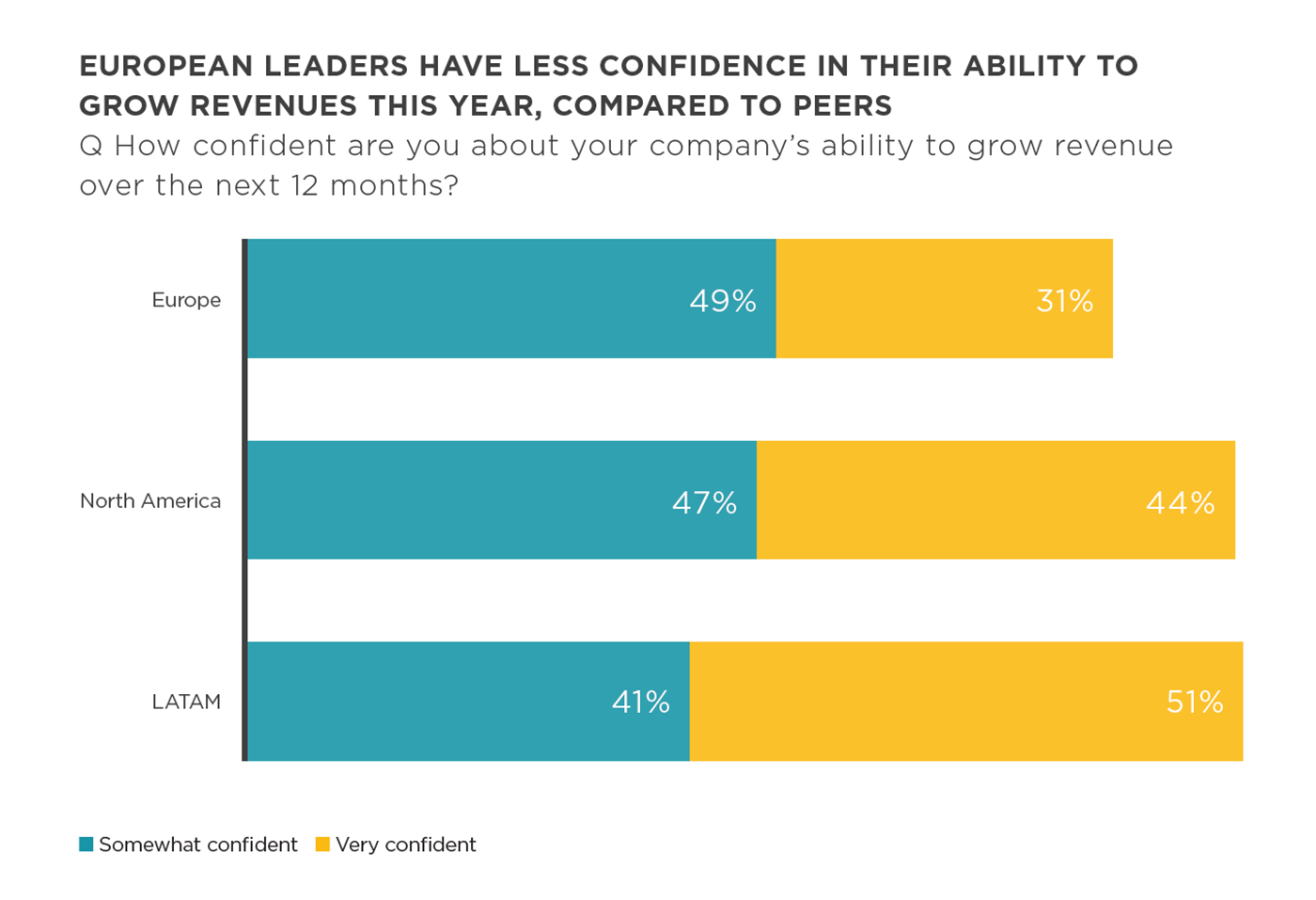

Perhaps reassured by early signs of recovery, 80% of European leaders express confidence in their company’s ability to grow revenue this year. Although their sentiment is much more muted, compared to peers in North America (91%) or LATAM (92%).

