Doing business in a Time of uncertainty

HLB’s Survey of Business Leaders – SME analysis

Key survey findings at a glance:

- Small and Medium sized Enterprise (SME) business leaders rank economic uncertainty top risk to business grow, followed by a mix of complex an inter-related concern.

- Expectations for global economic growth are gloomy with only 20% expecting economic growth rates to increase. Yet, confidence in own ability to grow optimistic with 31% stating they are ‘very confident’.

- Launching new products or services is the main actions SME business leaders plan to take in 2020, while improving operational efficiency ranks as their top focus area to strengthen.

- They recognise the importance of talent to unlock business success. 80% is exploring new ways of working and investment into human capital ranks in the top five actions SME business leaders are taking in the next 12 months.

- For the purposes of this article, SMEs are defined as enterprises with an annual turnover up to US$25 million. As part of our Inaugural Survey of Business Leaders, we interviewed 158 SME business leaders in a variety of industries and sectors, during the fourth quarter of 2019.

If there’s such a thing as a cast-iron rule of business, it’s this: markets do not like uncertainty. In an era of fluctuating currencies, slowing growth and political surprises, it’s no surprise that global economic forecasts are gloomy. This pessimistic outlook is shared by the SME business leaders surveyed in HLB’s Inaugural Survey of Business Leaders – at least when it comes to the world economy, with 41% anticipating an economic downturn. Yet, business leaders show confidence in their own companies, with 31% stating that they are ‘very confident’ that their businesses will grow this year.

Risks to SME business are complex and interrelated

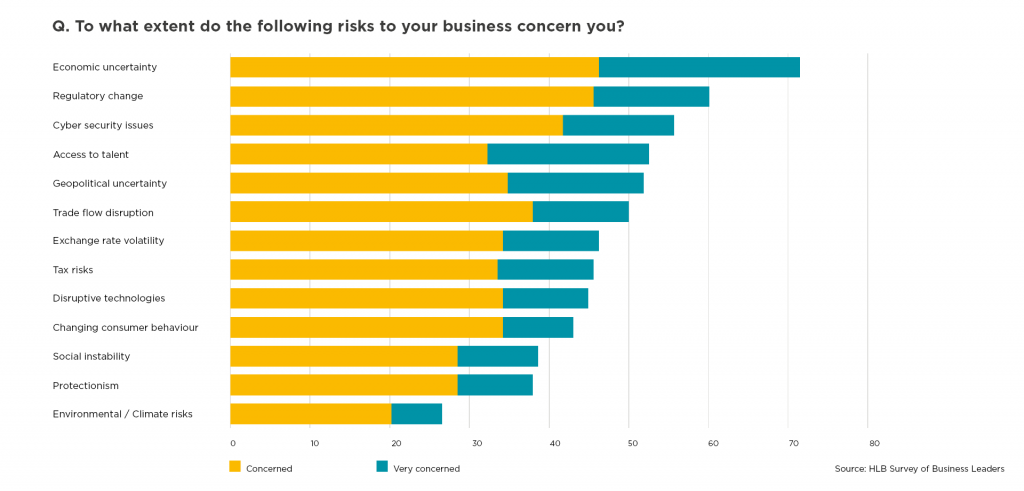

At the dawn of a new decade, business leaders are faced with a host of complex and interrelated issues. With 72%, economic uncertainty was by far the biggest concern of SME business leaders, and as we have seen, 41% expects global economic growth rates to decline in 2020. Notably, HLB’s survey was conducted in the last quarter of 2019, in the months before the onset of the Coronavirus crisis. We expect this percentage to be higher if we ask the same question today. It is likely that the after-effects of the Coronavirus pandemic will be felt for many months if not years to come, making it probably the biggest threat to SME businesses at present.

General geopolitical uncertainty concerned 52% of the business leaders we surveyed. Trade flow disruption, such as that caused by last year’s trade dispute between the USA and China, was seen as a risk by 50%. Protectionism, related to a rise in populist political movements throughout the western world, concerned 38%.

