The Spanish economy grew upwards, with the growth of 2.7% expected for the year 2023. However, on the other hand, there is a drop in expectations for the year 2024, with a forecast of 2.2%, according to estimates by the Bank of Spain.

Exports and the services sector contribute to the performance of the economy. Uncertainties regarding the real impacts of the NGEU - Next GenerationEU, funds on investment in the short term remain. The effect of the tightening of financial conditions, (the cost of capital due to the monetary policy impacts consumption and the cost to finance companies) together with the perspective of a fiscal contraction scenario, may negatively impact the future growth of the economy.

Spotlight on Spain

Despite the worsening of the financial conditions due to the effects arising from the control of the inflationary process and geopolitical uncertainties that still weigh on the largest economies, Spain is expected to do better than its European peers in the short to medium term. The country also has good prospects as a destination for foreign direct investment. According to information released by the Ministry of Industry, Commerce and Tourism in 2022, the country ranked twelfth in the ranking of foreign investment destinations, gaining five positions compared to 2021. It is also expected that the revision of the legislation that deals with foreign investments can speed up business and make the business environment friendlier.

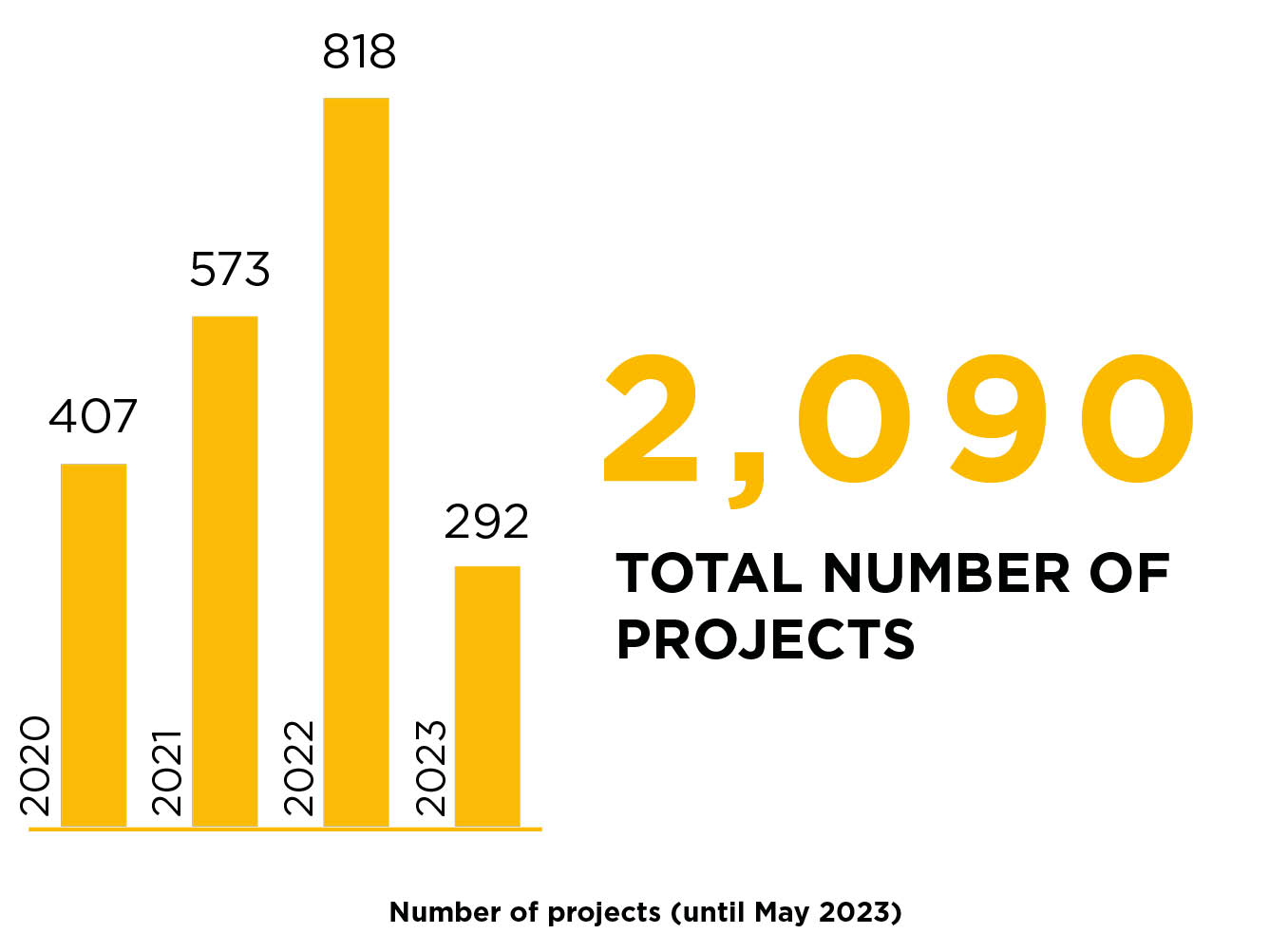

Key trends for the period 2020-2023*

For the purpose of this report, just-announced and already-executed projects were considered.