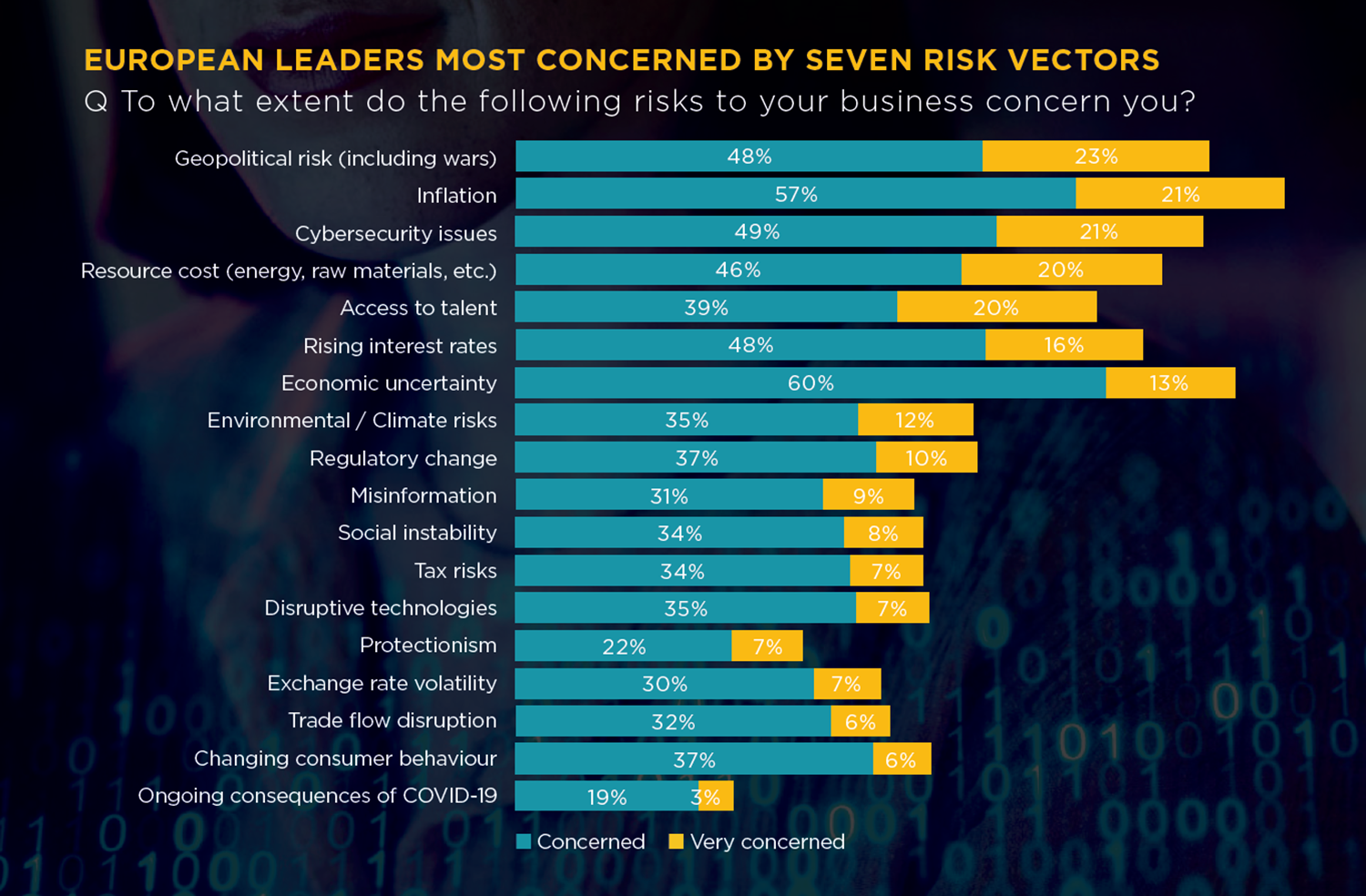

Confidence is bound to be dampened by the unceasing and overlapping poly-crises that continue to hit leaders in Europe. The top three concerns this year are inflation (78%), economic

uncertainty (73%), and geopolitical risks, including war in Europe and the Middle East (71%).