Regulatory change concerned 60% of SME business leaders. Given the volatile geopolitical situation, this is not surprising. The volume and pace of regulatory change – which can accelerate in an unpredictable political environment – can put strain on businesses, especially as they seek to explore new markets.

And it isn’t just economic concerns keeping SME business leaders up at night. As the business world becomes increasingly dependent on e-commerce, 56% are concerned by cyber-security risks, such as data breaches and malware attacks. Unexpectedly, cybersecurity is a higher concern for SME business leaders than their peers from larger enterprises (50%). Though SME companies may present less attractive targets for cyber-criminals, many lack the wherewithal to adequately defend against cyber-attack.

Recruiting and retaining the right people is an essential feature of running a successful business. So it’s little surprise that over half of the business leaders we surveyed (52%) were concerned about access to talent. They are exploring new ways of working to recruit and retain the talent they need.

Given their gloomy outlook on the economy, business leaders’ confidence in their own businesses is worth remarking on. Just under a third of the SME business leaders we spoke to (31%) state that they are ‘very confident’ in their company’s ability to grow in 2020, with a further 56% stating that they were at least ‘somewhat confident’. Though they foresee a difficult time for the global economy, more than half of SME business leaders expect that changes to longstanding trade agreements will create new opportunities for their businesses.

The road ahead - Actions SME business leaders are taking in 2020

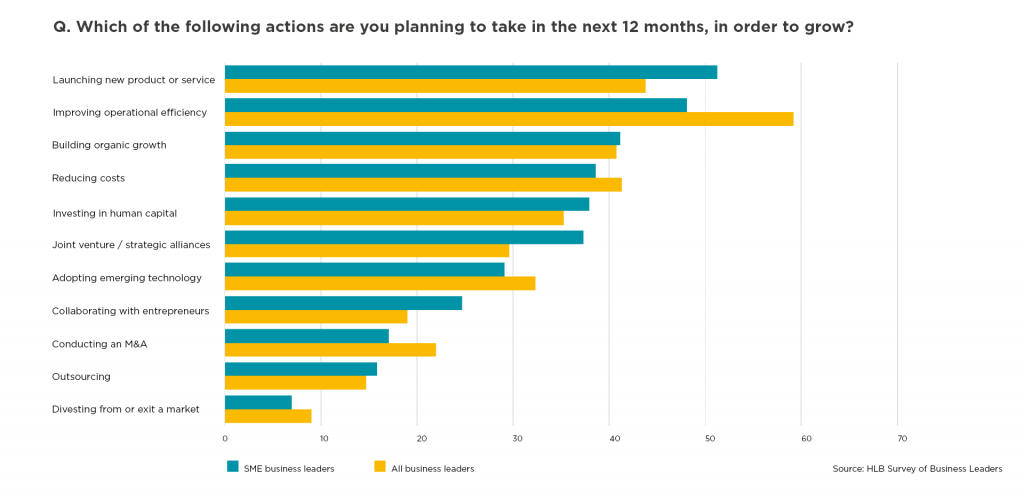

When it comes to planning ahead, our survey found that SME business leaders are chiefly focused on improving operational efficiency, with 48% stating that this is their main priority. But, given the uncertain economic climate, it is worth noting that over half – 51% - plan to launch new products and services in the next twelve months. In fact, this is the most popular action that business leaders plan to take in 2020.

With 41% of SME business leaders planning to build organic growth, and half planning to launch new products and services, it’s perhaps unsurprising that the need to build brand strength was cited by around a third of respondents as a priority. A strong brand, which boosts customer loyalty and gives companies a competitive edge, is especially important if a company is seeking to launch new products.

Business leaders understand that good market intelligence is vital in making the right decisions. So, how do business leaders stay abreast of market fluctuations? Intriguingly, while 54% of business leaders state that they use general market research, only 18% are focused on strengthening consumer acumen.