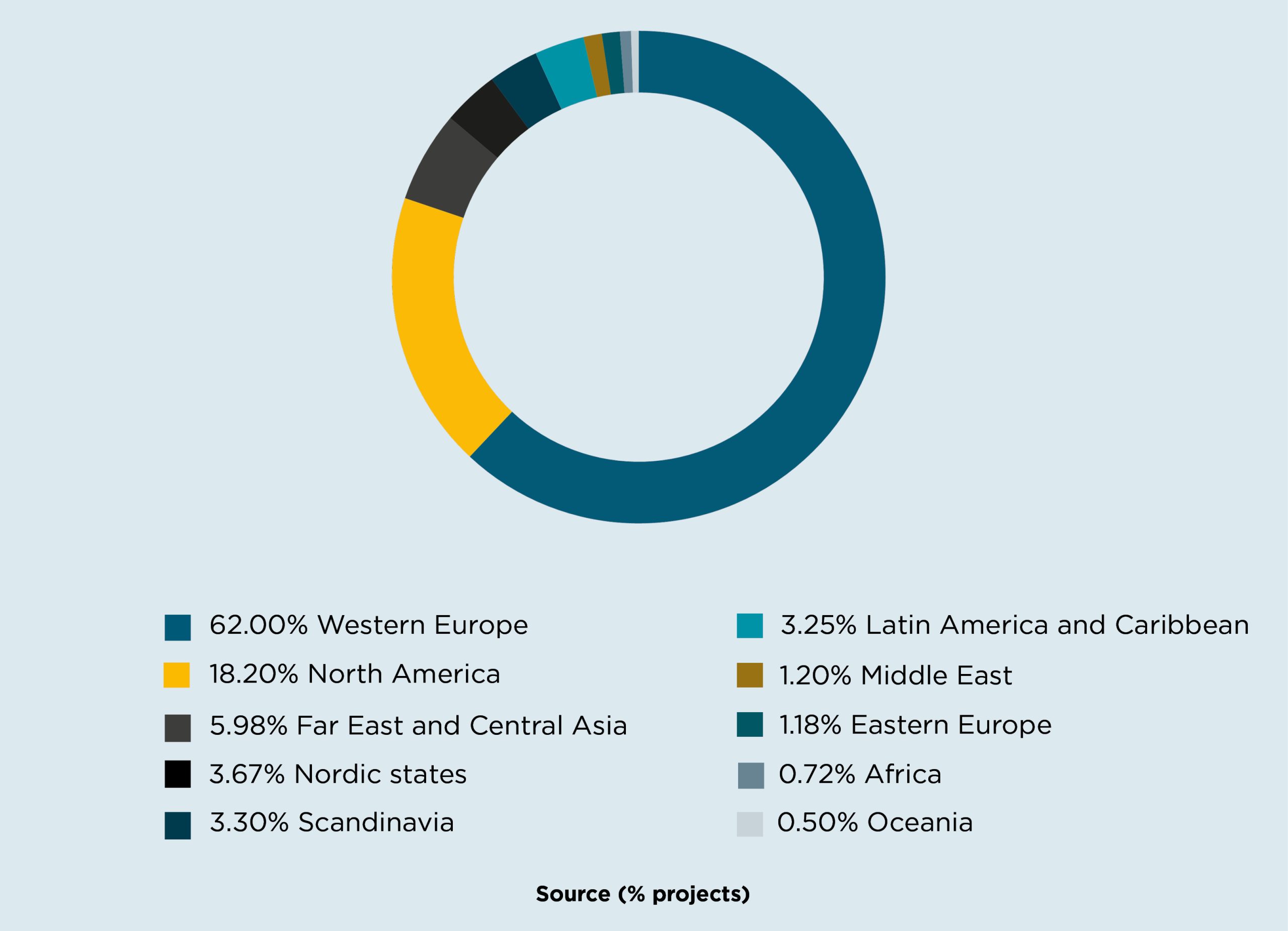

- Western Europe and North America are the main sources of foreign direct investment.

- Number of projects in 2023 shows a clear slowdown from the peak reached in 2022.

- Retail is the sector with the highest number of projects.

- Other sectors worth noting are:

- Computer Software

- Business Services

- Textiles and Clothing

*source of data: Orbis Crossborder Investment

Recent project highlights

- Stirling Square Capital Partners (United Kingdom) acquires majority stake in GTT – Gestion Tributaria Territorial SA from AnaCap. Deal value: US$326 million (unofficial).

- Generali Group (Italy) signed an agreement to acquire Liberty Seguros Compania de Seguros y Reaseguros. Deal value: US$2.491 billion (unofficial).

- CPP Investments Pension Plan Investment Board (Canada) to acquire a minority stake in FCC Medio Ambiente Holdind SAU from Fomento de Construcciones y Contratas. Deal value: US$1.030 billion (official).

To read more and see a sector analysis of how Spain’s investment has performed over 2023 as well as an economic outlook, download the full report.