Though the concern levels for each of these have reduced substantially, compared to last year.

Inflation has been steadily decelerating. In the second half of this year, the European Central

Bank and Bank of England are expected to gradually start reducing interest rates. Combined

with a growth in real wages and a tight labour market, these factors should lead to moderate

regional growth in 2024.

Generally, the risk radar is more clustered in Europe. While over half of global leaders feel

stressed about the impacts of at least twelve different risk factors, Europeans’ attention is focused on seven stressors: economic (inflation, interest rates, market uncertainty, and resource costs), political (ongoing conflicts), operational (access to talent), and tech-related (cybersecurity). Compared to the global cohort, fewer leaders are concerned with climate risks

(47% vs 52%) or regulatory change (47% vs 51%).

Short-sightedness in both areas, however, may prove to be problematic. “Understanding and

mitigating risks, particularly in cybersecurity, is not a one-time exercise but a continuous

journey. Working with trusted tech partners who understand tech, appreciate the commercial

benefits and risks, and assist in managing both is critical”, notes Mark Butler, Managing Partner at HLB Ireland.

Competitive energy pricing remains a policy concern in Europe, but so does advancing towards net-zero energy. The EU’s Carbon Border Adjustment Mechanism (CBAM) came into effect in October 2023, mandating new disclosures on carbon emissions generated in the production of certain goods, imported into the EU. The EU’s Corporate Sustainability Reporting Directive (CRSD) also starts taking effect for larger enterprises in the fiscal year 2024.

In 2024, the EU plans to further reduce the number of CO2 permits, which allow companies to emit a certain volume of greenhouse gases. All of these changes may have substantial impacts on business operations.