Finding and keeping the right people

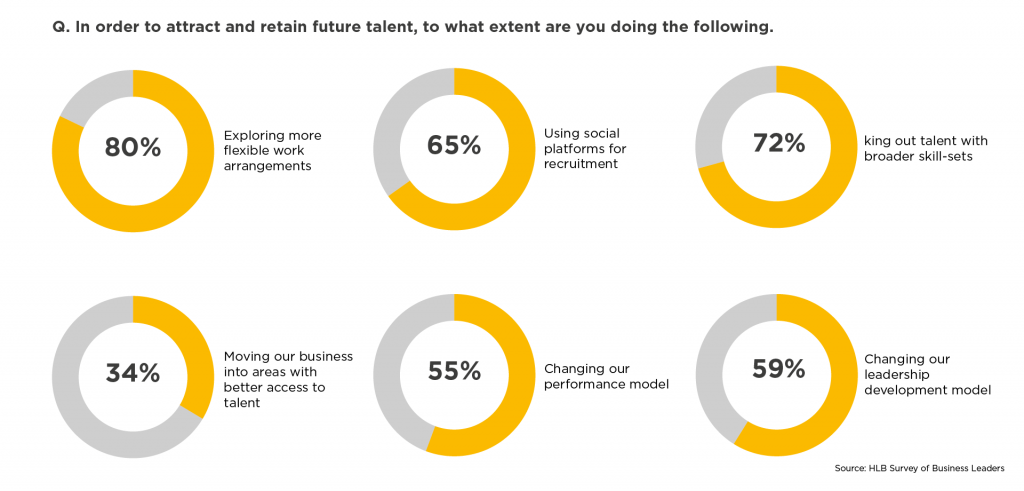

SME business leaders display a confidence in their businesses to weather the storms ahead. And it’s clear that SME business leaders see the hiring and retention of talent as a key to sustaining business growth. With access to talent ranking in the top five concerns, it’s no surprise that SME business leaders are exploring new ways of attracting and retaining the right people. Business leaders are seeking to use technology in sourcing and retaining talent. Our survey found that 80% are exploring more flexible work arrangements – facilitated by Cloud technologies – which are likely to come in handy today, as many businesses have opted for remote working to mitigate the spread of COVID-19.

Digital technology is also used by 65% of SME business leaders, who cited they are using social media platforms for recruitment. Another 72% are seeking out talent with broader skill-sets, indicating a general shift toward a more decentralised working model, in which a small core team perform work in-house, supported by outside specialists assisting with projects on a contract basis.

When it comes to improving their business in 2020, more business leaders cite ‘strengthening operational efficiency’ as a priority than any other option (40%). ‘Innovation’ finished a close second, cited by 37% of SME business leaders. It’s intriguing and perhaps inspiring that, despite the uncertain economic and political situations, business leaders are still seeking to innovate and explore new opportunities.

A focus on talent acquisition and investment in digital capabilities rank in the top five areas of focus, as leaders seek to strengthen their businesses. SME business leaders recognise the importance of finding the right people with the right skills-sets to drive growth, and 38% of SME business leaders plan to invest in human capital in 2020.

Embracing and embedding new technologies

As the internet generation assume leadership positions in major firms, a new generation of tech-savvy leaders is rising to prominence. Just as SME business leaders recognise the importance of employing the right talent, they are also aware of the need to embed new technologies in order to succeed. 61% believe that technological advancements will help overcome future cross-border business challenges.

