Overcoming difficulties through innovation in agriculture:

HLB's Survey of Business Leaders - Agriculture analysis

Key survey findings at a glance:

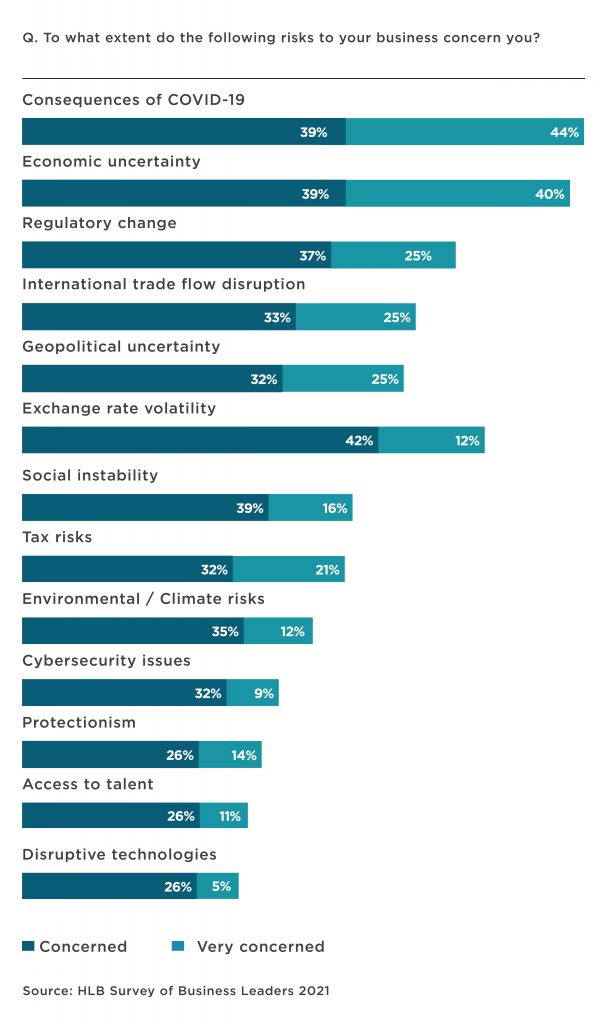

- Agriculture business leaders rank consequences of COVID-19 as the top risk to business growth, followed by economic uncertainty

- Confidence in global growth is significantly lower for business leaders in this sector. 60% of business leaders believe that global growth will decline in 2021, and only 12% are confident in their own organisation's ability to grow revenue.

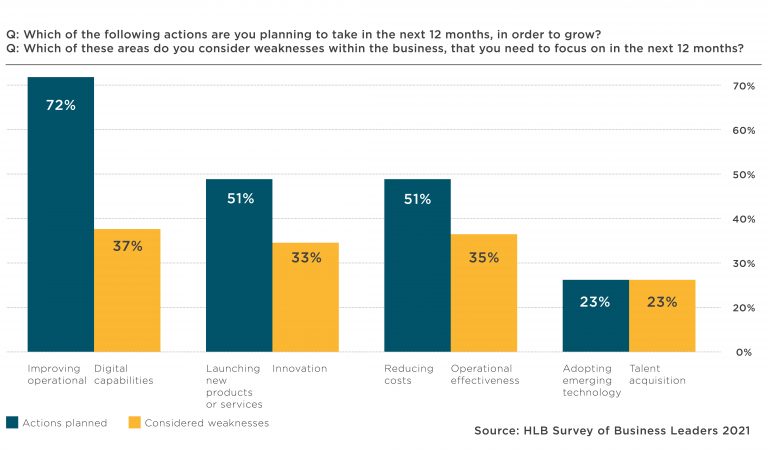

- Digital capabilities are a weakness of agriculture leaders and an area they are considering strengthening in the next 12 months

- 72% of agriculture leaders plan to improve operational efficiency, with 72% re-assessing their supply chain to source closer to home.

There’s no doubt that the agriculture, food, and beverage industries felt the impact of COVID-19. Nor that the effects continue to weigh heavily on the minds of leaders across the globe. From reports of dairy farmers dumping milk to a volatile commodity market, the uncertainty left many in and outside of the industry alarmed.

However, the pandemic also exposed the public to these issues. When supermarket shelves ran bare, and restaurants closed, consumers started asking where their food comes from. Moreover, as agriculture leaders look towards diversifying income streams or adding new products, the direct to consumer (D2C) market can provide opportunities.