Key focus areas: People, processes, and technology

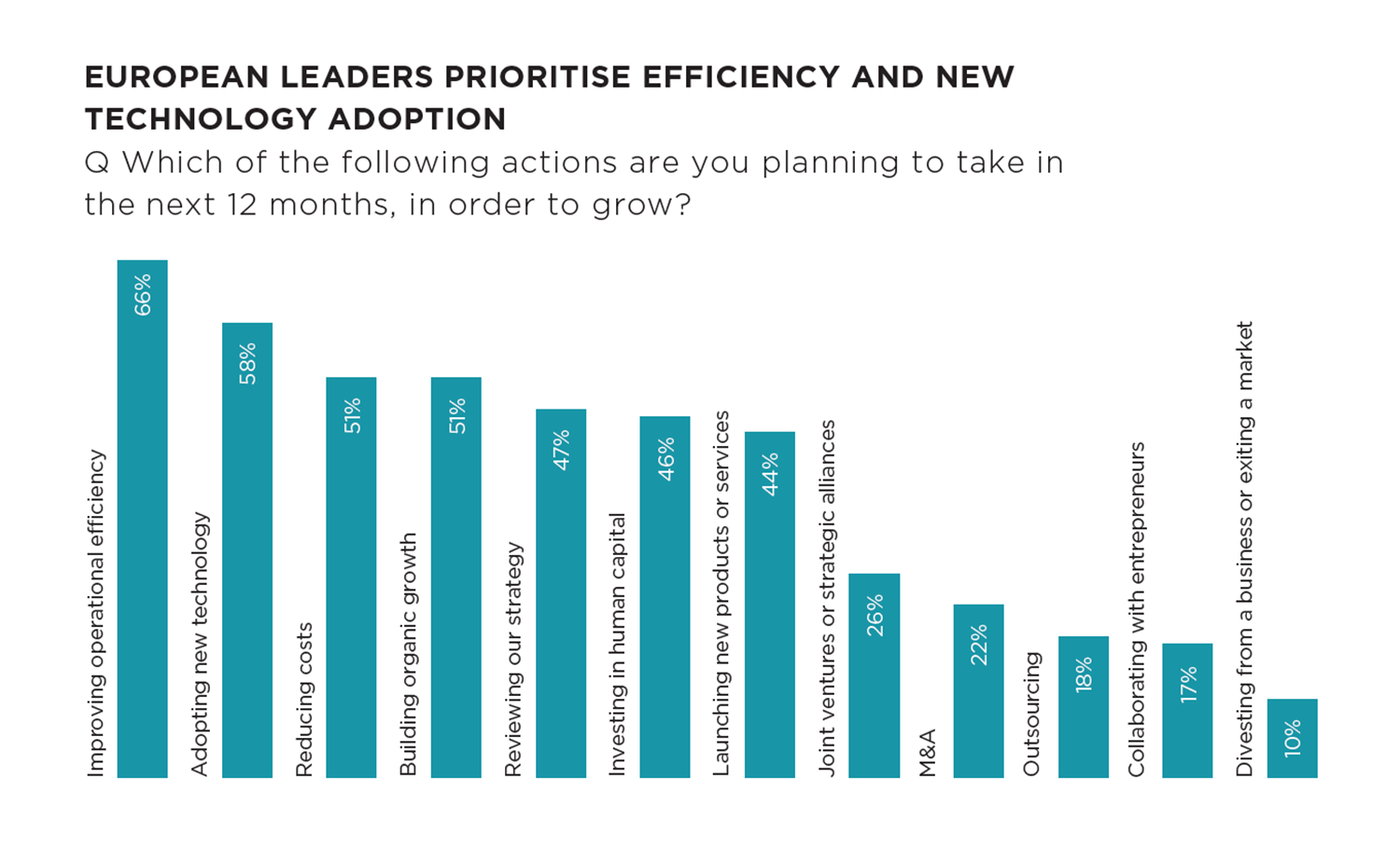

Given the ongoing challenges, European leaders are laser-focused on further business improvements: Improving operational efficiencies (66%), and adoption of new technology (58%).

Cost reduction and building further organic growth come as a joint third priority for 51%. This year, 47% plan to review their strategy to achieve growth, compared to just 35% in 2022. New

product development, however, appears less of a priority. Only 44% plan to release new products or services this year versus 53% in 2022.

Compared to the start of the decade, European leaders are almost twice more committed to using technologies as a lever for growth. Moreover, they are ten percentage points more inclined to invest in human capital than in 2021. Europe has a long history of innovation in engineering, biomedical research, and telecommunications.

However, there’s been a growing ‘digital’ divide between Europe, North America, and China. Since the start of this decade, both the US and China have substantially increased investments in tech R&D, especially in the hardware sector. In Europe, the levels of R&D investments, on the contrary, have been declining over the last 15 years.

R&D in the tech sector receives five times less funding in the European Union than in the United States. Although Europe and the UK have a segment of high-performing tech companies and

unicorn startups (valued at above €/£1 billion), the sector is more modest when compared to the US or China.