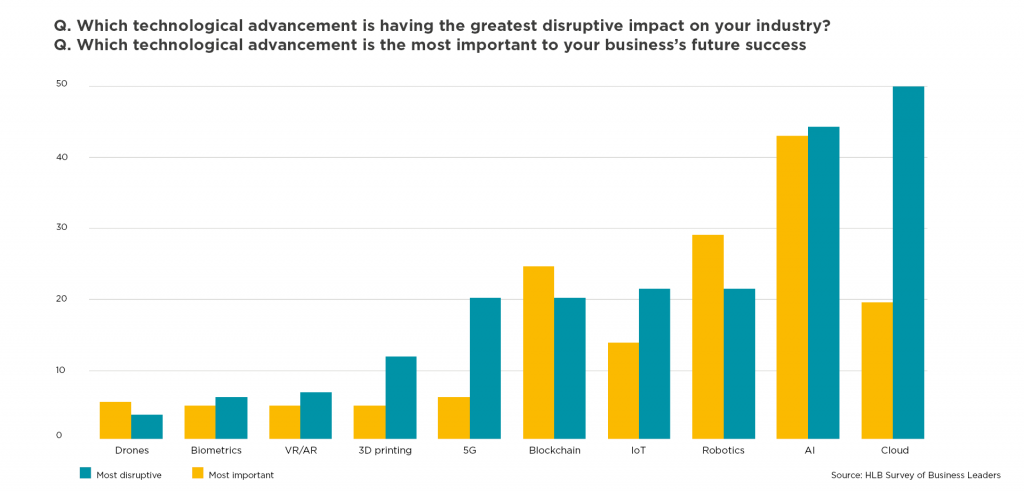

The business leaders we surveyed considered Cloud the most important technology for future business success (50%). Yet interestingly, when asked to rank which technologies had the greatest potential to disrupt their industries, business leaders did not rank Cloud in even the top three. It seems that Cloud – which allows users to store and access large quantities of data – is seen to complement existing business models. Cloud facilitates remote working, allowing firms to explore more flexible working arrangements and more mobile business models.

Curiously, Artificial Intelligence (AI) is recognised both as the second most important technology for future business success (44%) and having the greatest potential for disruption (43%). AI is currently used in fields as diverse as disease mapping and CV scanning, to a broad range of uses in the financial sector. Ride-sharing apps such as Uber, and streaming services such Netflix all depend on AI’s ability to perform complex algorithms at speed. All change is potentially disruptive, but the changes caused by the widespread use of AI are already revolutionising efficiency.

Besides the importance of technology for the future, business leaders also recognise its potential for overcoming challenges in times of economic, geopolitical and trade uncertainty. Remote working, for example, is proving essential to SME businesses as they contend with the effects of Coronavirus. It is entirely possible that new and more efficient forms of remote working will develop as a result of this crisis.

Conclusion

HLB’s Inaugural Survey of Business Leaders suggests that, during this period of uncertainty, businesses are focussed on improving existing processes - strengthening their operational efficiency, reducing costs and building organic growth. Although we collected survey result prior to the global Coronavirus pandemic, we believe operational efficiency and cost reduction are still high priorities for SME businesses. Maybe even more so as they are mitigating the impact of a global crisis.

It’s noteworthy that so many SME business leaders are planning – or were planning prior to the COVID-19 crisis – to launch new products and services in 2020. Business leaders recognise that the present economic uncertainty will bring new challenges, but also new opportunities. And remaining relevant to customers also means launching new products that fit their needs.

Business leaders’ pessimism regarding the global economy can hardly be seen as a surprise. Political uncertainty and economic uncertainty go hand-in-hand. But an optimistic thread runs throughout our survey findings – a confidence that well-run businesses can weather the storm and will continue to flourish.

SME business leaders consider access to talent a key concern, recognising that hiring (and retaining) the right talent is key to success in business. In addition to their faith in people, business leaders show a faith in tech. The right tech, our survey suggests, will enable businesses to overcome obstacles. Put simply, SME business leaders believe that the right people, equipped with the right technology, will find a way even in times of uncertainty. The challenge for SME businesses is to the bring the two together.

Methodology

Findings in this article are based on 158 survey responses from SME business leaders collected in quarter 4 of 2019, as part of HLB’s Survey of Business Leaders. SMEs in this article are defined as enterprises with an annual turnover up to US$25 million. The majority of SMEs surveyed are privately or family owned. For the full research report see HLB’s Inaugural Survey of Business Leaders: The Execution Challenge for a New Decade.