Transactions Outlook 2021:

An Overview of Global M&A Trends

The past year was unprecedented in so many ways. It changed the way we interact, do business and go just about everything in our lives. A recent HLB Cross-Border Business Talks podcast episode features our HLB experts — Chris DeMayo, HLB's Global Emerging Technology Leader, Patrizio Prospero from HLB Malta and HLB USA's David Sacarelos. They wrapped up 2020 and offered insights into what 2021 holds for the world economy.

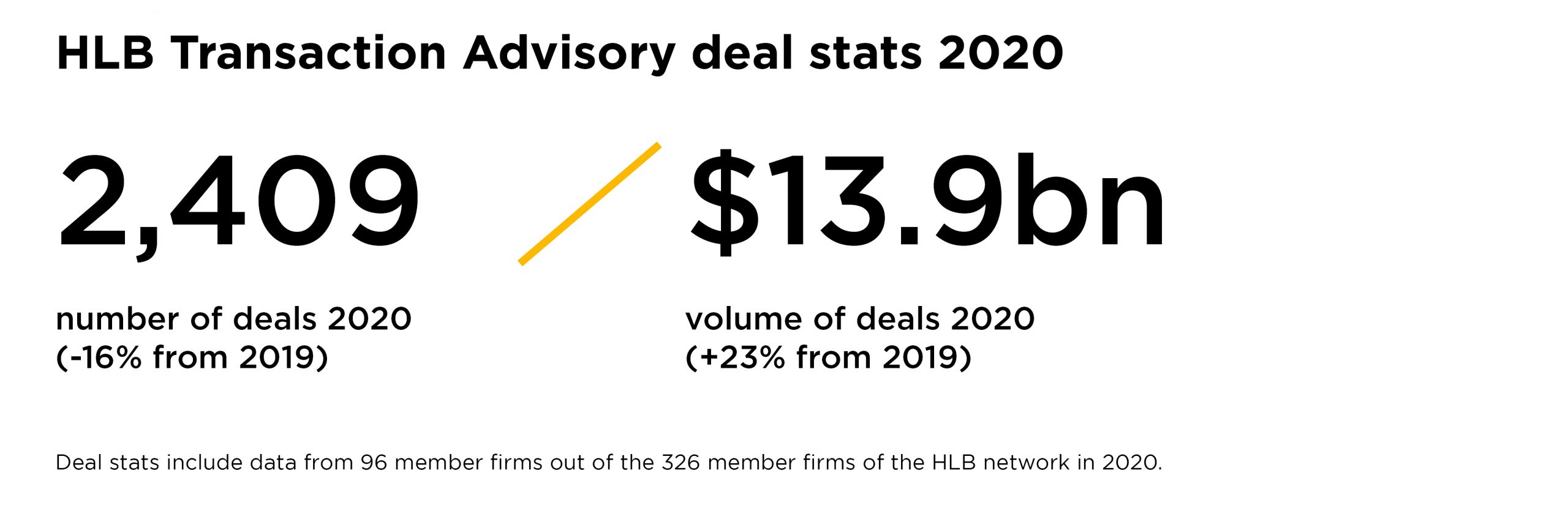

Deal-making activity stayed strong in 2020

The pandemic did not affect every business in the same way. There were companies that have benefited from the disruption and from good opportunities that opened, while others had to pause and reconsider their decisions, which means that some deals fell through.

Despite an unparalleled disruption brought upon the world economy, 2020 has seen a significant increase in M&A activity, but for various reasons.

Some acquisitions happened as a result of the devastating effect of the pandemic on some businesses. Without enough gumption to continue for another year or two and rebuild from the pandemic on their own, they resorted to a merger option as a lifeline. On the other side of these transactions were big companies with big balance sheets that had the capital to deploy and acquire good technology and a good employee base.

Another group of deals involved companies that were positively impacted by the pandemic such as online retailers, especially those operating in the food sector. They went out on the market and raised funding at high valuations off of exceptionally aggressive revenue growth.

The past year has seen a rise of companies, especially in new emerging technology, that seized opportunities to acquire companies that did not manage to sustain their business through the pandemic. Some other companies put their plans on hold as they tried to make sense of the impact of the virus outbreak. Deals that were put on hold in 2020 could be finalised this year, but some of them based on reassessed values to account for the pandemic.