Risks worth taking: AI adoption

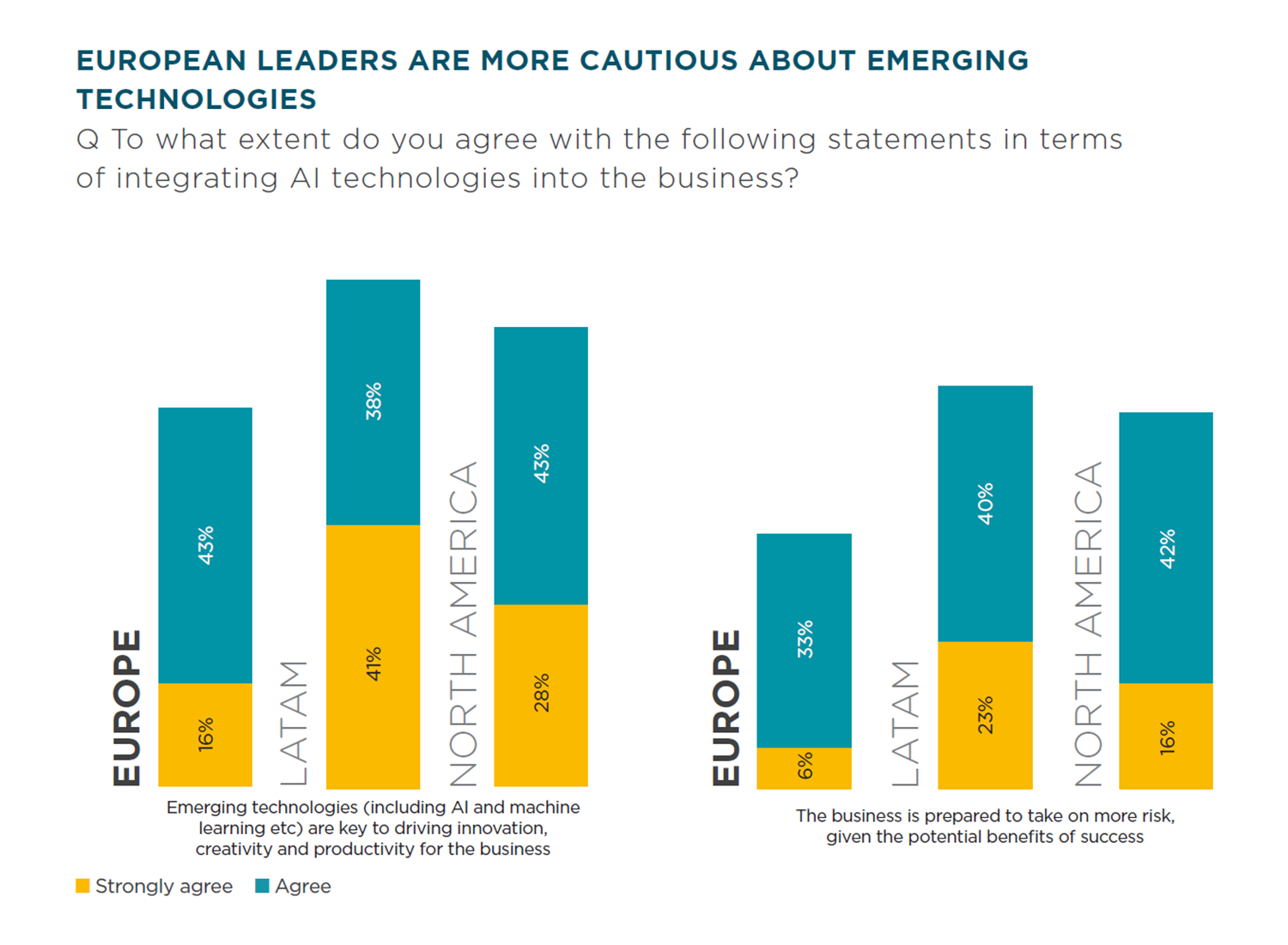

Business leaders in Europe are more conservative about the international business environment than their global peers. They know that long-term competitiveness involves embracing emerging technologies and maintaining a ‘digital’ mindset.

However, they are also cautious about pursuing ambitious transformations. Although 59% agree that emerging technologies are key to driving innovation, creativity, and productivity for the business, only 39% are prepared to take on more risk in this area, given the potential benefits of success. In comparison, leaders in North America and LATAM are much more eager to embrace both the risks and the gains new technologies could generate for their business.

Trade disruption has also been ongoing, but only half agree the tech advances will help overcome future cross-border challenges vs 63% globally. Curiously, however, European leaders are less likely to cite short-term priorities and unexpected market disruption as barriers to new technology investments, compared to peers in the Western hemisphere.

European businesses appear to not have AI as an immediate priority. Instead, they’re more focused on cost optimisation, workforce management, and immediate (geo)political concerns. The “EU AI Act”, proposed in June 2023, and due to pass a final vote in March 2024, may also deter some leaders from taking immediate action.