To learn how the pandemic affected producers and processors in 2020, along with their outlook for 2021, we surveyed global business leaders as part of HLB's Survey of Business Leaders. We asked questions relating to overall confidence levels and the concerns they had moving forward. Furthermore, we looked for insights to learn how innovation and increased digital capabilities could affect agriculturalists in the coming year, not only on finances and the labour pool but also on trade relations and climate concerns.

We found that although agricultural business leaders are less confident in growth prospects over the next twelve months, the majority aim to get new products to the market while improving operational efficiencies to make up the gap.

Top concerns for agriculture industry leaders

60% of survey respondents expect a decline in the rate of global economic growth over the next twelve months, suggesting that a downturn for the agricultural industry is expected. However, the pessimism is understandable when looking at the severity and reach of the impact.

For example, early in the pandemic, many industries were hit hard by closures to hospitality businesses and schools while also suffering from closures at the borders. Although business leaders had a supply of products, their typical buyers were not purchasing. Schools no longer required large shipments of milk for children. Restaurants didn’t need bulk-packaged products.

Unfortunately, factories were not equipped to transform bulk food products for sale into consumer-sized goods. The time and resources required to reimagine food production and delivery were not there. This problem only got worse as shutdowns continued because, especially in the hospitality industry, a lack of customers buying food products outside of their homes means fewer orders from suppliers, and those vendors didn’t need as much produce from farmers.

Moreover, as trade commodities turned volatile and prices dropped, producers who already face low margins felt the pinch. The agriculture industry took hit after hit with bottlenecks at ports due to COVID-restrictions and increasing concerns about imported products. Even the cost of biofuel prices fell, leaving little left for farmers to put in their pockets. Overall, agricultural leaders express more concern about 2021's prospects. 33% say they're not confident in their company’s ability to grow revenue over the next twelve months compared to 24% of global business leaders.

The challenge of international trade and exchange rates

The effects of 2020 show up clearly in survey responses, with 58% reporting concerns about international trade flow disruption, which is higher than the global average of 49%. Another 54% cite concerns over exchange rate volatility versus 40% in the global sector.

With the agricultural industry covering such a wide swath of niche sectors, what impacts a ginseng grower selling to its biggest market in China may not affect a grain producer exporting to multiple locations.

Yet, the concern over international trade flow disruption is vital to note. Both the US and UK recently saw significant changes that could affect global trade. Many experts don’t expect an immediate impact from the new administration for the US, and it’s unclear if trade relations with China will remain unstable. While it’s possible a reduction in tariffs could help the American agriculture industry, it’s simply too early to tell how policy changes will directly affect producers. In the UK, Brexit is a source of concern for European business leaders. Cross-border transactions are not as seamless as they once were, and things haven’t been ironed yet, leaving much uncertainty about the future impact.

For agriculture leaders in other parts of the world, the concern is over a shift to local products, resulting in fewer export buyers. Since the pandemic highlighted supply chain problems, many countries have made a push to produce and manufacture more products closer to home. Still, this solution is not immediate and will take some time to fund and ramp up operations. Until then, countries will continue to import much-needed supplies and products. In the meantime, the question is if consumers will continue to shop globally or if they also will seek out local products to replace those that they couldn’t get during the pandemic.

As to exchange rate volatility, in nearly all countries, agricultural producers, such as farmers, are older than the population at large. Although traditionally, agriculture leaders are more fiscally conservative, they haven’t worked within the global trade market as long as leaders in other fields. This unfamiliarity with the technology and a lack of desire to hedge bets against future contracts means they’re less likely to go online to manage their exchange rate risk.

Agriculture leaders address climate and environmental concerns

Lastly, 47% of agriculture leaders expressed concern over environmental and climate risks compared to 32% of global leaders. There are many possible reasons for this concern. Unlike other industries, the agricultural sector is deeply impacted by the weather. A couple of great years on the books can be quickly dashed by two years of drought or natural disasters. Farmers also face increased pressure regarding water rights and CO2 emissions.

Climate concerns from consumers and business partners also lead to uncertainty. For instance, the demand for beef globally continues to decline, and there is a public push to reduce CO2 emissions stemming from cattle. Our survey finds that 84% of agriculture leaders are making changes to profit in the low-carbon economy. Yet, few believe the solution is clear cut.

Many leaders worry about the effect that climate migration may have on farmland, with farmers already trying to co-exist in urban environments. New neighbours are not responding as kindly to the early hours and aroma of farm life. So figuring out how to present the best image and appeal to the public while protecting their farmland and crops from environmental damage will be a challenge in the years ahead.