There is real optimism about 2020. Robust government response to roll out vaccines and curb the pandemic, coupled with a view that there are ample funding and demand available reassures the market that 2021 will be an excellent year with deals that see the same valuations, if not higher than in the past. The outlook is especially positive for technology, healthcare and consumer goods, while the retail and real estate are at the downside of that trend.

Remote work and its impact on the real estate

The real estate sector will have to reassess and decipher how the new work models impact the industry and how the supply and demand will continue to evolve. Emerging companies have found new ways to attract both financial capital and human capital and technology and other aspects of innovation globally as the pandemic revealed that employees don't have to be in the same building to get the work done.

Still, it's becoming more evident that some employees — especially younger ones — are getting tired of not going into the office and not spending time with other people. They believe that in some cases, remote work does hamper innovation. But at the same time, they don't want to completely go back to the previous work model. Instead, they want to be able to do both — to be home on some days and go in on some others. As these developments unravel, the real-estate market will have to assess the supply and demand, David Sacarelos said.

In addition to that, the market needs to factor in a potential change in regulatory rules and tax laws as the new Biden administration takes over. These factors will also have a significant impact on the real estate market, especially in Silicon Valley, where the idea of putting start-ups in tax-efficient opportunity zones is gaining traction. In larger markets, such as California and New York, evictions from commercial properties are stopped at least until June, impacting technology and emerging companies that have long term leases on their balance sheets at the moment.

Working from home has enabled many companies to cut costs and relocate their offices or change the use of their space, which had a positive financial impact. Still, Patrizio Prospero draws attention to another aspect of the work-from-home model that needs to be accounted for, and that is the impact on human capital. The negative impact is especially prominent in technology companies, once perceived as fun companies to work in. Having time to meet each other, brainstorm new ideas, and discuss possible new things to do were probably one of their critical success factors as they used to approach human capital differently. Prospero cites statistics showing that there are people who feel more depressed, as they are deprived of the possibility to share and meet other people and exchange ideas.

“Employees in tech companies used to identify themselves with the company's culture and feel more sense of belonging to the company. But today, when they work from home, their work experience is standardised. This means that although work from home has positive financial repercussions, it has also negatively impacted innovative companies' work experience.” Patrizio Prospero, HLB Malta

David Sacarelos finds that remote work opens up many new possibilities. First, companies can now seek talent in places that are far from their offices. They are now able to accommodate talent that doesn't want to live in traditional business hubs such as New York City or California.

This will also have a visible impact on the way offices are laid out. Sacarelos finds that it may or may not change the square footage, but it will change the way the office space is designed. New commercial real estate will likely have more collaboration space and fewer offices and cubicles because not as many people will need them as they will probably share spaces more than they will use permanent spaces. Or perhaps, they will not share spaces, but then spaces will be substantially smaller.

"The ripple effect of remote work and remote work environment is so deep. It is not binary; we are not going to go to the full remote environment because there is absolutely a very real benefit to be around people. But I haven't talked to a single client that has said we are going back to five day work week in the office. Those days are over." HLB USA's David Sacarelos

Commercial real estate is facing many potential changes, and we don't know yet what the outcome will look like. Some of these changes will be positive; some will be very damaging. For example, online conferencing has advanced ten years in a matter of ten months. It will have a decimating effect on travel and hospitality as the world has seen that business travel does not have to happen anymore in a way that once did. Even big and important business meetings can now happen on video conferences. This shift will reconfigure the dynamics of the marketplace. And although no one can fully predict long term impact, there will certainly be winners and losers. Still, cultural norms are yet to be set as to what can we expect from our employee basis in the future.

The rise of SPACs as format for tech companies to go public

Going public is a fairly long, drawn-out, expensive process which can take years. SPACs (special purpose acquisition companies) have fast-tracked it, making it much more simple for private companies to go public.

SPACs are shell companies that don't have any commercial operations but instead merge with private companies that do have. A SPAC goes out and acquires a private company which makes that company a public company. Merging with a SPAC is a way for private companies to go public without the SEC's administrative burden. It can be done in a matter of months, rather than taking years to do. This possibility to fast track the process of going public has created a vibrant market in the US regarding potential SPAC targets in Silicon Valley.