The landmark ‘AI laws’ have a good cohort of critics and supporters. On the pro side, the AI Act aims to provide a shared legal framework for developing ethical AI applications, protecting user rights and data, alongside EU-funded infrastructure to support AI projects. It also aims to facilitate collaboration on AI projects between the government, private companies and research institutions in the block.

On the downside, the AI Act has been criticised for extensive supervision from government bodies, which may hinder the speed of innovation and global competitiveness of EU-based companies. The complexity of implementing certain requirements may also deter new market entrants and delay the time to market for new products — the type of action AI leaders prioritise.

Globally, companies that identify as AI innovators are 1.3 times more confident in their ability to grow revenues this year compared to their peers. They are also more likely to launch new products (56%) this year, seek strategic alliances with other businesses and collaborate with entrepreneurs (32% vs 13%) to grow their business.

European leaders are in the 'learning phase' on their AI journey

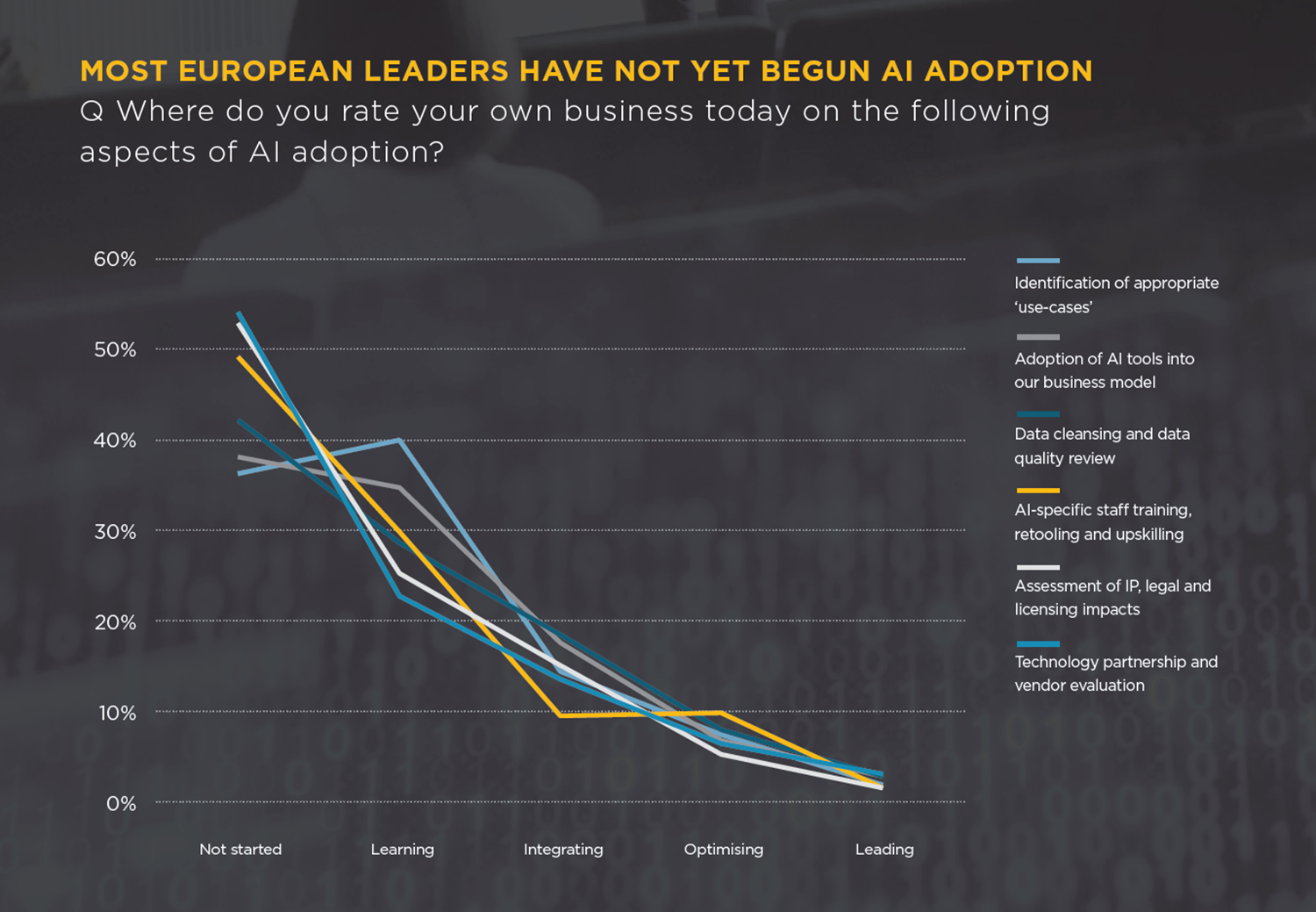

European leaders are still at the start of their adoption journey: 30% haven’t yet started with adoption (vs 21% globally), 45% are learning about the opportunities (vs 37% globally), 15% are integrating AI into their operations, while 8% are optimising and leading in this area.

