Foreign Direct Investment (FDI) Report: Africa

By Marcelo Fonseca, Global FDI Leader

Many regions view FDI as a source of economic development and modernisation. Africa is no exception. In our latest insights we explore the investment opportunities in Africa. We cover a few selected countries, using macroeconomic information and FDI projects in a summarised and easy to understand manner. On the base of GDP in US$, this article uses data from Algeria, Egypt, Nigeria and South Africa, as they are top four in the continent.

Information provided comprises:

- FDI information for countries under analysis and for the continent;

- Corporate taxation;

- “Competitiveness” rank;

- Economic data;

- Brief macroeconomic outlook.

In 2021 Africa was projected to recover from its worse recession in 50 years, caused by the COVID 19 pandemic. Tourism and commodities were expected to lead the way to GDP growth of 3,4% in 2021. However, poverty indicators worsened with nearly 30 million Africans being pushed into extreme poverty due to the pandemic. As with other economies, African governments responded to the pandemics with fiscal stimulus, resulting in higher levels of public debt.

Reorganising public debts will be key to resuming spending on education, health, and infrastructure, and private investment will respond positively to such policies. A movement towards the reduction of poverty and investment in human capital are critical to enhance productivity.

Economic activity in the region can be boosted by initiatives like the creation of the “African Continental Free Trade Agreement” (launched officially in January 2021) and could address issues like poverty reduction, productivity and regional output. According to The World Bank, the implementation of the agreement would:

- Lift 30 million Africans out of extreme poverty and boost the incomes of nearly 68 million others who live on less than US$5.50 a day;

- Boost Africa’s income by US$450 billion by 2035 (a gain of 7 percent) while adding US$76 billion to the income of the rest of the world;

- Increase Africa’s exports by US$560 billion, mostly in manufacturing;

- Spur larger wage gains for women (10.5 percent) than for men (9.9 percent);

- Boost wages for both skilled and unskilled workers—10.3 percent for unskilled workers, and 9.8 percent for skilled workers.

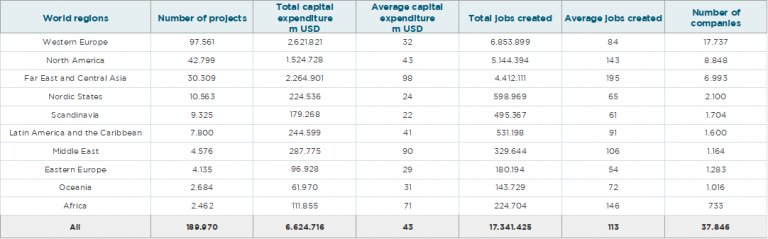

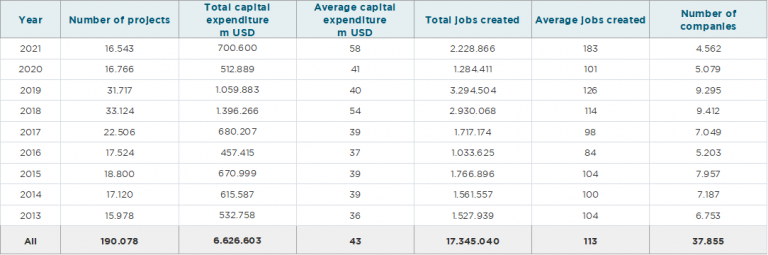

FDI overview, demographics, macroeconomic indicators, business regulations and competitiveness indexes:

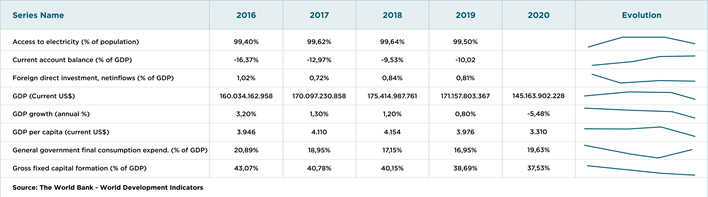

Algeria

The fall of oil prices during 2020 took a heavy toll on the Algerian economy. The dependence on hydrocarbon exports associated with the impact of revenues from oil and gas contributed to deepen the public and external deficits. A recovery of oil quotations and a sustainable plan to control its debts may resume economic activity on the short and medium terms.

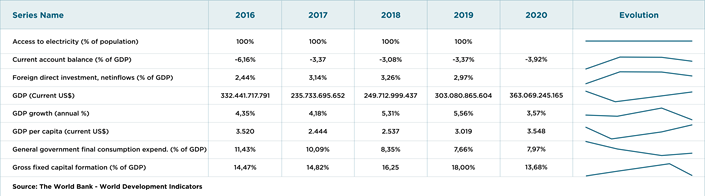

Egypt

As with other countries, Egypt´s economy has suffered from the COVID-19 pandemic and measures to control the disease had a negative impact on important sectors (tourism, manufacturing, extractives, the Suez Canal). Slow vaccination rollout is a risk to the recovery, on the other hand global economic growth may support Egypt´s economic activity. Internally, the return of tourists is also a key driver.

