Trade outlook in global real estate

HLB has long been a key player in the global real estate sector. As the official supervisor of the PropertyGuru Asia Property Awards—the gold standard for excellence across Asia-Pacific—HLB continues to shape conversations and standards in real estate.

Through our international network of legal, tax, and advisory firms, HLB aims to actively contribute to the sector's development through cross-border collaboration and specialised local expertise.

In a recent panel discussion hosted by HLB’s Growth Officer, Coco Ke Liu, legal experts from HLB—Juan Ignacio Fernández Torres of Sayma, HLB Spain, Pascal van Boxtel and Marco Haanappel, VDB Attorneys and Civil Law Notaries, HLB Netherlands—delved into the evolving trends shaping European real estate.

European real estate: A goldmine of opportunities

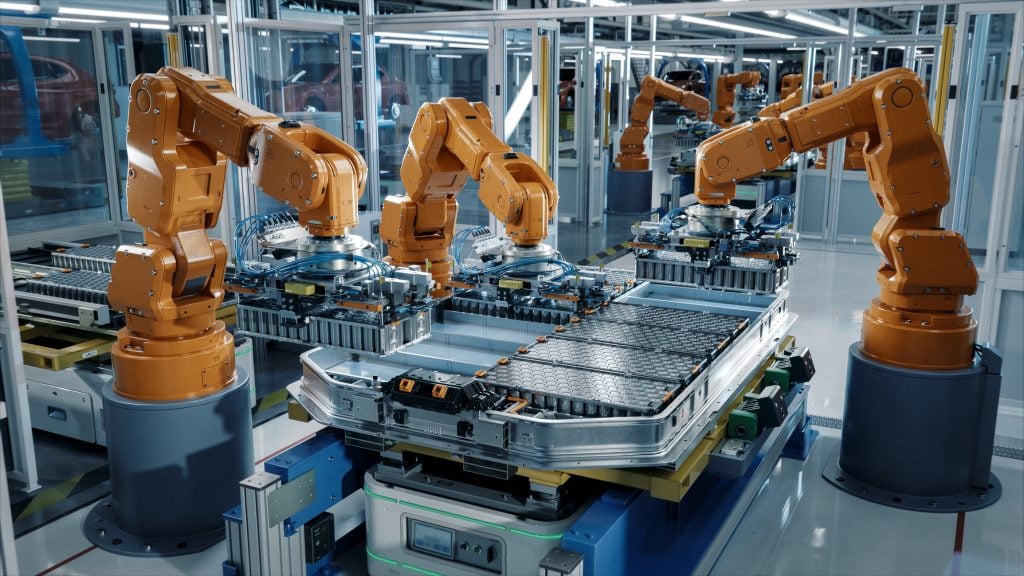

"In Europe, there's real growth potential in electric vehicles, renewable energy, and real estate—particularly manufacturing real estate," Fernandez Torres observed. Digital transformation and demographic shifts drive demand in new directions, with digital nomadism contributing to rising housing prices across major cities and regional areas.

In the Netherlands, housing demand among younger generations is sharply increasing. "There's a strong need to build new homes, especially for young people," Van Boxtel explained, citing supply shortages and affordability concerns as major forces. Due to the country's limited space, farmland is being repurposed for residential development, illustrating how real estate projects are evolving in response to environmental and spatial constraints.

High-tech investment is also gaining momentum in the Netherlands. "There was recently a €1 billion fund announced for NXP," Vann Boxtel noted, pointing to the Brainport region as a key innovation hub.

Overall, there is growth potential across European countries, particularly where real estate development intersects with high-value manufacturing or R&D. "We've seen that Europe is a gold mine for the real estate market because prices are growing exponentially. Plenty of people worldwide are looking forward to investing in Europe, both in manufacturing facilities and urban real estate. I think this is one of Europe's greatest assets right now—the real estate sector," Fernandez Torres concluded.

Navigating legal and environmental headwinds

Although the European real estate sector offers considerable growth opportunities, it is not without its challenges.

In Spain, main difficulties for investors include navigating zoning laws, tax incentives, and the economic environment. Fernandez Torres reports that verifying land registry records can be difficult, as listed details may not match the property. Also, the country's highly fragmented system requires expert guidance to navigate local complexities, including region-specific laws, tax systems, and available tax breaks and subsidies.

In the Netherlands, environmental regulations are driving the market. The government must meet nitrogen reduction targets by 2030, a legal obligation that developers must now factor into their planning. The country also faces electricity shortages and grid congestion, which are cited as the main challenges for new businesses. In response to these pressures, the government has launched more than 100 measures to increase capacity as quickly as possible.

With a consistent transfer tax nationwide, the Netherlands' tax system is generally more uniform than Spain's, although regional differences remain due to variations in municipal taxes. Staying informed on both national and regional regulations is crucial for successful real estate development in both markets.

Powering global deals through legal alignment

Recent market shifts highlight the growing importance of legal structures and international cooperation. The panellists discussed how HLB firms support cross-border investors by aligning tax advice and legal frameworks. This coordination enables swift, well-informed decision-making.

They also emphasised the strength of HLB's network in delivering a unified client experience. "We all speak one tone when serving the client, and that's the most important thing," said Haanappel. With experts across borders united by high standards and responsiveness, HLB delivers a seamless, one-stop solution for legal and advisory services.

"We have a strong legal network in Asia-Pacific—in China, Korea, Singapore—as well as in Latin America," added Liu. "They rely on us to support their clients when making investments from China to Europe, or via Spain to Mexico."

Legal structures for strategic investment

The conversation then turned to the legal vehicles most commonly used in cross-border real estate transactions.

In Spain, preferred structures include limited liability companies (LLCs), public limited liability companies, joint ventures, and European Groupings of Economic Interest. "The structure depends on the nature of the project. If an investor is buying property for their own use or as an income-generating asset, an LLC is often suitable," the Spanish lawyer explained, adding that a public limited company may be more appropriate for larger investments, while joint ventures are appropriate for infrastructure and large-scale construction projects, where local expertise is critical.

Dutch perspectives were similar. "In the Netherlands, it's quite similar," said Van Boxtel. "Often, companies are incorporated initially for tax purposes, and then we step in to assist with the legal framework." Structures such as public (NV) and private (BV) limited companies, limited partnerships, and private equity frameworks are all commonly used.

ESG and the urgency of sustainable development

Sustainability is becoming a major priority—not just in green construction, but also in designing buildings to meet evolving community needs.

European countries are adapting to these shifts, albeit unevenly. In Spain, the legal landscape for green investment is fragmented. Incentives vary widely between regions and municipalities, with some jurisdictions proving more proactive than others.

In both Spain and the Netherlands, retrofitting buildings for sustainability and eco-friendly real estate solutions is on the rise.

In the Netherlands, ESG initiatives are supported by robust government subsidies to encourage sustainable business practices, even as the ESG framework continues to evolve. Land scarcity adds urgency to this transition. As a small, densely populated country, the Netherlands must make difficult decisions about land use—balancing agriculture, housing, and industrial needs. These constraints make sustainable development not merely a trend but a necessity.

Seamless global network, built on local expertise

This recent HLB panel offered more than just insight—it revealed the strength of HLB's legal network: globally connected, locally grounded, and seamlessly collaborative.

By combining legal, tax, and regulatory expertise across borders, HLB member firms are helping clients navigate complex real estate markets while advancing sustainable development. This shared commitment allows HLB to deliver something unique for the clients: a seamless cross-border experience.

Related content