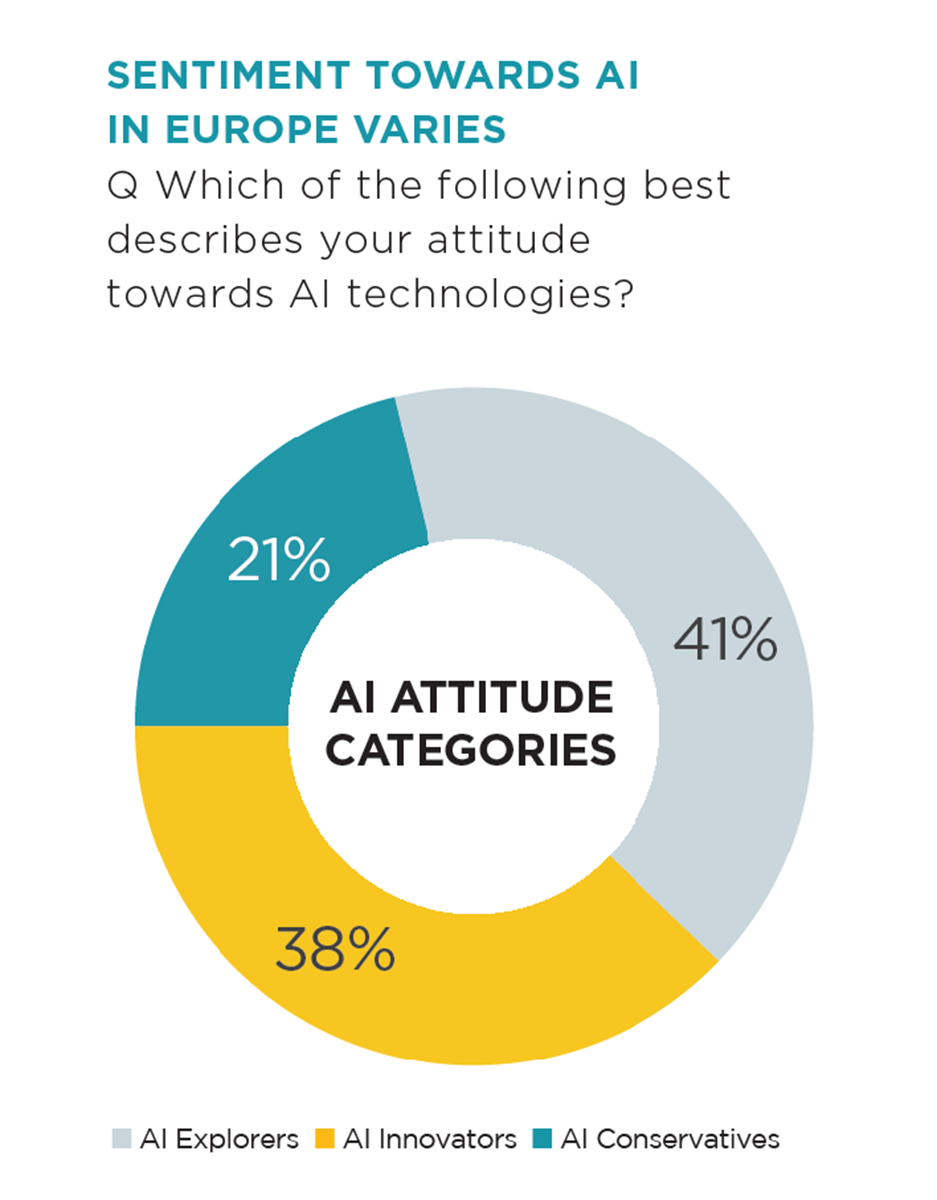

The majority of European leaders (41%) identify as Explorers. They’re willing to deploy AI technologies if there is a convincing business case for them. Another 38% are Innovators, who are either already using AI to an extent or eagerly preparing a business case for adoption. Compared to all regions, Europe also has the largest fraction of AI conservatives. 21% of European leaders are cautious or even averse to using AI.

European leaders have made the most progress in the baseline tasks for AI adoption: 29% have completed data cleaning and quality reviews, 26% did technology readiness assessments, 23% identified appropriate AI use cases, and 22% performed assessments of IP, legal and licensing impacts.

Fundamentally, however, Europeans are behind their peers on the AI maturity curve. In APAC, for example, over 40% of businesses claim to be already adopting AI tools into their business model versus only 28% of Europeans. Similarly, North American leaders made twice the progress with regard to ‘use case identification’ and assessments of regulatory implications.

Fewer European businesses have also completed vendor evaluations or entered technology partnerships than in North America, LATAM, Africa, and the Middle East. A European CEO in the Real Estate industry expressed what appears to be the general sentiment about AI in the region: “We need to spend time learning the benefits of AI and how to integrate it into our activities”

‘Lack of use cases and unclear ROI’ was named as the main barrier to adoption by 39%. Almost immediately followed by data security and privacy concerns (38%), with the lack of time (35%) being the top third concern. ‘Lack of budget’ and ‘low executive commitment’, however, are less of an issue.