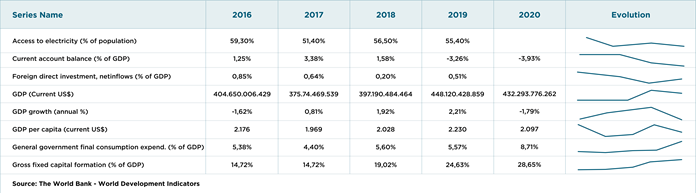

Nigeria

Dependence on oil revenues (oil accounts for over 80 percent of exports, a third of banking sector credit, and half of government revenues) and the decline in oil prices during 2020 took Nigeria into a deep recession. Long-awaited Government reforms targeting subsidies to gasoline, cuts in spending and management of public debt, were implemented to face the pandemic. However, economic prospects remain uncertain.

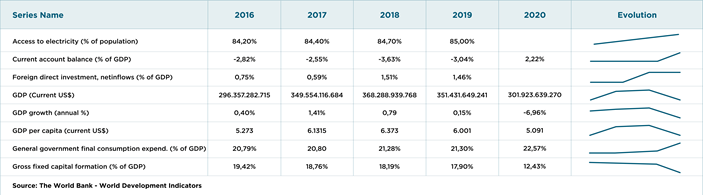

South Africa

Commodity prices are positively affecting South Africa´s economic recovery, improving tax and royalty over minerals estimates. Like other countries, public debt poses a risk. According to The World Bank, a more inclusive set of public policies should target constraints such as electricity shortages, transport and logistical costs and bottlenecks.

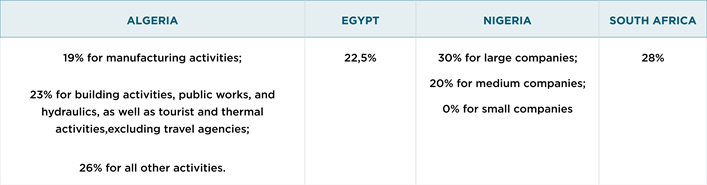

Corporate taxation:

Source: PWC – Worldwide Tax Summaries

Competitiveness:

The table below comprises information from the Global Sustainable Competitiveness Index (GSCI), a report from “Solability – Sustainable Intelligence”. As stated on its website:

“The GSCI measures competitiveness of countries based on 127 measurable, quantitative indicators derived from reliable sources, such as the World Bank, the IMF, and various UN agencies.”

In summary, index captures (180 countries covered):

- Natural capital (population, geography, climate, biodiversity and natural resources;

- Management of human, natural and financial resources;

- Income differences, opportunities, freedom of press and human rights, among others;

- Education, R&D performance, infrastructure levels;

- Business legislation, level of corruption and government investments.

Source: solability.com

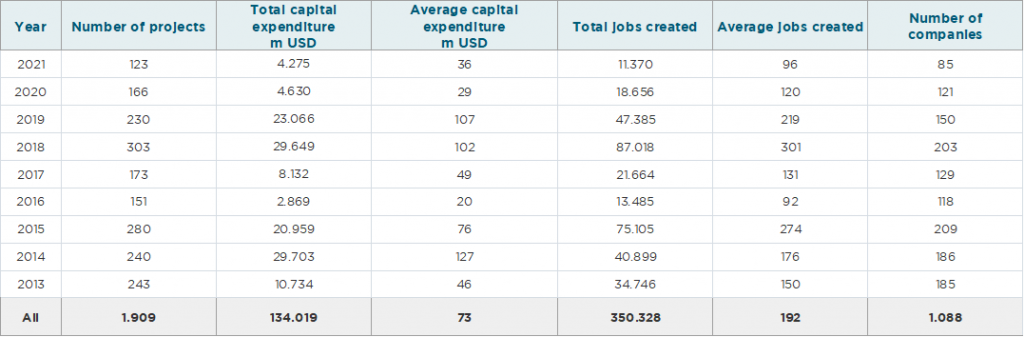

Key FDI Indicators for Algeria, Egypt, Nigeria and South Africa (combined)

Date

Source: ORBIS CROSSBORDER INVESTMENT

Source Market

Source: ORBIS CROSSBORDER INVESTMENT

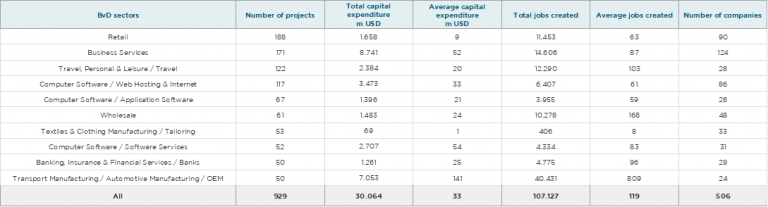

Highlighted Industries (Top 10)

Source: ORBIS CROSSBORDER INVESTMENT

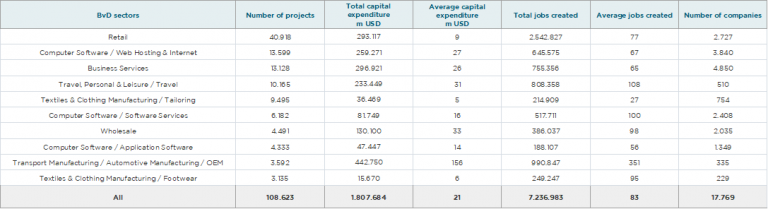

Key FDI Indicators for the African Continent

Highlighted Industries (Top 10)

Source: ORBIS CROSSBORDER INVESTMENT

Source Market

Source: ORBIS CROSSBORDER INVESTMENT

Date

Source: ORBIS CROSSBORDER INVESTMENT