The SPACs offer an enticing financing option for all innovative companies, from traditional SaaS companies to FinTechs and electric vehicles companies. Chris DeMayo highlighted that already five companies have announced plans to go public through a SPAC merger at valuations over of billion-dollar. Over the last four months, only one deal didn't include a SPAC as they offer a faster, cheaper way for tech companies to raise capital, while also being attractive to private equity companies in California. For these reasons, we will likely see many more of this type of funding in the coming years.

David Sacarelos agrees that this way of going public reduces disclosure at the front end as companies have more opportunities to speak more directly to their investors. Still, for him, the critical question is whether or not these valuations are realistic. There are conversations in Congress and Federal reserves to decide whether or not there needs to be more regulation around this activity.

Chris DeMayo agrees that SPACs open up challenges for the marketplace for the next couple of years as private companies with thin infrastructure continue to go public.

Many questions need to be addressed as SPACs proliferate the marketplace. Will these companies have an internal accounting function that will provide accurate financial statements every quarter? Will they be able to speak accurately to Wall Street about revenue projections and growth? These are things they were never trained to do as private companies. Putting that infrastructure in place is part of the two-year process of going public that they are skipping.

"The risk that I see out there is that so many companies that are going to be targets of SPACs, they are not really ready to be public companies. They are going to snap a finger and all of a sudden they are going to be a public company. The rules of their reporting are no different than rules for a traditional public company...How is that going to affect the market in the future when you have companies that are sort of building the plane as they are flying and going into a big IPO. And now you have public markets that are investing in these companies. They are going to have to really step up." Chris DeMayo, HLB's Global Emerging Technology Leader

Final thoughts from experts: The tech losers and winners in 2021

We have seen many tech winners and losers during this pandemic. Those companies that provide services to people who stay at home are the clear winners. For example, in pre-pandemic times, Zoom had 10 million subscribers. In just a few months during the pandemic, the company reached 200 million users. Other winners include gaming and streaming companies like Netflix or Amazon as people are spending more time at home and have to entertain themselves. Gaming companies like Nintendo has more than doubled sales during the pandemic.

There are also tech companies that won in some aspects but also lost in some others. For example, Amazon is perceived to be a big winner, but at the same time, the public raised a lot of concerns about work conditions at Amazon, which is creating a lot of pressure on the company. Finally, there are those identified as significant losers. Companies like Uber, which had to change the business model moving into food delivery space or once-booming tech middlemen like AirBnB and Booking that have also experienced significant losses.

2020 has seen a massive increase in revenue of the online businesses which were able to deliver goods conveniently. But the impact is not confined to the pandemic. As Chris DeMayo puts it, that change marks a permanent shift. As people were forced to adopt new technology, now that they have, they will stay with it. Retailers will have to deal with the fact that fewer people will walk into the stores to buy goods, now that they became comfortable buying online.

This shift spans across demographics. Before the pandemic, younger people were already shopping online, but those in 50-70 year age bracket — a massive buying demographic — were much less inclined to do so. Now that they have experienced the benefits of online shopping, they are not going back.

Hospitality will likely struggle for a long time. We will probably see a surge in leisure-related travel when the pandemic is over and people want to go on their vacations. Still, business travel, traditionally more lucrative than vacations, will be much different over the long term.

Looking beyond economics, one area that DeMayo finds important is leadership in crisis. When revenue is going north and money is flowing in from investors, it is easier for companies to lead as they face fewer pressures.

But when a crisis hits, companies that demonstrate a capacity to respond to challenges such as cutting costs, dealing with people, or other difficult decisions to be made, they emerge as leaders. Companies that come through the other side will be better, more solid businesses because they know it is not only about burning cash and how fast they can spend money, but about building a business that can survive adverse events. This may be one of the most important byproducts of the pandemic, which Sacarelos believes we maybe don't see now, but that will grow out over time.

David Sacarelos cites technology and healthcare as sectors that will remain at the forefront, but also AgTech where the field robotics and farming are niches that investors keep their eye on. Artificial intelligence and Machine Learning, remote work technology, cloud companies are also expected to fare well and fintechs and businesses related to enterprise, health and wellness. FoodTech, where we see innovative companies creating lab-grown meat and technology run insurance industry, will be essential as well as mobility companies, retail health and wellness. Finally, anything connected with supply chain technology that makes easier to move things is expected to perform well.