Leaders from several European publicly listed companies also mentioned the “lack of the right human skills set for digital transformation” and “education and opportunity awareness” as current constraints. Small and medium businesses (SMB), in turn, are seeking greater support for formalising their business case for adoption. SMB leaders seek “clear illustrations of how AI works and the benefits the technology can provide”, “educational and cybersecurity support”, and more general guidance on available commercial solutions.

As a CEO from the Retail sector notes, “All businesses are suffering from challenges that could be solved with a simple integration with a third-party AI tool, but they are just not aware of the possibility”. European leaders appear to have most of the internal resources to muster AI transformations. Yet, they’re reluctant to dive head-first into the project.

Some caution is a good practice as the implications of new technology only look obvious in retrospect. However, “too many of the highlighted concerns could slow adoption”, a COO from a technology sector noted.

European leaders are more likely to be exploring their options

The majority of European leaders (41%) identify as Explorers. They’re willing to deploy AI technologies if there is a convincing business case for them. Another 38% are Innovators, who are either already using AI to an extent or eagerly preparing a business case for adoption.

Compared to all regions, Europe also has the largest fraction of AI conservatives. 19% of European leaders are cautious or even averse to using AI.

AI Innovators appear to be powering ahead to get a better position at the start of the new growth cycle, while AI Conservatives appear to be gearing up for another economic downturn. Counterintuitively, AI Innovators are more concerned about the geopolitical climate, inflation, and cybersecurity risks than AI Explorers and AI Conservatives.

Half of European AI Innovators plan to launch new products this year. AI Conservatives, in turn, are mostly committed to cost reduction (49%) and seeking improvements in operating efficiencies (47%).

Learn more about our research