Labour: A positive outlook

Fortunately, there is one area where agriculture leaders are less concerned than global leaders, and that’s in talent acquisition. Only 39% of respondents identify this as a top area of concern versus 47% of global leaders. This is partly due to greater efficiencies that began well before 2020, resulting in less labour-intensive operations.

Large machinery and automated processes reduced the reliance on skilled labour well before 2020. Although some work in processing facilities and farms were affected by the pandemic, many essential jobs still took place, and workers were allowed to cross borders to keep the supply chain running. Sectors that saw the most impact include those with labour-intensive requirements, such as high-value crops, fisheries, and meat products. In fact, many farmers struggled to secure a meat processor as nearly all were booked and simply didn’t have the capacity or labour to meet the demand.

98% of business leaders recognise that it’s important to ensure equal support and opportunities for their people. Regardless of the sector, professionals understand the critical role employees and partnerships play in their business and the supply chain as a whole.

Moving forward: focus on improvements

To respond to concerns over revenue, industry leaders plan to improve their operational efficiency. 72% suggest this is a key way they will enhance their business in 2021. Additionally, 51% plan to launch new products and services. For many, the growth may be related to finding direct to consumer avenues instead of relying on retailers or manufacturers to create the final product and reap the rewards.

Furthermore, 72% expect to reassess their supply chain to source closer to home versus 59% of their global peers. For this very competitive market with low margins, increasing local sales, creating new products, and improving efficiencies can help ensure future sustainability.

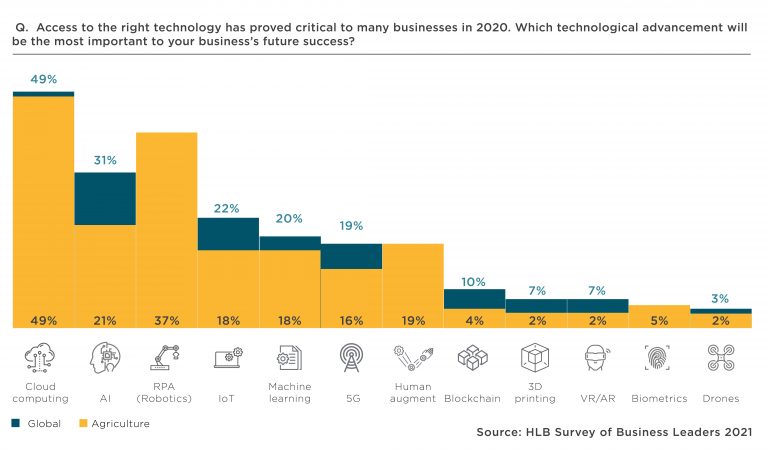

To get to a better place, agriculture leaders recognise that it’s essential to strengthen weak areas. Digital capabilities, innovation, and cost management are the main areas where leaders believe they are vulnerable. Overwhelmingly, leaders point to cloud computing as a crucial area for improvement. However, many producers live in rural areas with less high-speed internet access, which may hinder their progress towards this goal. Yet, others already use cloud computing to oversee their operations, especially those who don’t live near their farm ground.

Technology improvements in artificial intelligence (AI) and robotics are seen as fundamental areas for improvement. Nevertheless, some wariness exists. In many ways, producers enjoy the benefits of technology used in large farm machinery and to automate repetitive tasks. But it also proves more costly as they’re unable to handle regular machine maintenance and repairs due to AI-driven machines and computerised equipment. To fully take advantage of digital innovations, agriculture leaders will need to shore up their digital capabilities and seek out tools that’ll help them better serve a direct to consumer market and get products out to customers faster.

Innovation leads the way

Agriculture, food and beverage leaders faced a myriad of issues before the pandemic. Indeed, these problems were only magnified in 2020. From shifts in consumer demands to continuing outcries for climate-friendly products, 2021 will surely be one of great change. How that change will be reflected on family farms and local producers remains to be seen.

For sure, consumers are shifting their focus to healthier lifestyles and seem concerned about where their food comes from. This outlook represents an opportunity for food producers. However, agriculture leaders face challenges in their quest to enter the D2C market, navigate environmental issues, and shorten the supply chain. By using innovation and digital technology, farmers may improve operational efficiencies while launching new products that encourage people to invest in local producers.

Methodology

Findings in this article are based on 57 survey responses from agriculture, food and beverage business leaders collected in quarter 4 of 2020, as part of HLB’s Survey of Business Leaders 2021. The majority of businesses surveyed are privately or family owned. For the full research report see HLB’s Survey of Business Leaders 2021: Achieving the Post-Pandemic Vision: leaner, greener and keener.